Fed set to cut rates, focus to fall on the dots

Traders on the edge of their seats awaiting Fed decision

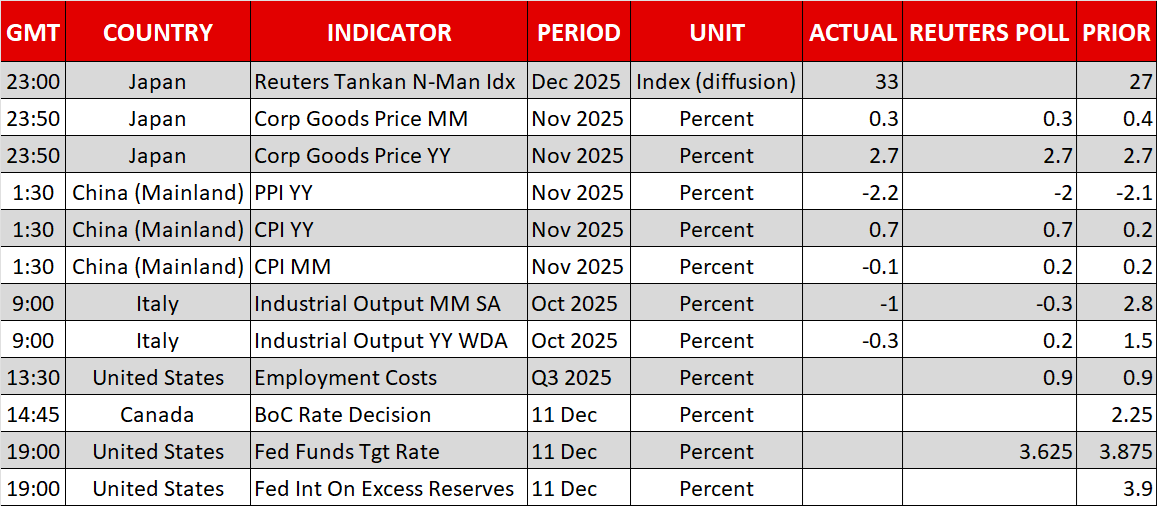

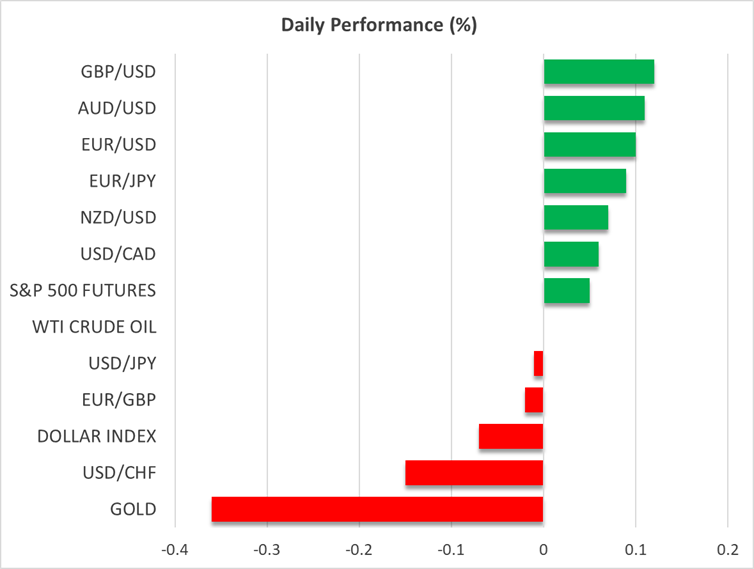

The US dollar traded mixed against its major counterparts on Tuesday, gaining ground against the yen, the euro and the pound, while underperforming against the commodity-linked aussie, kiwi and loonie. It traded virtually unchanged against the franc. Today, ahead of the Fed decision, the greenback is slightly down or unchanged.

Although the dollar was unable to gain against all its peers, Treasury yields extended their recovery, while Fed fund futures suggested fewer rate cuts for 2026 as data yesterday showed that US job openings increased slightly in October after surging in September. On top of that, the National Federation of Independent Business (NFIB) report revealed that firms are planning to create new vacancies in the near term.

This prompted investors to anticipate only two rate cuts for next year, which changes the dynamics on how the market may respond to today’s FOMC decision. A 25bps rate cut is nearly fully priced in and thus, it is unlikely to shake the markets. Investors are likely to quickly shift their attention to the statement, the updated economic projections – especially the new dot plot – and Chair Powell’s press conference.

Should the dot plot agree with the market and point to two rate cuts next year, the dollar is unlikely to decisively rally; unless Fed Chair Powell appears more concerned about sticky inflation rather than the lately-observed softness of the labor market, or if there is a decent number of policymakers voting for only one rate cut in 2026, even if the median points to two.

Aussie extends gains after RBA, BoC also decides on rates

The aussie was the main gainer yesterday, extending its rally after the RBA kept interest rates steady as expected and ruled out further easing. Officials also noted that a rate hike could be possible should inflation pressures prove to be more stubborn than expected.

Today, a few hours ahead of the Fed, the Bank of Canada will announce its own monetary policy verdict. At its latest meeting, the BoC cut rates by 25bps and said that they are at about the right level. Since then, data revealed a strong rebound in economic activity and employment growth, while underlying price pressures remained sticky.

According to Canada’s Overnight Index Swaps (OIS), investors are 95% confident that officials will refrain from pushing the rate cut button at this gathering, and they are surprisingly pricing in a rate hike by December 2026. Combined with headlines that US President Trump and Canada’s Prime Minister Mark Carney were reported to have had constructive talks on trade on Friday, this may allow the Bank to remain on hold and repeat a message of satisfaction about the level of interest rates.

Should this be the case, the market could remain convinced about a potential rate hike by the end of next year and may allow the loonie to add to the massive gains it posted on Friday after the surprisingly robust jobs data for last month.

Stocks mixed ahead of Fed, oil prices decline on Ukraine headlines

On Wall Street, the three major indices finished Tuesday’s session mixed, with the Dow Jones losing 0.38%, the Nasdaq gaining 0.13% and the S&P 500 finishing virtually unchanged. Today, stock futures are fractionally in the green, suggesting some degree of cautiousness ahead of the Fed outcome. If the well-anticipated rate cut is painted with hawkish colours, stocks could pull back as expectations of fewer rate cuts next year mean lower present values (PV) for high growth firms.

Oil prices are holding relatively steady today, after falling nearly 1% yesterday, perhaps due to renewed hopes about peace between Ukraine and Russia. Ukrainian President Zelenskiy said that in coordination with its European partners, they will present the US with a refined plan to end the war. A resolution could result in the removal of sanctions on Russian oil companies and thereby unblock restricted supply.