The reversal of the trend in crypto has been confirmed

The reversal of the trend in crypto has been confirmed

Market Overview

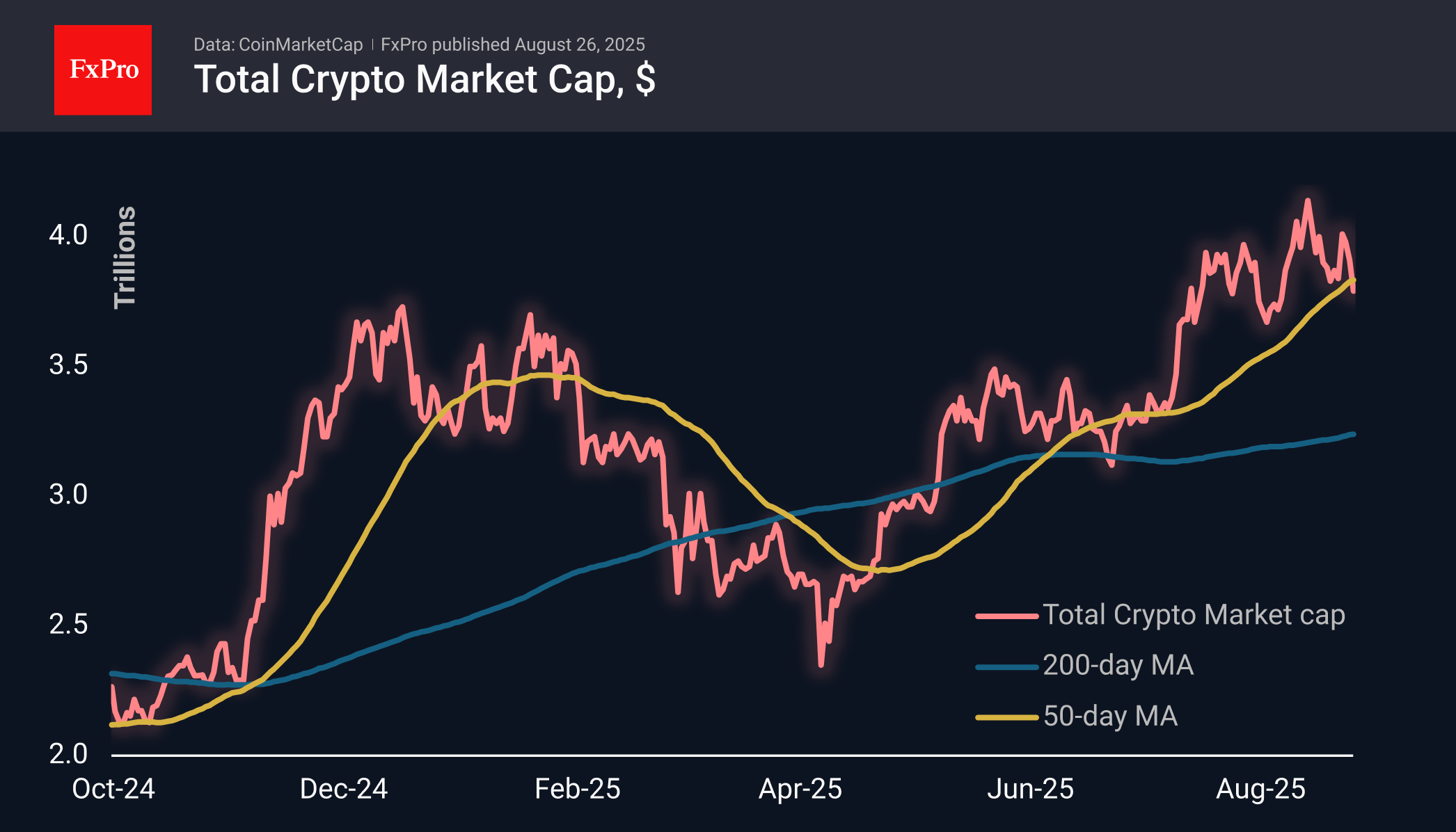

The crypto market has been on a downward trend for the last 12 days, falling to $3.76 trillion on Tuesday morning and later stabilising at $3.79 trillion. Capitalisation fell below the 50-day moving average and the area of recent lows, giving a technical signal of a change in the trend from growth to decline. The declines in this area over the past three months have been close to the bottom of local corrections.

Bitcoin is trading near $110K, dropping to a low of $108.5K. Local attempts to stabilise in BTC are being replaced by even greater sell-offs, leading to new lows in recent days. Bitcoin encountered resistance near current levels in January, May and June. As expected, the former strong resistance is becoming an important support. A failure below it will open the way to 100. The ability to hold on now will inspire the bulls to make a new push towards the highs.

News Background

The sentiment index as a whole remains fairly stable in neutral territory (48 versus 47 the day before). Declines in this area over the last three months have been close to the bottom of local corrections.

Information appeared on social network X about a large Bitcoin whale that allegedly sold more than 24,000 BTC in a few days, leading to a sharp drop in the first cryptocurrency. However, Kronos Research believes that it is difficult to pinpoint a single culprit for the fall in BTC and that it is the result of the actions of several whales.

According to WhaleWire, most of the proceeds were moved to Ethereum. The slow growth of Bitcoin in the current cycle is associated with sales by ‘old whales,’ according to analyst Willy Woo.

The Philippine parliament has proposed creating a strategic reserve of 10,000 BTC. If the bill is passed, the country's central bank will purchase 2,000 BTC annually for five years.

Japan's finance minister said that cryptocurrencies could become part of diversified portfolios thanks to the creation of a suitable investment environment. However, he acknowledged that crypto assets carry risks associated with high volatility.

Economist Harry Dent said that three charts — Bitcoin, Nasdaq 100 and Nvidia — show signs of an impending crash in the next couple of years.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)