Dollar extends slide as Bessent talks double rate cut

Bessent calls for a double rate cut by the Fed

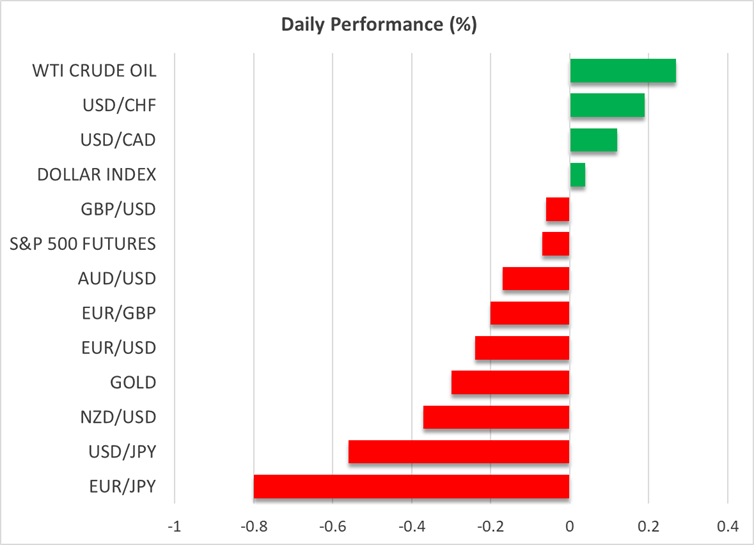

The US dollar continued to lose ground against all its major peers on Wednesday, eroded by increasing Fed rate cut bets after the US inflation data for July suggested that the impact of tariffs on consumer prices has so far been small.

Yesterday, Treasury Secretary Scott Bessent said that a “series of rate cuts” is warranted and that the Fed should resume its easing policy with a 50bps reduction at the September gathering. This adds to the political pressure the Fed has to deal with when conducting monetary policy, with investors on the edge of their seats over whether the White House will get its way.

Besides Bessent’s remarks, White House spokeswoman Leavitt said that President Trump is considering a lawsuit against Fed Chair Powell in relation to the management of renovations at the Fed’s headquarters.

Fed cut bets increase ahead of PPI data

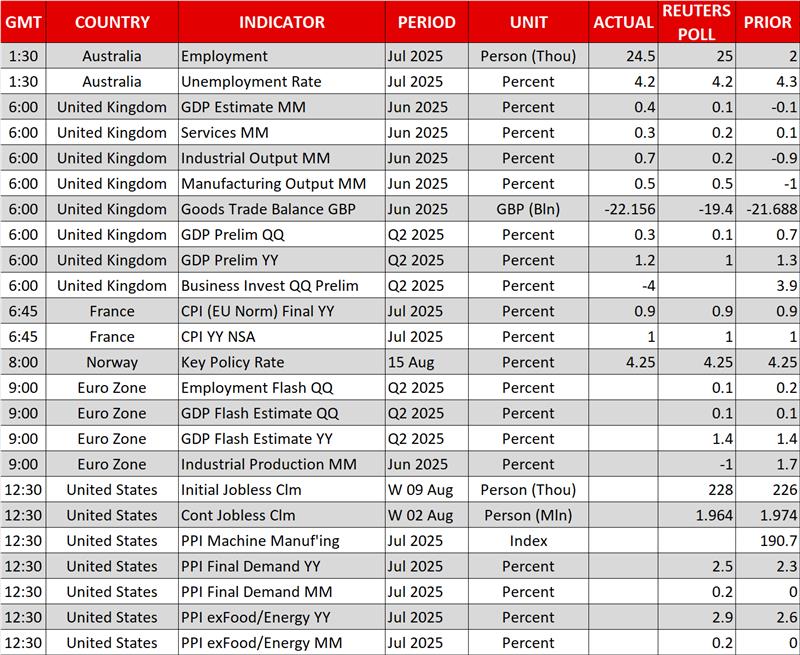

With all that in mind, investors are now more than fully pricing in a 25bps rate reduction at the September gathering. They are actually assigning a small 7% chance of a double 50bps cut. As for the total number of basis points worth of reductions for this year, it has risen from 60 to 64.

Atlanta Fed President Bostic said yesterday that the nearly full employment allows the Fed to stay patient and not rush to make any policy adjustments, while Chicago Fed President Goolsbee said that they are trying to understand whether tariffs will fuel inflation temporarily or more persistently. Both policymakers are in line with the broader well-held view within the Fed that there is no rush for lower interest rates. But what is unprecedented is how market participants are paying more attention to what officials outside the Fed have to say.

Having said all that, today, dollar traders are likely to pay extra attention to the PPI data for July. A slowdown in producer prices could imply further softness in consumer prices in the months to come and thereby hurt the US dollar even more as a third quarter-point rate cut by year-end becomes even more likely.

Is the BoJ behind the curve?

Treasury Secretary Bessent is not only commenting on what the Fed should do. He also said that the BoJ has gotten “behind the curve” by delaying rate hikes. Combined with reports suggesting that some BoJ members are pushing to drop a vaguely defined inflation metric, Bessent’s comments gave the yen a shot in the arm.

BoJ Governor Ueda has been in favor of going slow on rate hikes due to underlying inflation remaining below the Bank’s objective of 2%. However, there is no single metric that gauges “underlying inflation”. Both the headline and core CPI rates have been above 2% for years and thus, opposing voices have become louder, saying that the BoJ is overly reliant on an obscure reading to guide policy. According to Japan’s OIS market, the probability of a 25bps hike by the end of the year has risen back to 65%.

Wall Street and Bitcoin stretch their rallies

On Wall Street, both the S&P 500 and the Nasdaq hit new record highs for the second day in a row, driven by hopes that the Fed may need to cut interest rates faster and deeper than previously thought. Although stock futures are down today, a set of soft PPI readings could encourage investors to increase their risk exposure and aim for uncharted territory again.

Bitcoin also pushed to a new record high amid the weakness in the dollar. The world’s leading cryptocurrency has already been boosted by increasing institutional interest in the wake of critical regulatory changes, with the latest move being Trump’s executive order to allow crypto assets in retirement plans.

.jpg)