Bitcoin could correct to $60K

Market picture

The cryptocurrency market is under pressure, losing 6% of its capitalisation in the last 24 hours to $2.6 trillion.

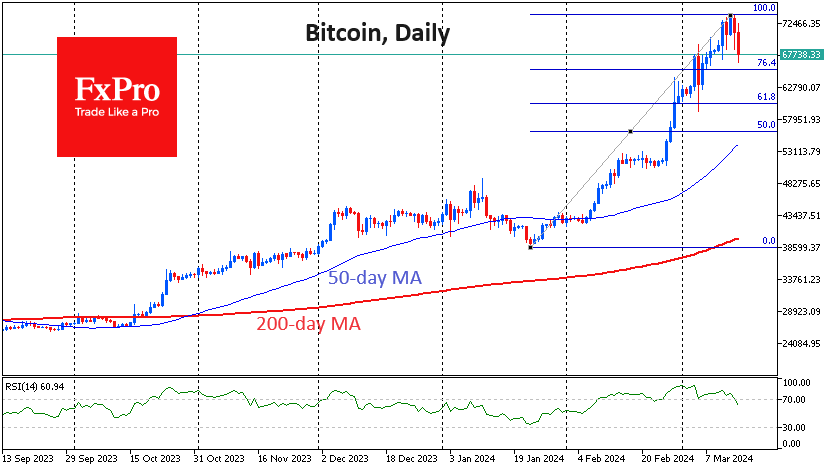

Bitcoin is losing almost 7% in 24 hours, at one point wiping out last week's gains and falling to $66.7K. We note that the current area of active buying is below last week's selling levels. Obviously, new historical highs are a trigger for selling. Some players are taking profits, which raises the question of whether there will be enough hot buyers at current levels or whether the majority will prefer to wait for a deeper correction.

In a corrective scenario, the $65.0-65.5K and $60.0-60.5K areas are of particular interest, as they contain important round levels (significant for retail) and the 76.4% and 61.8% Fibonacci retracement lines.

As a result of another recalculation, the difficulty of mining the first cryptocurrency increased by 5.79%. The indicator updated the historical maximum at 83.95T. The average hash rate for the period since the previous change in value was 600.72 EH/s.

News background

The addition of spot bitcoin ETFs to the list of instruments by major platforms and the approval of options based on them will be "powerful catalysts" for demand by the end of the year, notes Bloomberg. The ETFs are not yet available to clients of registered investment advisor platforms with $7-10 trillion in assets, but that could happen within the next few months.

Fees in EIP-4844-implemented layer-2 networks saw a several-fold decline after the Dencun upgrade in the Ethereum mainnet. Gas fees in the Base protocol dropped from $0.7 to $0.0024. In Optimism, transaction fees dropped from $0.66 to $0.0055, and in zkSync - from $0.32 to $0.097.

QCP Capital predicts that Ethereum will fall after the Dencun upgrade. Appetite for ETH-focused instruments in the futures and options markets has declined, suggesting a deterioration in the altcoin's medium-term prospects.

MicroStrategy launches its second round of Bitcoin fundraising. The company will raise $500 million through the issuance of convertible notes due in 2030. The offering will be subject to "market and other conditions". MicroStrategy previously held an $800 million bond sale in early March.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)