Copper Analysis: Copper prices are expected to rise in 2025

Fundamental Analysis of Copper

Copper Key Takeaways

Russia-Ukraine conflict progress: Trump takes action on copper: On Tuesday, U.S. President Trump signed an executive order instructing Commerce Secretary Lutnick to begin an investigation into whether copper imports and foreign copper production pose a risk to the U.S. economy and national security. White House officials said that based on the findings of the Commerce Department’s investigation, tariffs may be imposed on copper imported from abroad by the United States, but few details were disclosed, including when the investigation will end, what the tariff rate may be, and when it will take effect.

The impact of potential copper tariffs: Once new copper tariffs are imposed, they may stimulate domestic copper production in the United States. After the news that Trump ordered an investigation into copper, New York copper futures rose rapidly, and COMEX March copper futures once rose from $4.550 to above $4.6650.

Supply and demand relationship of copper in 2025: With the global electrification wave sweeping in, the copper market is at the starting point of a new round of upward cycle, and will be in short supply in the next few years. It is expected that the copper supply gap will reach 180,000 tons and 250,000 tons in 2025 and 2026. Copper prices are expected to rise again in the next two years, and may even set a record high.

Technical Analysis of Copper Daily and Hourly Charts

(Copper Daily Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator: In mid-February, the indicator sent a short signal in the overbought area, suggesting that the short-term bullish force subsided, and then the copper price fell all the way, and has now fallen below the 50 median line.

Key support: Copper prices fluctuated abnormally this week. After a sharp rise on Tuesday, they fell rapidly yesterday. Currently, it is close to the opening price on Tuesday. Based on the strong fundamentals, even if the copper price falls below today, we need to be alert to the probability of false breakthrough.

Copper H1 Chart Analysis

(Copper H1 Price Chart, Source: Ultima Markets MT4)

Stochastic oscillator: The indicator sends a bullish signal in the oversold area. Yesterday’s rapid and extreme decline may usher in a shock adjustment in the short term.

MA resistance: If the copper price starts a rebound trend during the Asian session, pay attention to the purple 13-period MA above. At present, all three MAs send out bearish signals, and there is a probability of mean reversion in the short term.

Pivot Indicator Insights for Copper

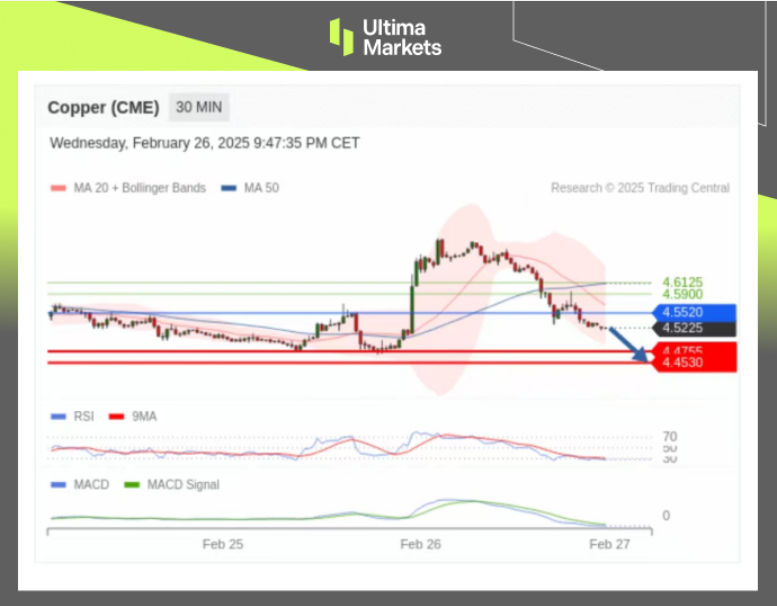

(Copper M30 Price Chart, Source: Ultima Markets APP)

According to Pivot Indicator in Ultima Markets APP, the central price of the day is established at 4.5520,

Bullish Scenario: Bullish sentiment prevails above 4.5520, first target 4.5900, second target 4.6125;

Bearish Outlook: In a bearish scenario below 4.5520, first target 4.4755, second target 4.4530.

Learn more: https://bit.ly/4gWTyEA

How to Navigate the Forex Market with Ultima MarketsTo navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

—–

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.