EBC Markets Briefing | Euro firms with signs of a thaw with China

The US dollar sagged near an 11-week low on Wednesday, under pressure from sliding short-term Treasury yields after a run of weak economic data. The euro firmed with “peak pessimism.”

Treasury Secretary Scott Bessent said on Tuesday the economy is more fragile under the surface than economic metrics suggest, citing interest rate volatility, sticky inflation and job growth focused on the government sector.

Optimism for more spending in Germany has supported the euro, although election winner Friedrich Merz said it was too soon to say whether the outgoing parliament could wave through a massive military spending boost.

The economy shrank by 0.2% in Q4 compared with the previous quarter as exports of goods and services were down considerably. Fiscal loosening and red tape cuts are seen as necessary to jolt it out of the doldrums.

The EU should craft its own China policy and not ape the Trump administration’s confrontational stance, Spain’s foreign minister said this week. The member states do not have a unified position on the issue.

In a sign of a potential EU-China thaw, commission president Ursula von der Leyen this month called for a new effort to improve relations between Brussels and Beijing – a hedge against Trump.

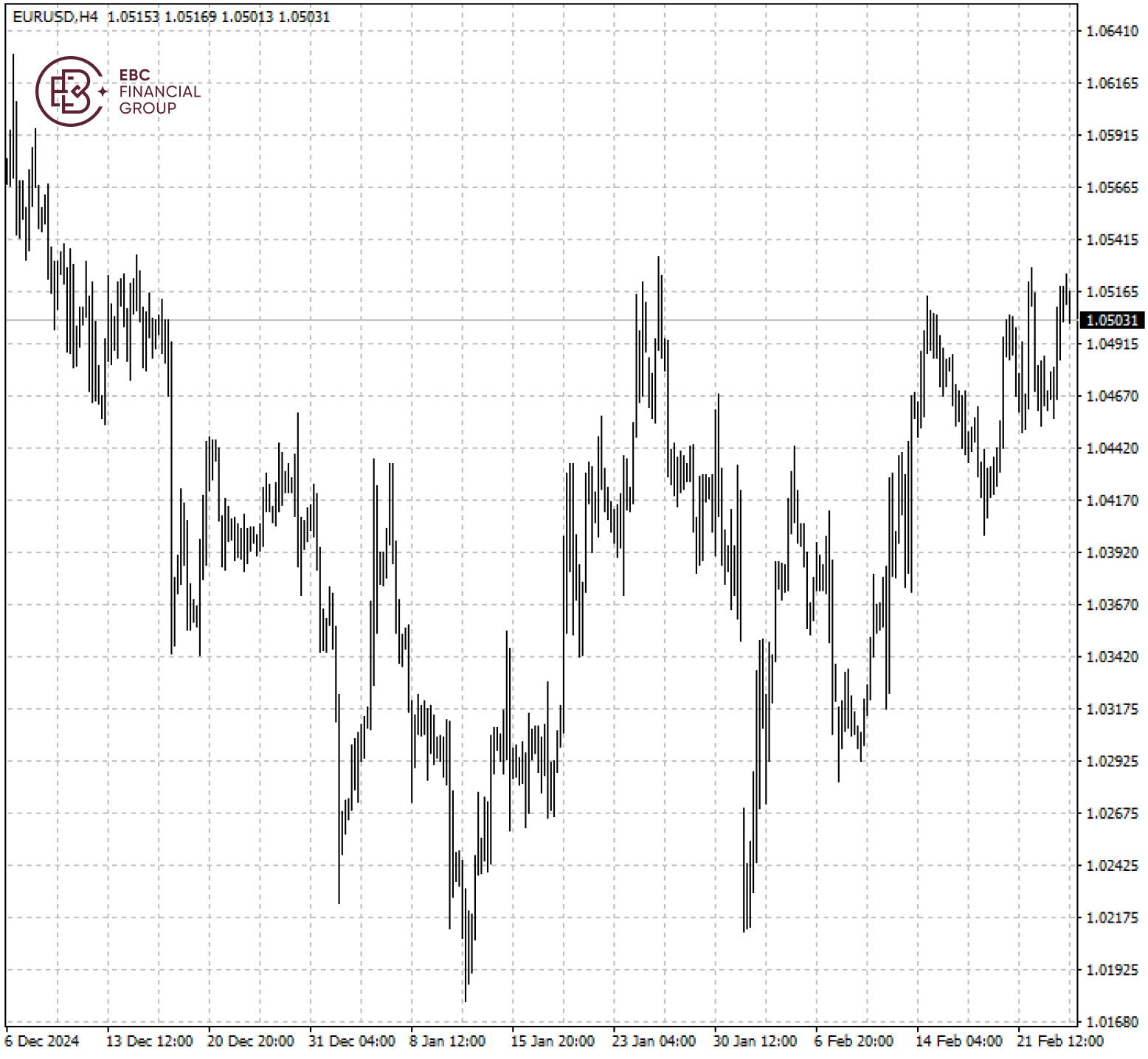

The single currency has been capped by the resistance around 1.0530 for months. The risk is tilted towards the downside given its proximity to that level.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.