EBC Markets Briefing | Gold market has regained composure

Gold prices extended their rally from Monday, after six days of losses, as the US dollar's surge cooled and heightened uncertainty over the Russia-Ukraine conflict rekindled safe-haven demand.

The yellow metal posted its largest loss in more than three years last week as Trump’s America First policy will get in the way of Fed’s rate-cutting cycle. His endorsement of Bitcoin also dampened its appeal.

Meanwhile physical gold premiums in India climbed to a near four-month high, driven by a rebound in demand as prices dropped, while top consumer China still saw limited retail buying interest.

President Joe Biden has given the green light for Ukraine to use long-range missiles supplied by the US to strike Russia, US officials say. Putin has previously warned Western nations against such a move.

Gold will hit $3,000 next year on central-bank buying and monetary easing, according to Goldman Sachs, which listed the metal among top commodity trades for 2025 and said prices could extend gains during Trump’s presidency.

But the bank suggested “the dollar will be stronger for longer.” As for the euro, that will decline to $1.03 over the next 12 months, they predicted, while the yen will weaken to 159 per dollar.

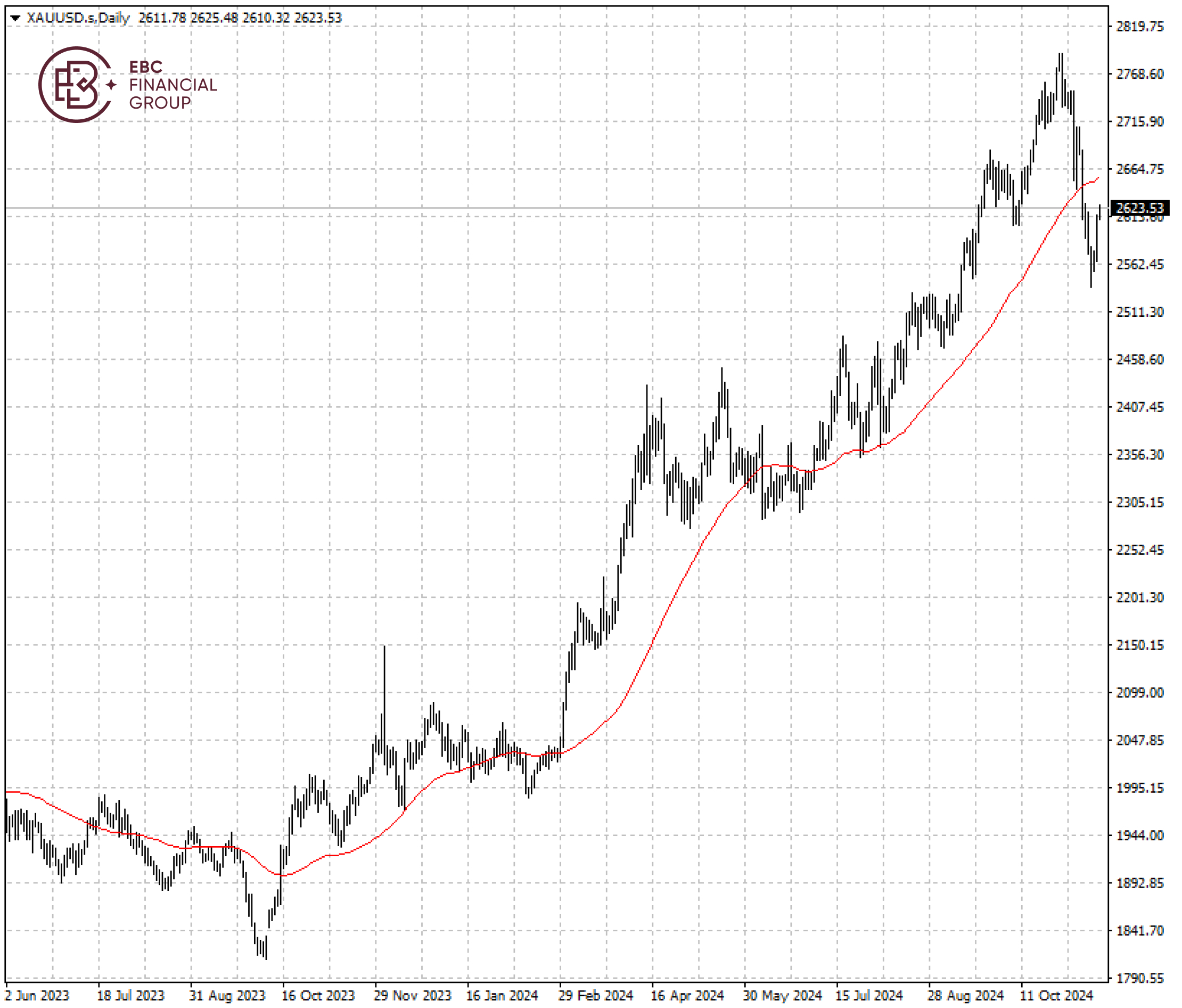

Bullion managed to reclaim the $2,600 level, but it needs to break above 50 SMA to reverse the downtrend. If that does not materialise, we see a drop towards $2,550 as likely.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.