EBC Markets Briefing | Speculators highly bearish on loonie

The Canadian dollar steadied on Tuesday after a report showing the economy added more jobs than expected in December. Speculators have raised bearish bets on the loonie to historically high levels, CFTC data showed.

The dollar hung near its highest in more than two years as trades scale back US rate cuts in 2025. The focus will shift to Trump who is set to return to the White House next week.

BofA even sees no Fed rate cut this year. Goldman Sachs upgraded its dollar forecasts, citing a robust US economy and likely higher tariffs that may slow monetary easing.

The bank saw a dollar gain of 5% this year, a shift from its less bullish view previously, and lowered its forecast for the euro, the pound and the Aussie dollar.

Investors including hedge funds appear to be backing the upbeat view on the US currency, with bullish dollar positioning now at the highest since January 2019, Bloomberg-compiled data from the CFTC show.

Still speculative bullish positions on the on Brent oil rose to an eight-month high as of 7 January – a silver lining for the loonie’s weakness. Frigid weather in Europe and the US has raised energy demand for heating.

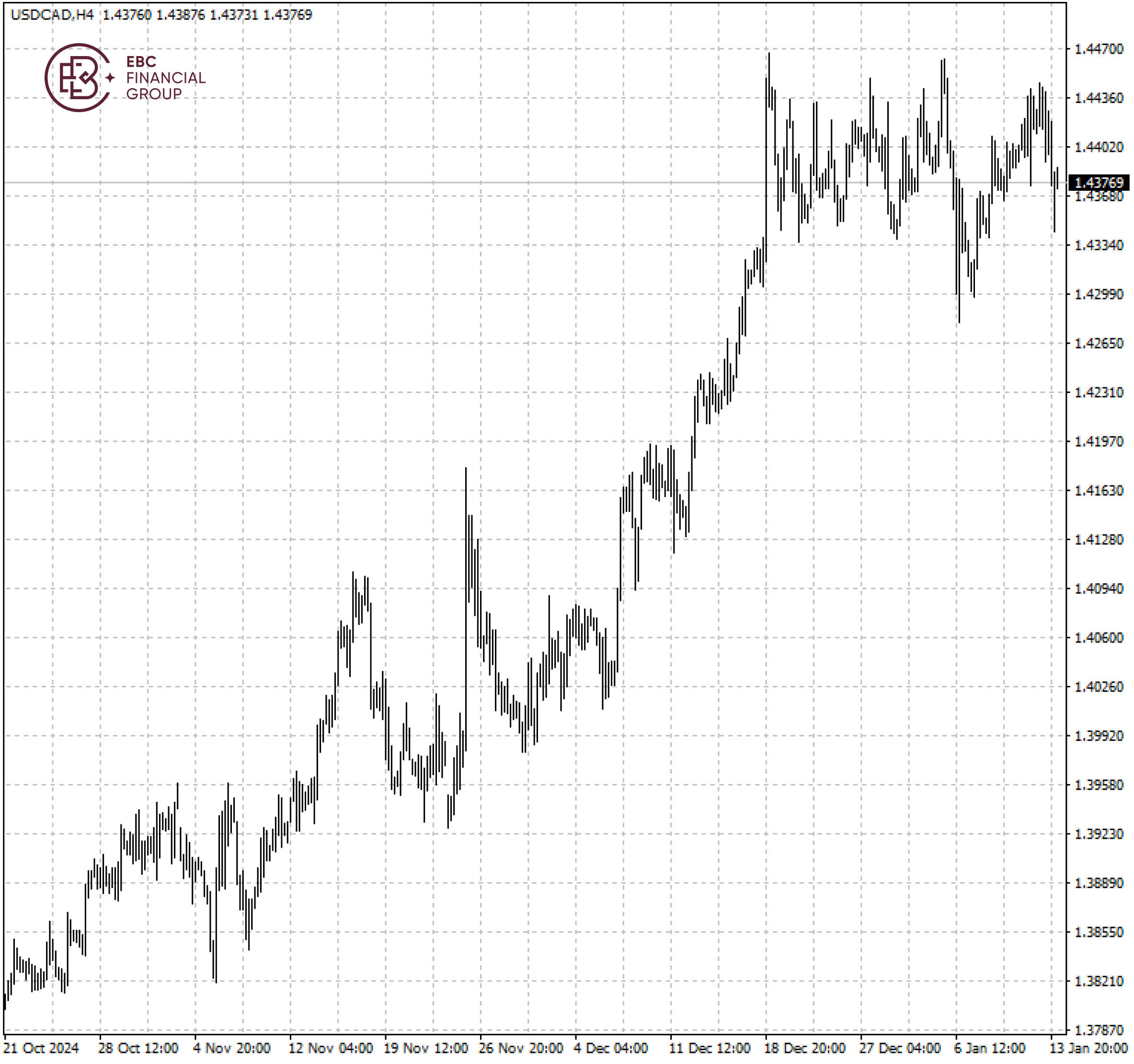

The Canadian dollar fell back to its trading range that was formed from 18 December. As such it could inch up before pulling back from the resistance around 1.4370 per dollar.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.