EBC Markets Briefing | Stagflation may lie ahead for sterling

Sterling struggled around one-month low on Monday as policy divergence between the UK and the US narrowed. The Fed caught financial markets off guard with a hawkish tone in part due to Trump’s unpredictability.

The BOE kept its main interest rate unchanged at 4.75% as expected on Thursday but policymakers became more divided about whether rate cuts were needed in the wake of Reeves’s tight budget.

Three MPC members voted to cut rates, saying a "very restrictive" policy risked pushing inflation too far below 2% target in the medium term and creating an unduly large amount of spare capacity in the economy.

Governor Andrew Bailey said the central bank needed to stick to its existing "gradual approach" to cutting rates. Two rate cuts were priced in for next year considering faster-than-expected wage growth.

Data showed British consumer price inflation rose to 2.6% in November, the highest among G7 nations. The BOE’s caution came as little surprise as the stagflation risk hangs over the economy.

The BOE also cut its growth forecast for Q4 2024 to 0% from a 0.3% forecast just six weeks ago, citing that consumers could eventually bear the brunt of the costs of higher employment taxes.

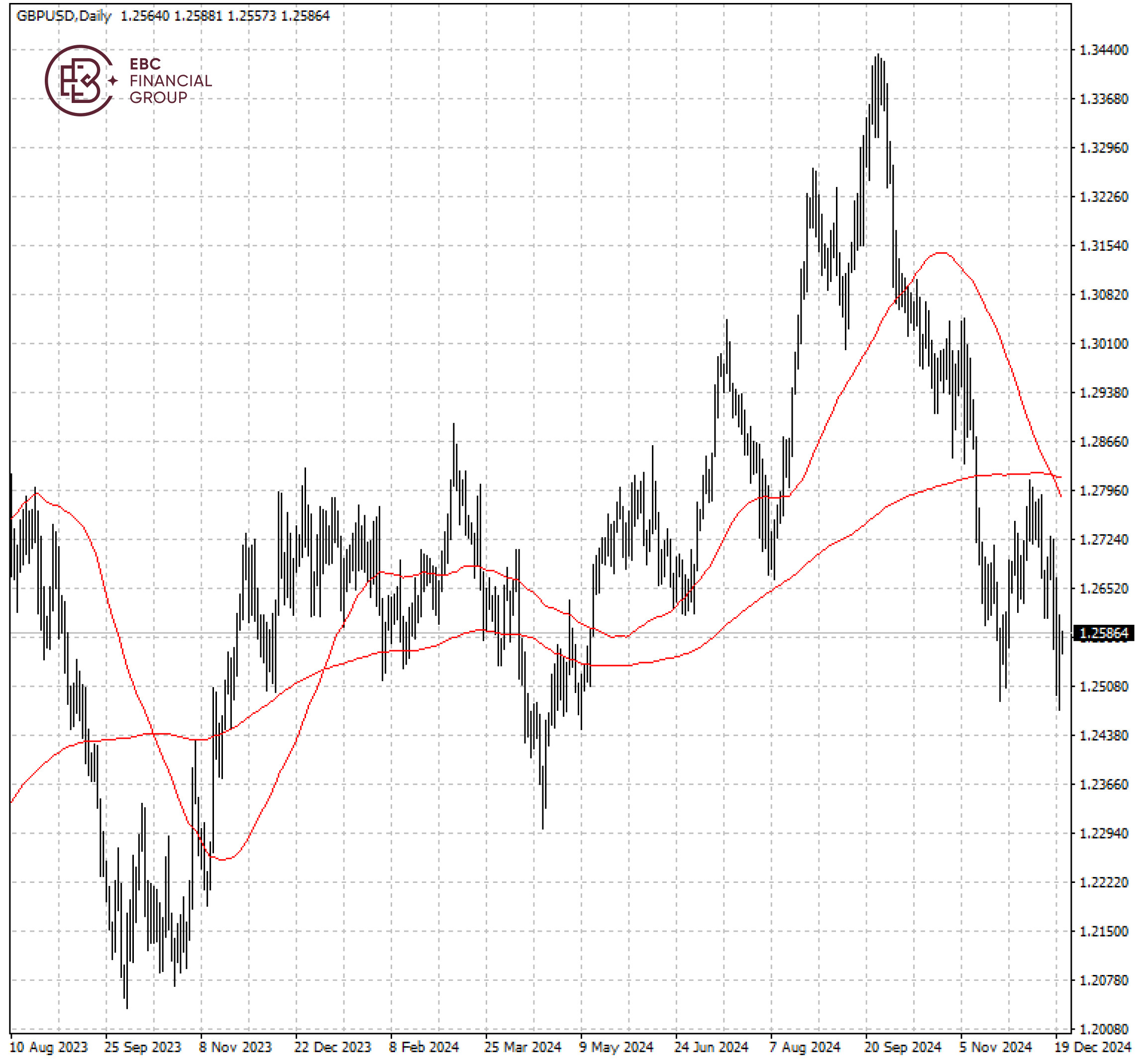

The pound formed a dead cross last week, which preceded a leg lower. The latest rally stalled around the neckline around 1.2610 and hence a likely decline towards 1.2500.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.