Eurozone data to reaffirm ECB hike this week

OVERNIGHT

Asian equity markets were mixed, paring earlier gains, as most markets reopened after yesterday’s holiday. The weekend’s China PMIs were weaker than expected, with the manufacturing index falling below 50. Chinese markets remain closed until Thursday. Overnight, Australia’s central bank unexpectedly raised interest rates by 25bp to 3.85% and signalled the possibility of more hikes ahead. In the UK, the British Retail Consortium reported a fall in shop price inflation to 8.8% in April from 8.9%, led by heavy discounting in clothing and furniture. Food price inflation, however, reached a new all-time high of 15.7% but the BRC said it should start to fall in the coming months.

THE DAY AHEAD

Today’s focus is on the last bits of information ahead of Thursday’s policy update from the European Central Bank (ECB). The ECB’s quarterly Bank Lending Survey at 9am will be analysed for any impact of recent international financial sector strains on the provision of credit to the wider economy. Following that, Eurostat will release its flash estimate of Eurozone CPI inflation for April at 10am. Available national data suggest headline CPI may edge back up to 7.0% following the sharp decline to 6.9% in March. The forecast increase is expected to be temporary, reflecting an energy price base effect. Underlying core inflation, excluding the volatile food and energy components, is expected to fall slightly to 5.6% from 5.7% which would be the first decline since last June. That, however, will not be sufficient to prevent another rise in ECB interest rates on Thursday. The question, though, remains whether it will hike by 25bp or 50bp. A quarter-point rise looks more likely, but upside surprises to inflation and/or resilient credit conditions would raise the probability of a larger hike.

This morning’s final readings for the April manufacturing PMIs for the UK and Eurozone are expected to remain below the key 50 level, signalling contraction and underperformance relative to services activity. The respective flash estimates of 46.6 and 45.5 for the UK and the Eurozone are expected to be confirmed. German retail sales for March, released earlier, were weaker than expected, falling by 2.4%m/m.

The US Federal Reserve begins its two-day policy meeting today with expectations for another, and potentially a final, rate rise of 25bp to be announced on Wednesday. Today’s data include durable goods orders and job openings, with the ADP employment and ISM services reports due tomorrow. Durable goods orders are predicted to rise, while job vacancies probably fell to the lowest for nearly two years but remaining high relative to pre-pandemic levels.

MARKETS

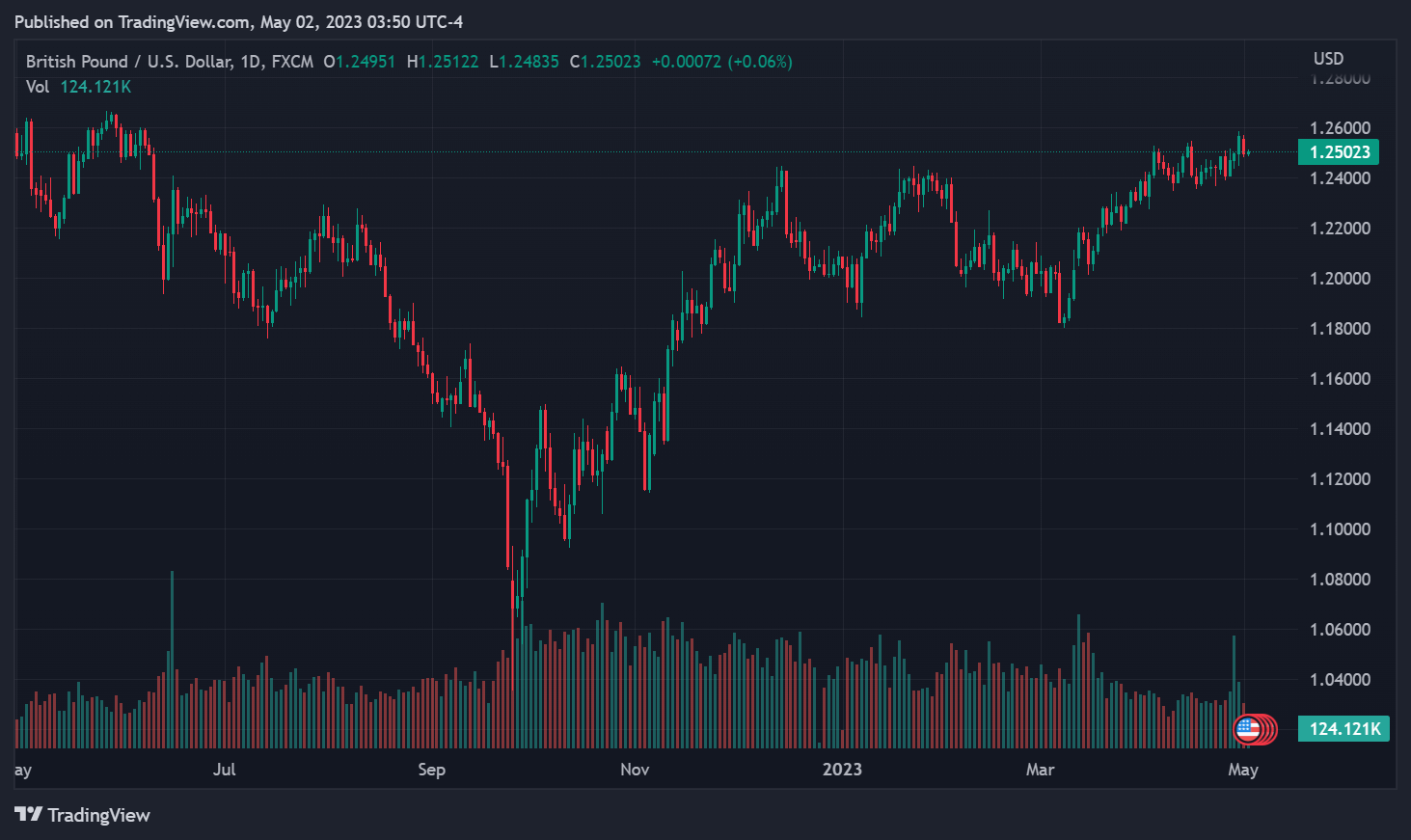

The Australian dollar predictably outperformed, gaining more than 1% against the US dollar, after the surprise RBA hike. The US currency increased yesterday following unexpectedly strong prices in the ISM manufacturing survey, but it was a touch softer in overnight Asian trading.