Fed's favourite indicator confirms slowing inflation trajectory

Fed's favourite indicator confirms slowing inflation trajectory

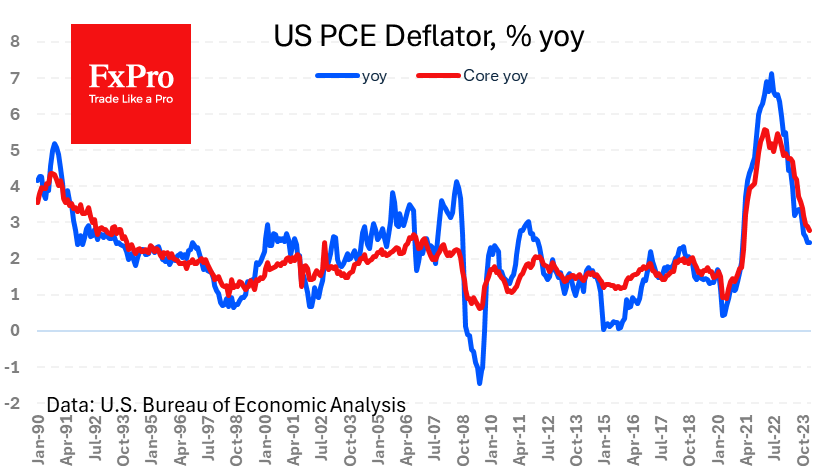

Friday's market focus was on US household income and spending data and the Personal Consumption Expenditures Index (PCE), the Fed's preferred measure of inflation.

Core PCE Price Index rose 0.3% m/m and 2.8% y/y, which is in line with average expectations and below the previous month's readings of 0.5% and 2.8%, respectively. The lack of surprises here promises to ease pressure on the Fed, as the official CPI numbers in recent months have not created the mood for an imminent easing of policy. Some observers have begun to suggest that the FOMC may not cut rates before the end of the year.

Today's data may support expectations of a June cut. A shift in rate expectations from a 64% chance of a June cut to 100% is potentially negative for the dollar.

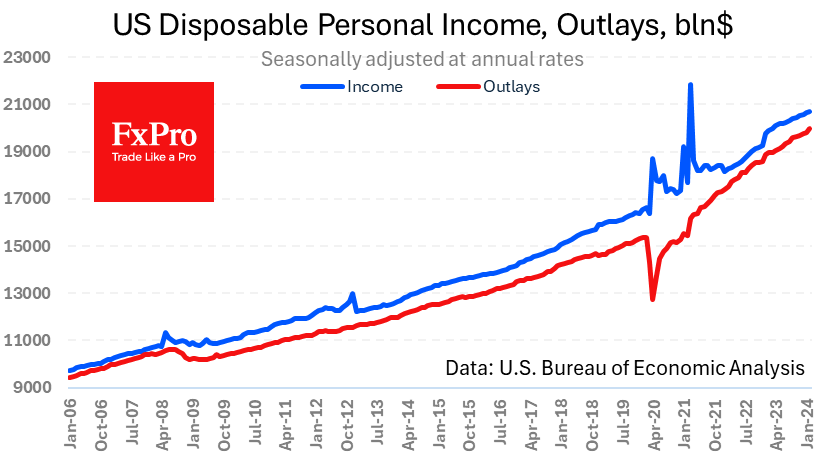

For February, personal spending rose 0.8% after 0.2% the previous month and 0.5% expected. Incomes rose 0.3% in February but were up 1% in January. Spending keeps pace with incomes, and this is positive for markets as high spending is positive for earnings.

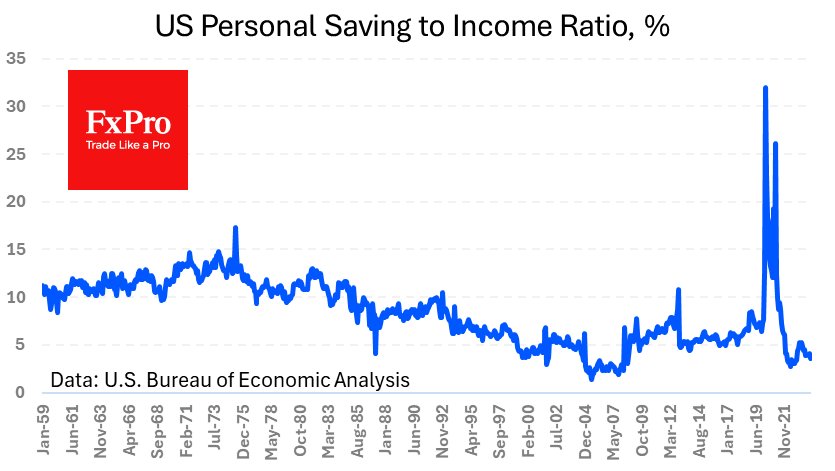

The savings-to-income ratio fell to 3.6% in February, the lowest since December 2022, and a downward trend has continued since the middle of last year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)