Gold stalls near 2,700. Is it losing its shine?

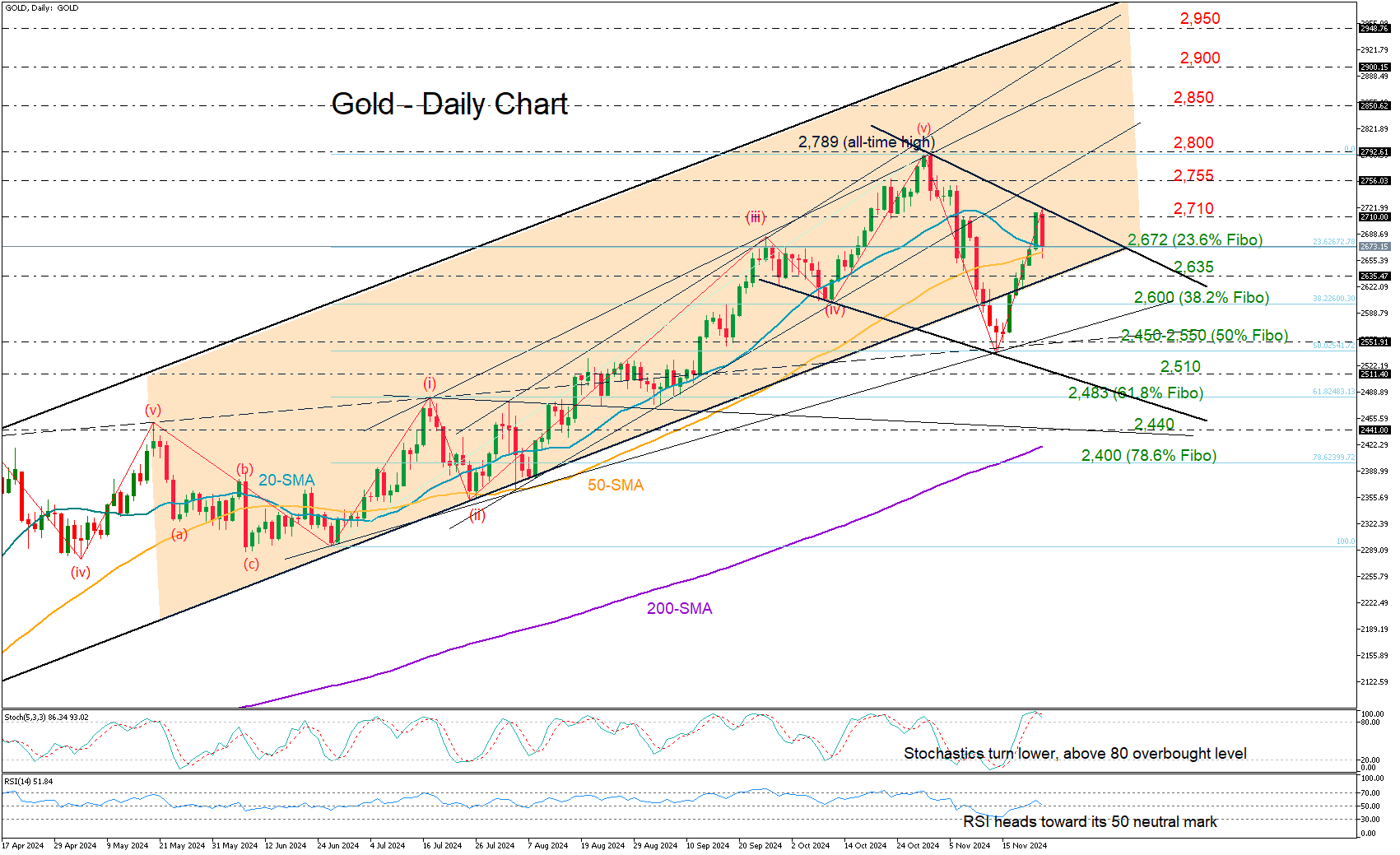

Gold felt Monday's blues, retreating immediately toward its 20-day simple moving average (SMA) at 2,670 after five consecutive winning days.

The pullback in the price is now raising concerns about whether the metal will form a lower high in the coming sessions. With the 20-day and 50-day SMAs nearing a bearish cross, sentiment could stay downbeat, although some key support levels could still come to the rescue.

The 2,672 area, which aligns with the 23.6% Fibonacci retracement and the short-term SMAs, is currently keeping the bears busy. If it breaks, the next level to watch is 2,635, where the lower boundary of the big bullish channel sits. Then the spotlight will fall on the 38.2% (there is an extra space here) Fibonacci at $2,600, a break of which could bring attention to the $2,450-2,550 zone, where the 50% Fibonacci level lies. A drop below $2,510 would signal a bearish trend reversal, likely leading to a decline toward 2,483 or 2,440.

On the upside, if gold recovers, it could target 2,755, with a break above this level potentially clearing the path to the all-time high of 2,789, and even to 2,800. A further rise could push prices to 2,850 and possibly toward the critical trendline zone of 2,900–2,950.

In summary, gold’s bullish momentum remains at risk. A move above 2,755 would remove downside risks, while a drop below 2,510 could indicate a bearish trend reversal in the short-term picture.

.jpg)