Inflation surprise doesn't help the Aussie

Australian inflation surprised on the upside, reigniting expectations of another rate hike as early as November. However, the Aussie could not enjoy the buying momentum for long as the US dollar strengthened.

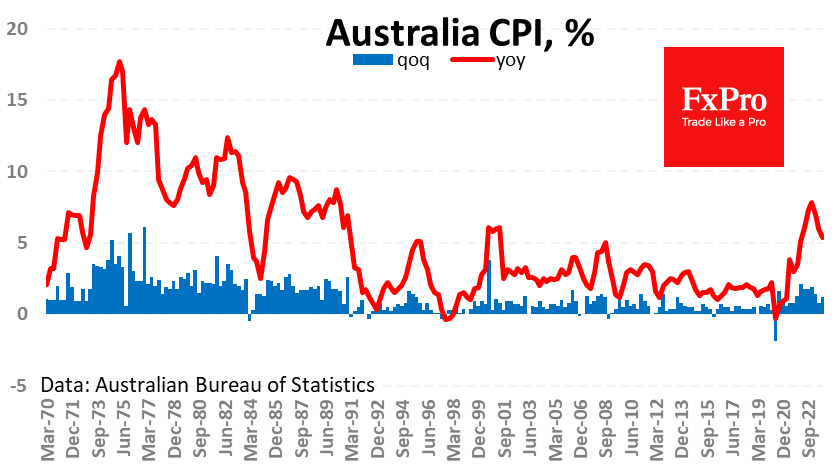

In the third quarter, CPI rose 1.2%, accelerating from 0.8% three months earlier due to fuel and energy cost dynamics. Annual inflation slowed to 5.4% from 6.0%, above expectations of 5.3%.

Monthly data showed that inflation accelerated to 5.6% y/y in September from 5.2% in August and 4.9% in July. This looks like a dangerous and sustained uptrend, although it is yet to be seen in the quarterly numbers, which are the central bank's primary focus.

AUDUSD came close to 0.6400, adding two-thirds of a cent shortly after the news. However, the round level and touching of the 50-day moving average also triggered heavier selling in the pair, repeating what we saw in EURUSD a day earlier.

At the time of writing, the Aussie has pulled back to 0.6330, erasing the gains made early Tuesday. Technically, the Aussie remains in the hands of the bears as it makes a series of lower local highs and stumbles off the 50-day moving average. There is significant support at 0.63, from which the pair has been bought on the downtrend since the beginning of the month. A break below this level would open the door for a quick fall back below 0.62.

The risk of the AUD falling into a downward spiral should raise the RBA's alert level. But will it happen?

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)