Mood improves as equities rebound but gold and dollar stay bid

US-EU trade war moves to the next level

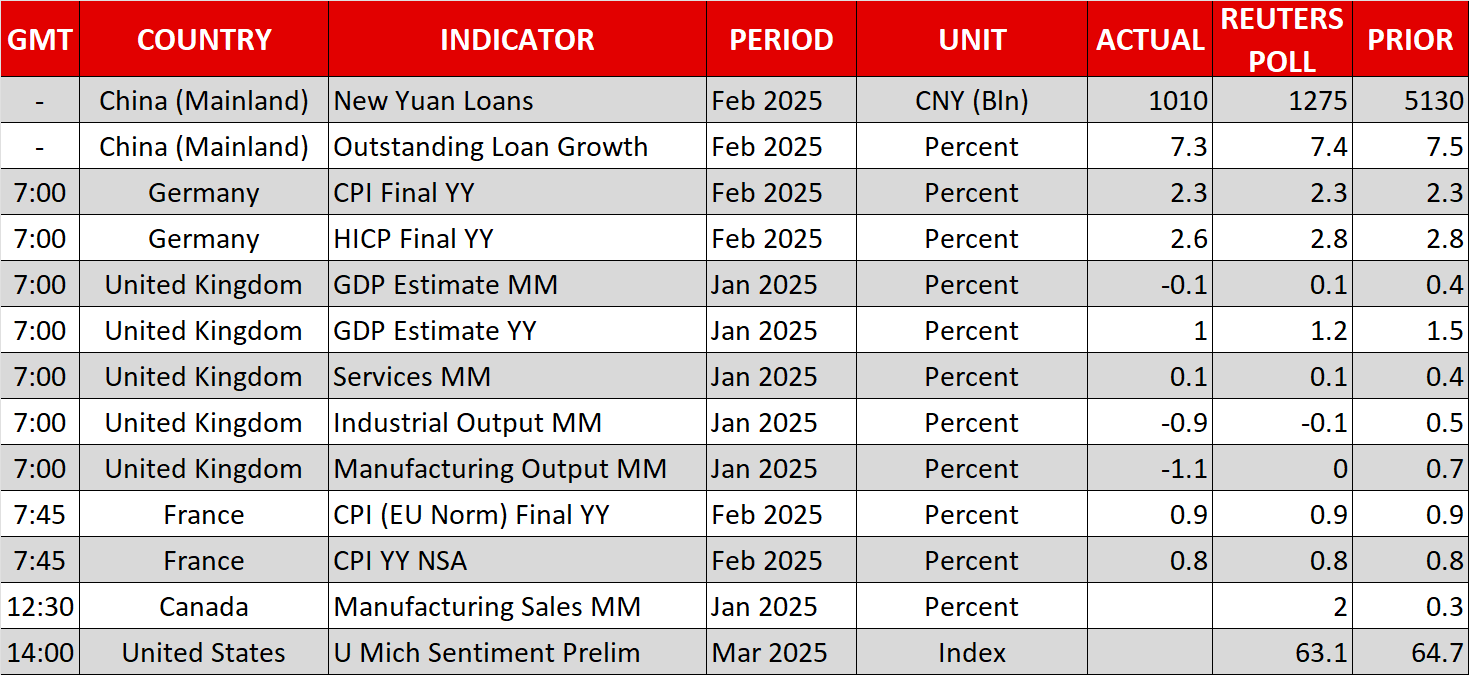

Tensions between the United States and the European Union over trade reached a boiling point on Thursday after President Trump angrily reacted to the bloc’s retaliatory levies by threatening to impose 200% tariffs on all EU alcohol imports.

The EU’s counter tariffs announced on Tuesday were in response to Trump’s steel and aluminium duties that went into effect. Trump is clearly sending a message that any retaliatory measures will be met with an even fiercer response, as was also demonstrated with Canada.

Euro rally loses steam ahead of German vote

What’s notable here, however, is how this latest escalation dented the euro and European equities, while the US dollar appears to have somewhat restored its safe-haven status. Doubts about how quickly the German parliament will be able to pass the legislation needed to amend the debt brake rule that’s enshrined in the country’s constitution also weighed on the euro.

Germany’s Green party, whose support is needed to secure a two-thirds majority, continues to negotiate with the CDU/CSU and SPD parties. Parliament will vote on the measures, which include a massive bump in defence and infrastructure spending, on Tuesday, and whilst a deal by then is likely, any delay could trigger a correction in the euro’s recent surge.

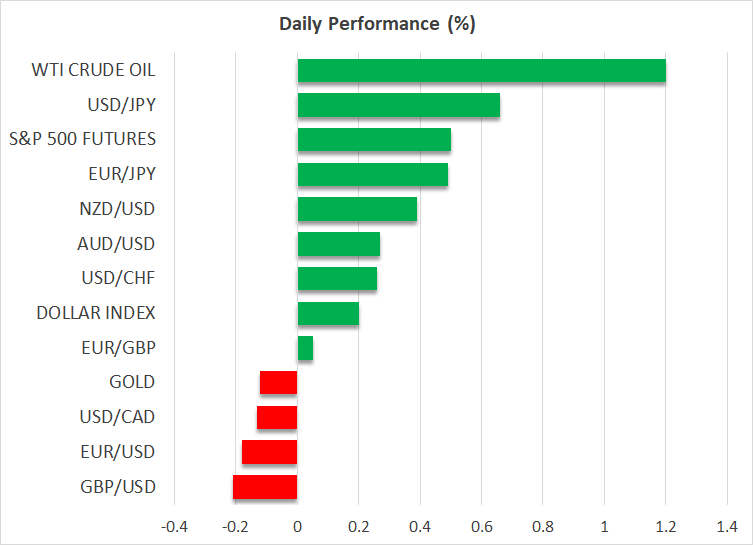

Stocks pare losses after dreadful week

Traders on Wall Street have not taken too kindly to Trump’s increasingly hostile trade rhetoric either, pushing the S&P 500 into a technical correction on Thursday. The benchmark index is headed for its fourth straight week of decline while the Nasdaq is staring at a weekly loss of almost 5.0%.

However, a rebound appears to be underway as US futures are climbing today and European indices are up too. China is leading the bounce where stocks have been lifted by renewed efforts by authorities to boost domestic consumption. More details will likely be announced on Monday when senior officials will hold a press conference.

Further supporting sentiment today is the relief that a weekend shutdown of the US government has been averted. Senate Democratic leader Chuck Schumer has backed down from blocking the stopgap funding bill despite not winning any concession from the GOP. The Democrats are likely being careful about what fights to pick with the Republicans. But for now, this has offered some much-needed reprieve from the negative headlines.

Gold smashes new record above $3,000

The slight improvement in sentiment isn’t deterring gold bulls, however, as the precious metal just broke above the $3,000 milestone. The worsening trade relations between the United States and its allies as well as the overall heightened economic and geopolitical uncertainty are keeping demand for the safe-haven gold elevated.

Trump is laser-focused on achieving his goals on trade policy and does not seem to be paying much attention to what’s happening on Wall Street. His influence over Moscow, meanwhile, is being put to the test as Russia’s President Putin has laid out several pre-conditions before accepting any ceasefire deal with Ukraine.

Dollar bounces back despite soft inflation data

The US dollar also appears to be back in favour for safety flows, edging higher for a third straight day against a basket of currencies. Investors continue to price in about three 25-bps rate cuts for this year, but the Fed will likely maintain its neutral stance when it meets next week as the jobs data this week from the JOLTS job openings and jobless claims have been rather solid.

Hence, the soft CPI and PPI reports did not alter rate cut bets much and this is likely supporting the greenback.

The pound on the other hand took a knock on Friday after GDP data showed the UK economy unexpectedly contracted slightly in January.

.jpg)