USD/JPY holds flat, but bulls remain on watch

USD/JPY closed flat again around the 148.35 level on Wednesday, staying trapped within the monthly sideways pattern after weaker-than-expected JOLTS job openings prevented a breakout above the 149.00 area.

Given the credibility concerns surrounding Friday’s nonfarm payrolls report, volatility could resurface when the private ADP employment report is released later today at 12:15 GMT, with forecasts pointing to a slowdown to 73k from 104k previously.

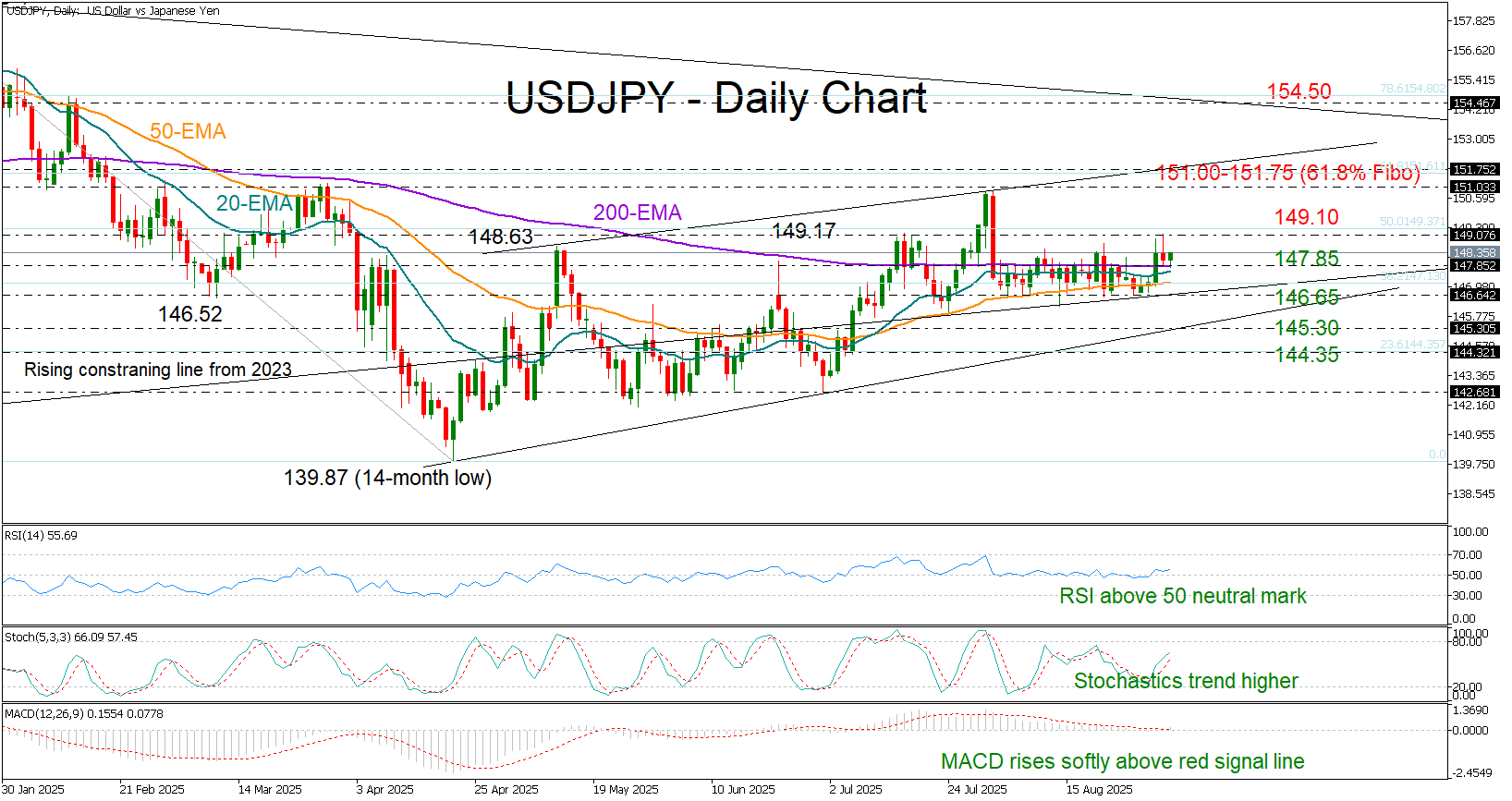

The short-term bias remains tilted to the upside, as the technical indicators continue to fluctuate within bullish territory, with the MACD preparing to cross above its red signal line for the first time since June.

Still, the floor around the 200-day exponential moving average (EMA) at 147.85 must hold firm for the bulls to successfully pierce the 149.10 resistance and drive the pair toward the next barrier at 151.00–151.75. The 61.8% Fibonacci retracement level of the January–April downtrend overlaps with this area. A successful breakout there could open the door for further gains toward 154.60.

On the downside, sellers may re-emerge below the 146.65 support area, where a break could initially bring stabilization near the tentative ascending trendline at 145.35, followed by the 23.6% Fibonacci retracement level at 144.35.

Overall, Wednesday’s pullback in USD/JPY has not eliminated short-term upside potential, as bulls continue to defend the 147.85 area, while bears may only gain traction if the price drops below 146.65.

.jpg)