Crude Oil may be ready to fall further

Crude Oil may be ready to fall further

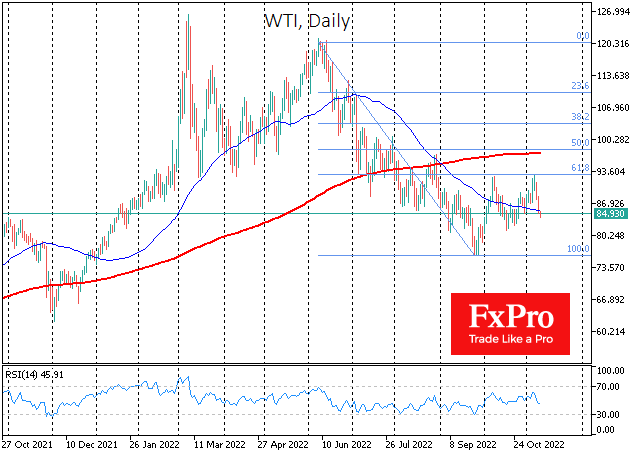

Oil has lost 7.5% since Tuesday, bouncing back to $84 for WTI. Pressure intensified on Wednesday after the weekly inventory report. Having failed to break above $93 for the second time in just over a month, oil appears to have completed its correction from its June-September decline, heading towards $75.

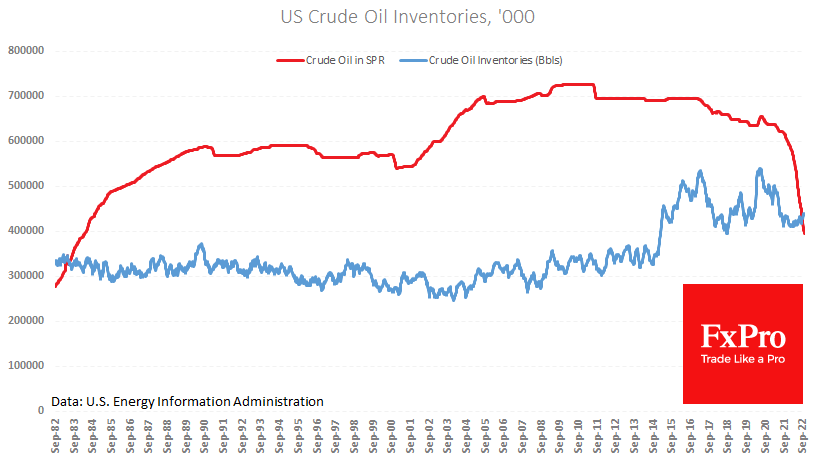

Weekly data showed a 3.9M barrel increase in commercial inventories, reversing the decline a week earlier. At the start of November, inventories were 2.5% below the five-year average for the same week. From this point of view, the situation is quite normal-ish. The strategic reserve continues to melt away, masking the lag between production levels and demand.

Notably, weekly production levels remain close to 12M BPD, at 12.1M last week versus 11.9M the week before. However, these numbers may well be considered sufficient given the slowdown in China, which is increasingly evident from the data released this week.

Also on the side of the market bears was Oman, whose oil minister warned of a possible drop in the price to "$70 after this winter". Adjusting to the shift of the OPEC cartel member, market participants began to consider an even deeper decline.

On the chart, oil has formed a ‘double top’, failing to raise above $93 at the start of the week. And now, the $83 level, where the previous support area is located, is worth paying more attention to. A fall below that would confirm the pattern, suggesting a possible target in the $73 area.

A resistance area in oil has formed in the last month at 61.8% of the decline, a classic Fibonacci retracement. This pattern will finally get confirmation if the price falls under $75. It is considered that in this case, the bears' target will be the area of 161.8% of the initial movement, i.e., the mark near $50.

A drop here looks excessively pessimistic now, but volatile oil has repeatedly lost more than 70% of its peak value during economic downturns. And given the increasing risks of a recession early next year in the USA, the Eurozone, and the UK, plus a sharp slowdown in China at the same time, a fall to $50 looks like a pessimistic working scenario.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)