US data cement Fed rate cut, Wall Street at new record

US CPI and jobs data greenlight September cut

It’s been a week of key US data releases that ran the risk of causing a major upset just days before the Fed’s September FOMC decision. But markets and policymakers are breathing a sigh of relief as there’s been no change to the post-Jackson Hole narrative.

Following Wednesday’s much weaker-than-expected producer prices, yesterday’s CPI report didn’t quite match the downside surprise, but neither did it raise any alarms. Headline CPI quickened slightly to 2.9% y/y as expected, and although the month-on-month rate of 0.4% was somewhat worrying, the no change in core CPI at 3.1% y/y eased concerns that inflation is spiralling out of control.

More importantly, a larger-than-expected increase in weekly jobless claims reinforced the view that the labour market is in trouble. Claims for unemployment benefits jumped to the highest since 2021 last week, supporting the Fed’s case to prioritize employment over inflation for its dual mandate.

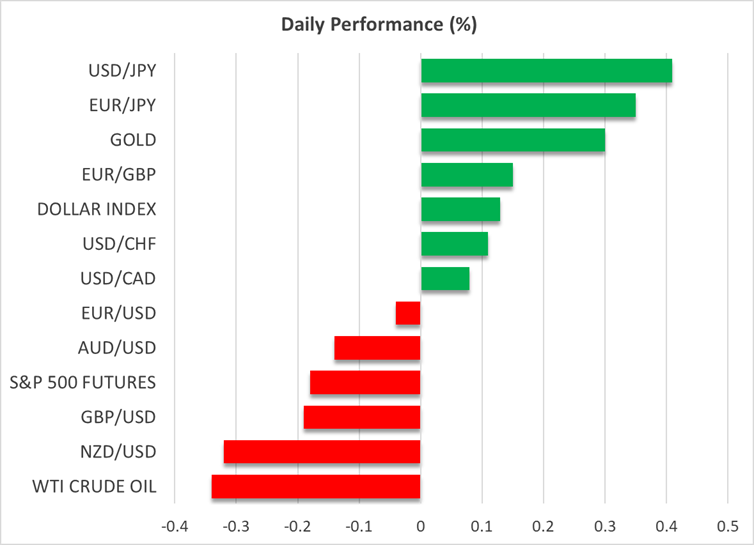

Dollar and yields slide, lifting gold

The US dollar took a dive after the data, slipping across the board. But the moves weren’t dramatic and over the medium term, the greenback continues to trade within a mostly neutral range against a basket of currencies.

What’s most surprising is that expectations for a larger 50-basis-point cut at next week’s meeting barely budged, indicating that investors see the Fed maintaining some caution until inflation risks have dissipated more substantially. Still, markets are now confident that there will be back-to-back rate cuts for the three remaining meetings of the year, with a further three 25-bps reductions to follow in 2026.

This dovish outlook has been weighing on Treasury yields since the August NFP report, with the slide accelerating yesterday. The 10-year yield briefly dipped below 4.0% to the lowest since April.

Global sovereign bond yields have also been pulling back during September, adding to gold’s appeal. The precious metal hit a new all-time high of just under $3,674 on Tuesday. It’s attempting to climb back towards that level today, but the steadier dollar may prevent it from surpassing it just yet.

Euro supported by ECB pause, pound pares gains

The euro reclaimed the $1.17 handle on Thursday after the European Central Bank left its key lending rates unchanged, as was widely anticipated. In her post-meeting press conference, President Lagarde hinted that it may be some while before rates are cut again, saying that the economic risks have become “more balanced” amid the receding trade tensions.

But ECB ‘sources’ later intervened to make it known that a rate cut could be debated at the December meeting at the earliest. Investors weren’t too convinced, however, and have priced in only a 40% probability of one final rate cut over the next 15 months.

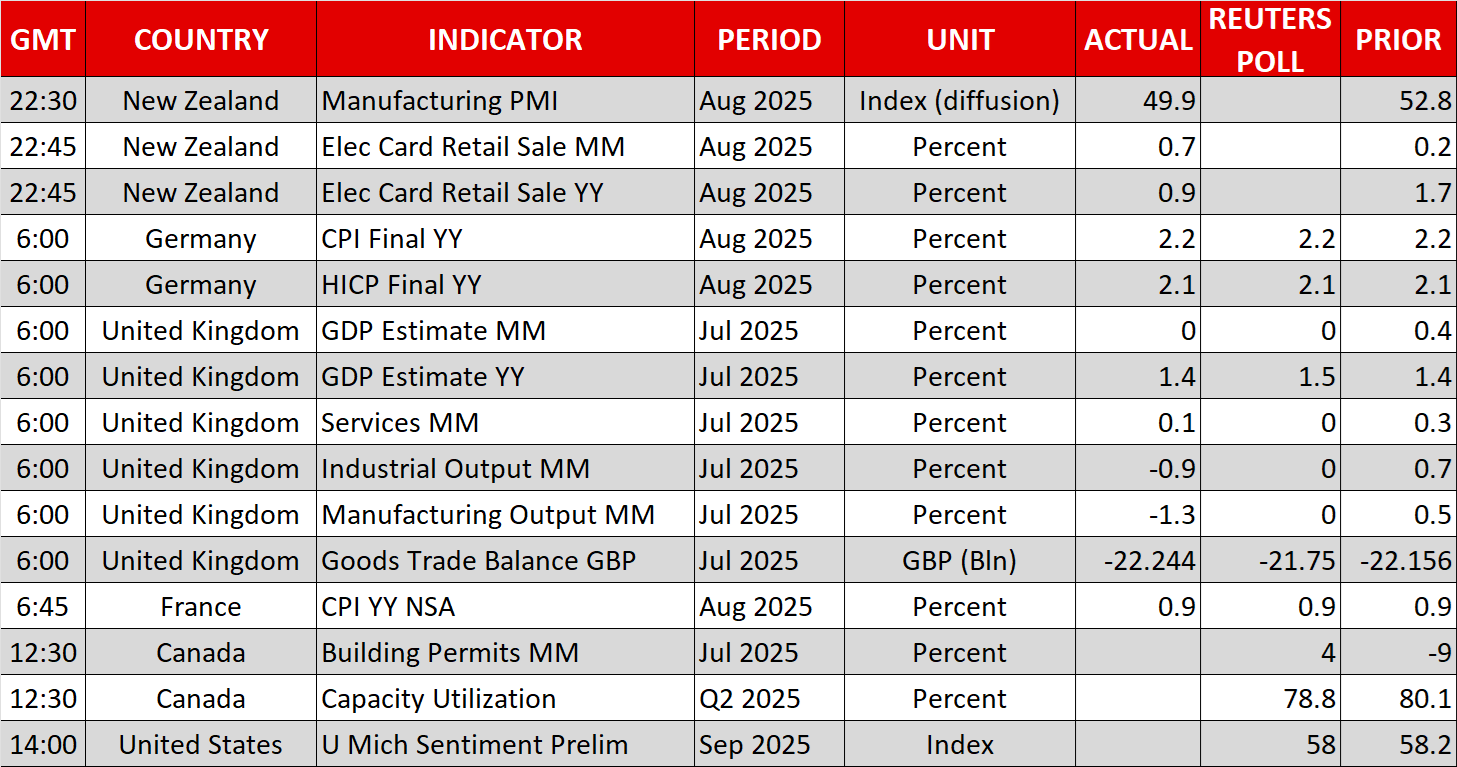

The pound is slightly underperforming today following a slump in UK industrial output in July. Overall GDP growth was flat, but traders are more likely distracted by UK Prime Minister Keir Starmer’s repeated unsuccessful attempts at resetting his government, following two high-profile resignations recently.

Rate cut and AI optimism energise stocks

In equity markets, it’s all about the Fed’s expected rate cut next week and the AI frenzy. Following Oracle’s very upbeat earnings outlook that sent the stock surging 36% on Wednesday, Adobe is next to report earnings results boosted by investment in AI. The company announced a beat in earnings as well as strong guidance on Thursday, pushing the stock up more than 4% in pre-market trading.

US futures are slightly in the red on Friday, likely due to some profit taking following record closes for all three of Wall Street’s main indices yesterday.

Heading into the weekend, investors will be keeping an eye on the University of Michigan’s preliminary consumer sentiment survey, which includes the closely watched inflation expectations gauges.

.jpg)