EBC Markets Briefing | Asian equities surge in tandem on AI frenzy

South Korean stocks notched a record high on Friday after President Lee Jae Myung said he would not press for a capital gains tax increase, a proposal that had hit investor sentiment earlier this year.

The Kospi benchmark is Asia's best performer in the year to date, up more than 41%. Markets in Japan and China have also been firing on all cylinders, while India and Australia descend into underperformance.

The gains came as the left-wing government is pursuing policies aimed at improving stock valuations. Since taking office in June, Lee has strived to draw capital from the overheated property market.

South Korea's housing, especially in urban areas, is unaffordable due to a combination of high demand and limited supply. Ageing crisis is posing a dire threat to the highly speculative market.

Addressing housing mismatch will also help improve the president's approval rating that sunk to a record low in August. Trump is imposing a 15% import tax on South Korean goods after July's negotiation.

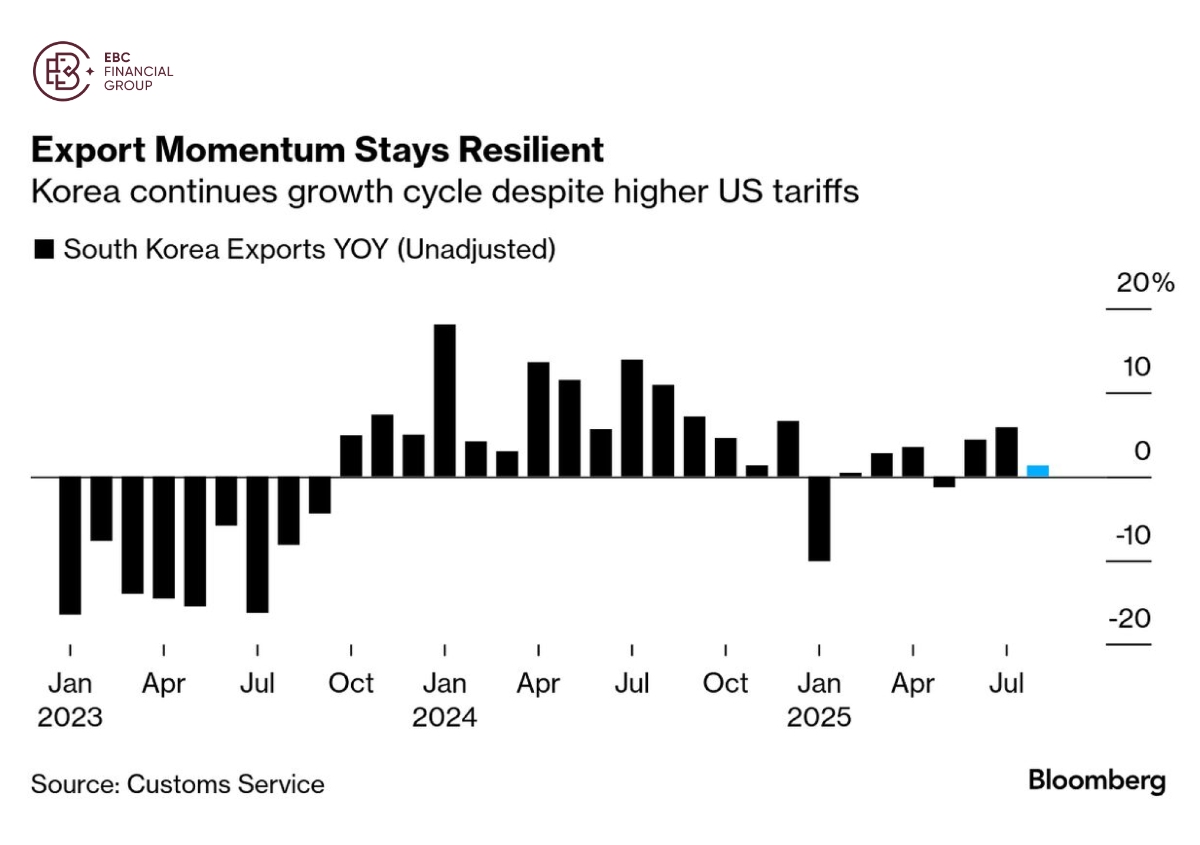

South Korea's exports held up last month, buoyed by strong semiconductor and car shipments. The BOK recently kept its 2026 growth outlook at 1.6% and said tariff effects could intensify over time.

iShares MSCI SOUTH KOREA ETF, which tracks the investment results of an index composed of South Korean equities, represents a lower-valued alternative option to Big Tech or the Nasdaq 100 index.

A shot in the arm

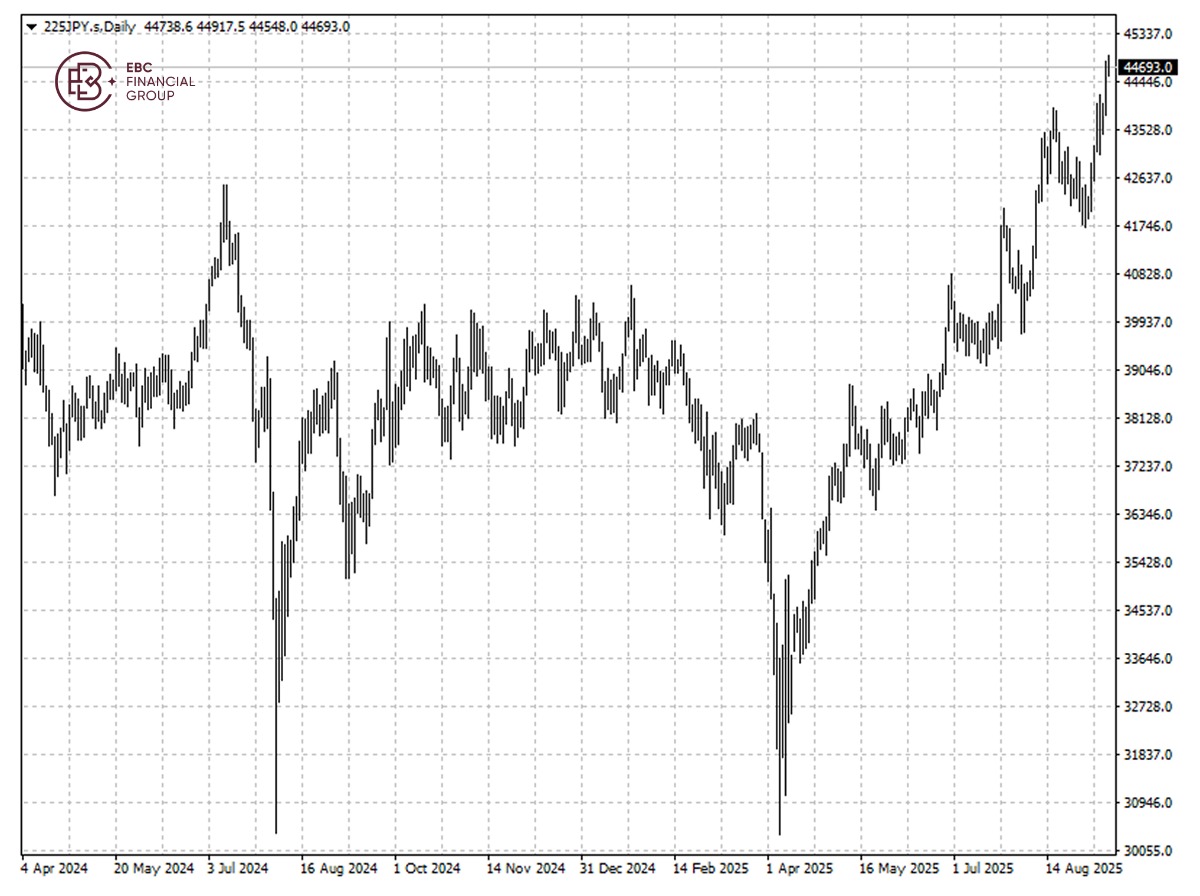

The Nikkei 225 also set a fresh peak this week. Gains in the market have been strong and steady this week, after PrM Shigeru Ishiba announced his intention to resign on Sunday.

Expectations for more fiscal spending and monetary easing under the next prime minister booster confidence, analysts have said. Opposition parties are opposed to the de factor QT in place.

But the BOJ is firming up a strategy to unload its huge holdings of risky assets that will likely center on a plan to gradually sell ETF in the market, according to sources familiar with its thinking.

Almost half of Japanese companies regard BOJ Governor Kazuo Ueda's performance positively, outpacing the 30% with negative views of his handling of monetary policy, a Reuters survey showed on Thursday.

With the number of foreign workers in Japan rising 12.4% from a year earlier to a record 2.3 million in 2024, immigration emerged as one of the hottest issues in an upper house election in July.

The number of bankruptcies in which labour shortfalls have played a role came to 238 in the first eight months of the year in Japan, on a trajectory to hit a record high for the whole of 2025, according to Tokyo Shoko Research.

Core inflation slowed for a second straight month in July but remained above 3%. Tighter restrictions on letting in foreigners and tax cuts would add fuel to price growth, give policymakers less leeway to stand pat.

Ahead of the curve

China's tech stock rally has extended into a twelfth month, with onshore equities largely catching up to offshore counterparts over the past few weeks and lifting the broader Shanghai stocks to levels not seen in a decade.

Morgan Stanley noted US investors are showing the highest level of interest in Chinese stocks in five years, and their return to China is just "starting" despite some lingering reasons for caution.

But foreign buying of Chinese stocks continued for a third month in August, albeit at a slower pace, as long-only funds increased their exposure to A-shares.

Money managers in Asia-Pacific turned more enthusiastic on China amid expectations that Beijing would act to combat persistent deflation, according to a BofA Securities survey published in mid-August.

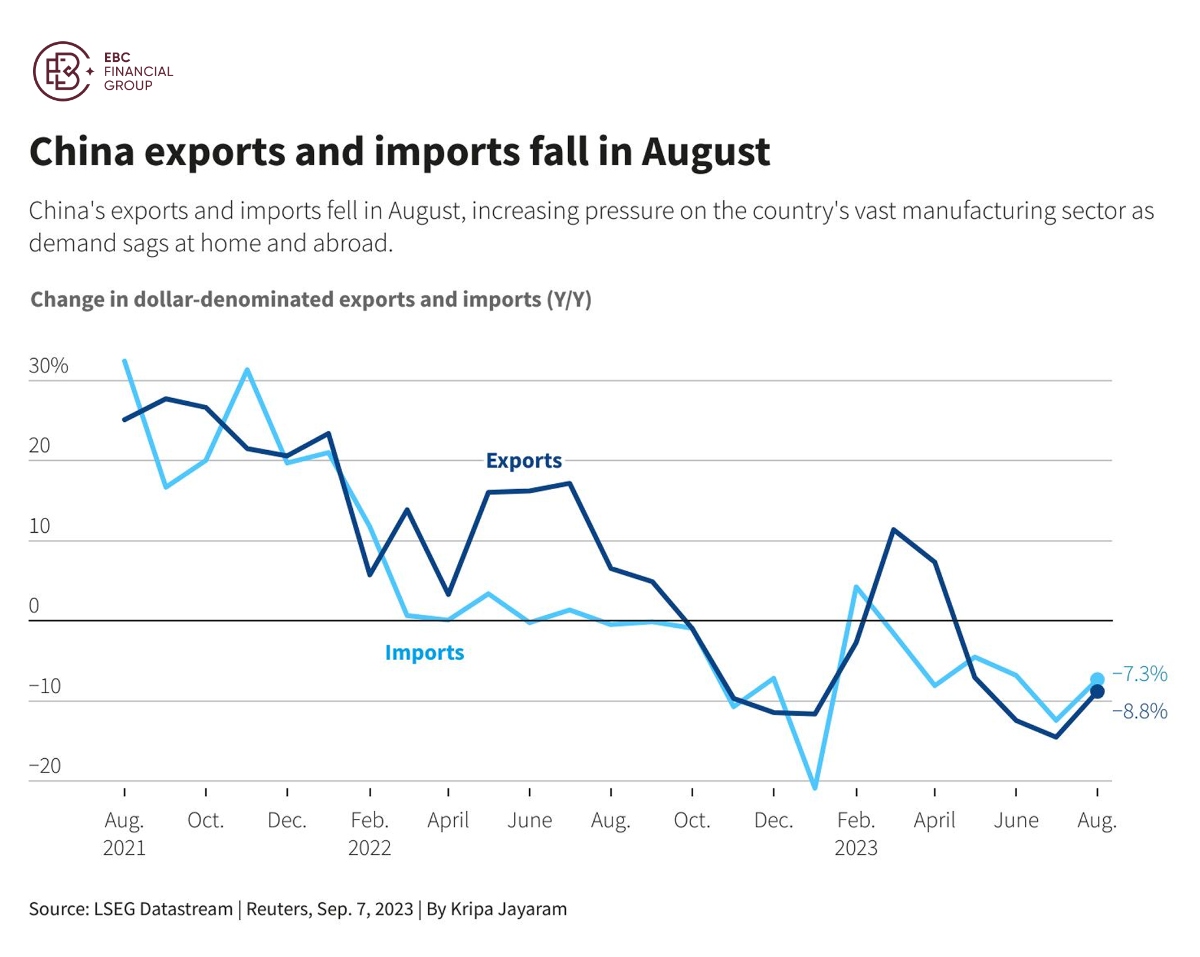

China's export growth slowed to a six-month low in August as a brief boost from a tariff truce faded, but demand elsewhere provided officials some relief. Moreover, a durable pick-up in consumption is still missing.

A protracted slump in the property sector is squeezing consumer spending. And depleted land-sale revenue is limiting local authorities' ability to back Beijing's drive to revive demand through subsidies.

With the most popular tech stock Cambricon trading at more than 500 times trailing earnings, a more broad-based rally is needed to pull the massive amount of cash on sideline.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.