Bitcoin is holding, while Solana is on the edge

Market Overview

The crypto market capitalisation fell to $2.91T (-2.4% for the day). The surge at the start of the US session on Wednesday only fuelled the bears, who drove the market down to $2.89T by the end of the day, retreating only slightly from these lows. Under intense pressure, the major old altcoins — Ethereum, XRP, and Solana — retreated to multi-month lows, losing about 4% over the past 24 hours.

Bitcoin is trading near $87K, roughly where it was the day before. A sharp jump in price above $90K hit a wall of selling, and now just above this round level is a significant short-term resistance line, which was support until 14 December. However, it is also difficult for the market to find reasons to go below the $85K level, from which the price has been rebounding since the beginning of the week. Additionally, it is worth noting that BTC is trading significantly above its late November lows of $80K, outperforming major altcoins.

Bitcoin is trading near $87K, roughly where it was the day before. A sharp jump in price above $90K hit a wall of selling, and now just above this round level is a significant short-term resistance line, which was support until 14 December. However, it is also difficult for the market to find reasons to go below the $85K level, from which the price has been rebounding since the beginning of the week. Additionally, it is worth noting that BTC is trading significantly above its late November lows of $80K, outperforming major altcoins.

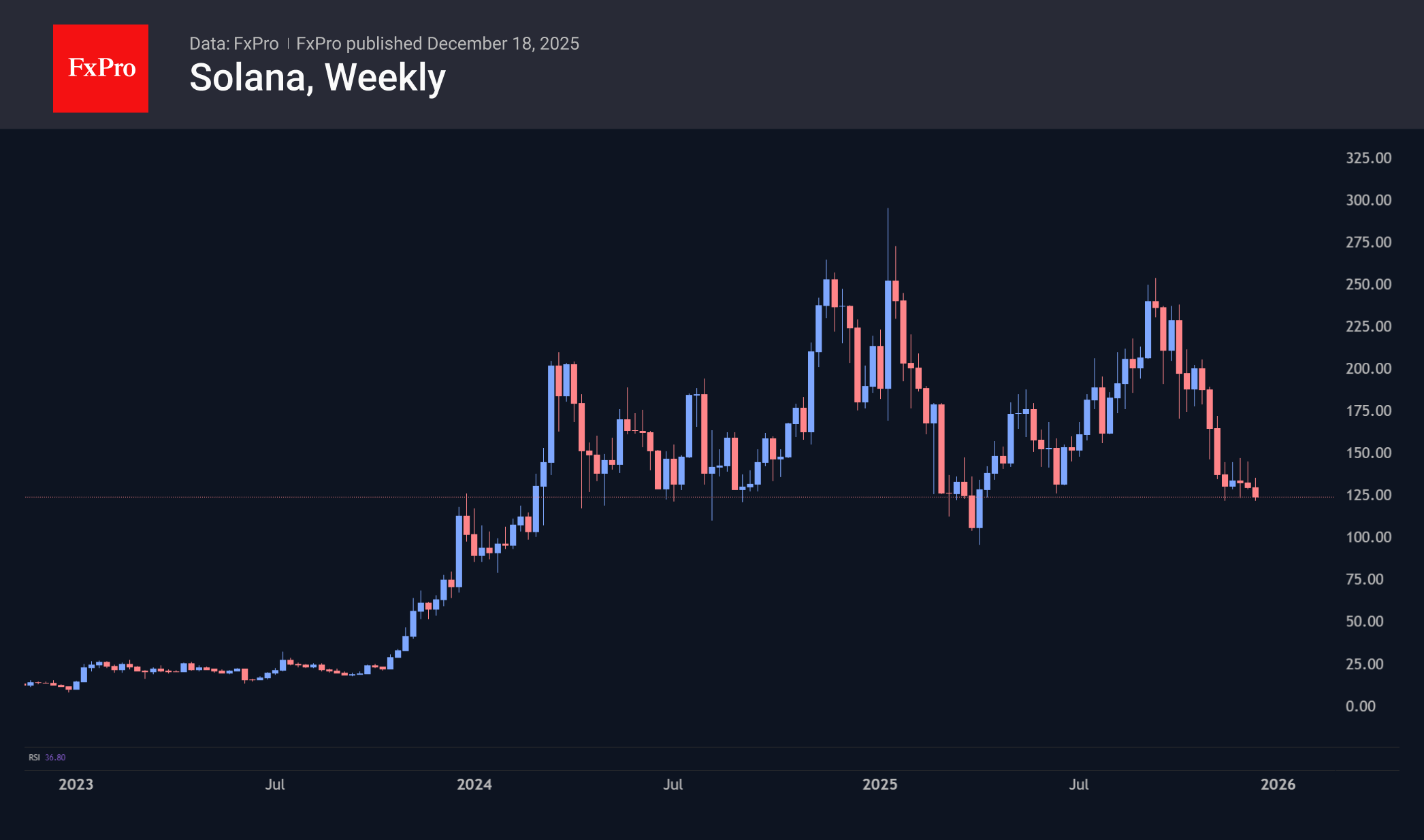

Solana's price fell to $123, testing an important support area from March 2024. Since its peak in September, this seventh-largest altcoin has lost half of its value. The technical rebound that began at the end of November has ended, and if support at $120 fails, the road down to $90 or even $70 will open up.

Solana's price fell to $123, testing an important support area from March 2024. Since its peak in September, this seventh-largest altcoin has lost half of its value. The technical rebound that began at the end of November has ended, and if support at $120 fails, the road down to $90 or even $70 will open up.

Long-term Bitcoin holders have almost completed their active selling phase, according to K33 Research, which anticipates a decrease in selling pressure. Over the past two years, 20% of the supply has returned to the market, and this process is almost complete.

Long-term Bitcoin holders have almost completed their active selling phase, according to K33 Research, which anticipates a decrease in selling pressure. Over the past two years, 20% of the supply has returned to the market, and this process is almost complete.

Institutional investors have begun buying Bitcoin at a rate faster than miners can mine it, Capriole notes. For the first time since November, demand from companies has exceeded the inflow of new coins into the market amid a more than 30% drop in the asset from its October highs.

Strategy bought 641 bitcoins daily in 2025, according to Finbold Research. This allowed it to increase its holdings by 223,800 BTC (a 50% increase) in less than a year.

The capacity of the Lightning Network (LN) micropayment network has reached a historic high, thanks to technical improvements and the implementation of the solution by major exchanges. The growth of this indicator is a sign of demand for faster and cheaper transactions.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)