Crypto: slight rebound within a bear market

Market Overview

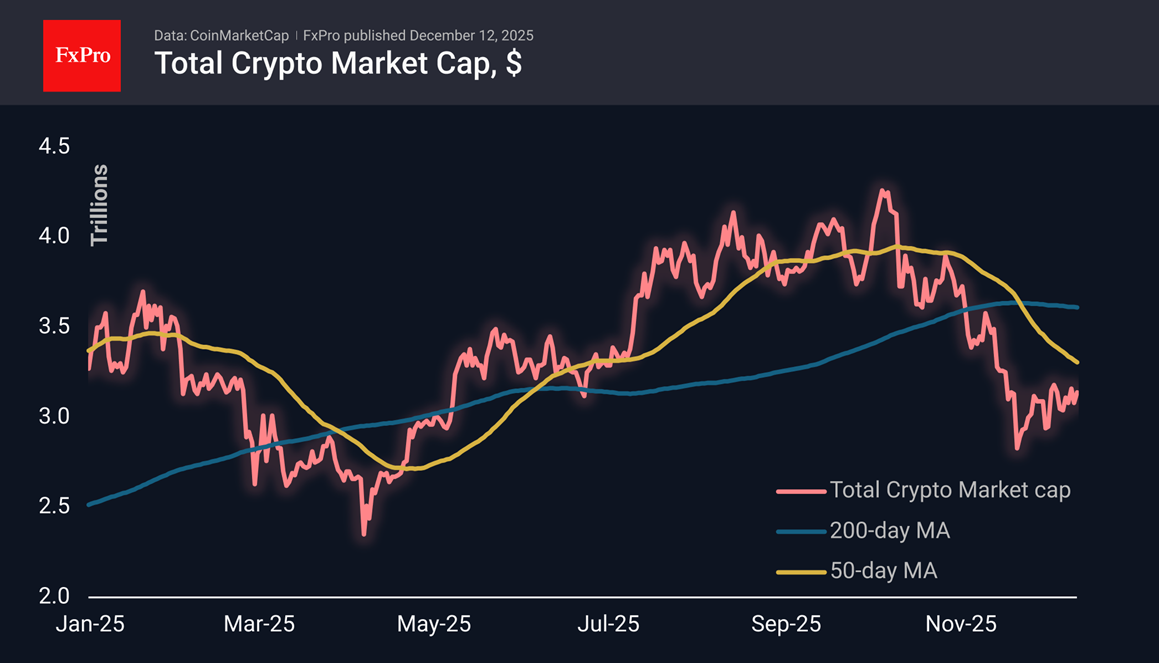

The crypto market capitalisation gained about 2%, returning to the $3.14T level. The good news is that the latest local low fits into the upward trend of higher lows since the end of November. The bad news is that resistance near $3.20T has remained in place all this time. The spring is compressing, promising an end to the relative calm in the next few days. The market will need to decide on a direction for the coming weeks.

The cryptocurrency sentiment index has been stuck at 29 for the last two days, its highest level since early November. The exit from the zone of extreme fear and the prolonged period of calm are working in favour of the bulls, significantly increasing the chances of a bullish rally soon. At the same time, we continue to believe that cryptocurrencies have already entered a bear market, and a price recovery will attract more sellers.

The cryptocurrency sentiment index has been stuck at 29 for the last two days, its highest level since early November. The exit from the zone of extreme fear and the prolonged period of calm are working in favour of the bulls, significantly increasing the chances of a bullish rally soon. At the same time, we continue to believe that cryptocurrencies have already entered a bear market, and a price recovery will attract more sellers.

Bitcoin continues to find support on dips, but, like the rest of the market, is facing horizontal resistance. This dynamic suggests that since the end of November, a rebound in the bear market has occurred, and a new downward momentum will likely follow soon.

The crypto market is showing signs of cautious optimism but has yet to fully recover from the effects of the October 10 crash, according to Block Scholes.

Bitcoin needs to consolidate above $95,000 to break out of the bearish trend, according to Glassnode. Without this, the asset will remain overly vulnerable to macroeconomic events.

The Fed's key rate cut was insufficient to stimulate growth in the cryptocurrency market. The situation adds uncertainty and dashes hopes for the traditional ‘Santa Claus rally,’ Coin Bureau notes.

The main driver of growth for the first cryptocurrency is a decline in seller activity. The daily inflow of coins to exchanges has decreased fourfold since November 21, to 21,000 BTC. Bitcoin could rise to $112,000 in the next one to three months, but for this to happen, the Fed must ease its monetary policy, according to CryptoQuant.

The entry of institutional investors into the crypto market has buried the chances of an alt season. Risk-prone retail traders have shifted to the stock market, where they trade shares of high-volatility companies, Gemini notes.

According to Arkham, Tom Lee's BitMine company bought 33,504 ETH for a total of $112 million. The deal took place against the backdrop of the Fed's decision to cut its key rate for the third consecutive time.

In 2025, 117 new companies added Bitcoin to their reserves; however, the overall trend towards adopting the first cryptocurrency is losing momentum, according to CryptoQuant.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)