Dollar extends gains, BoE and BoJ stand pat

Looming US government shutdown to delay NFP data

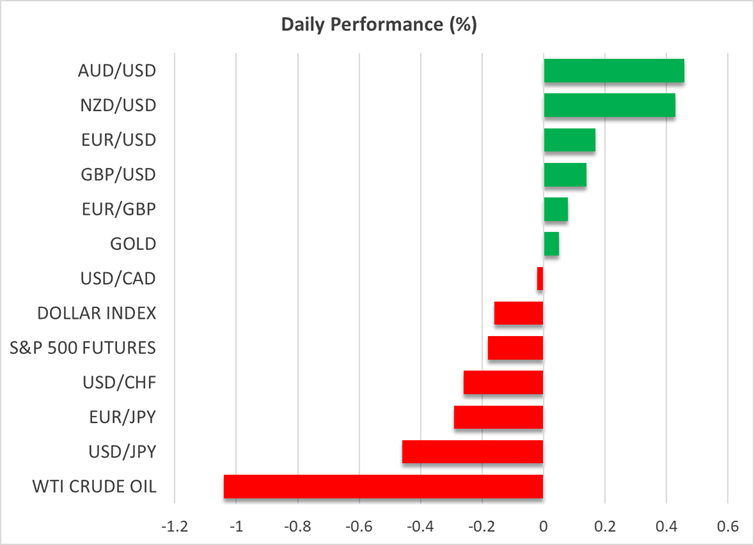

The US dollar slid against most of its major peers on Monday and it is extending its slide today amid increasing risk of a US government shutdown tonight as US Congress policymakers are struggling to agree on a spending bill for the new fiscal year.

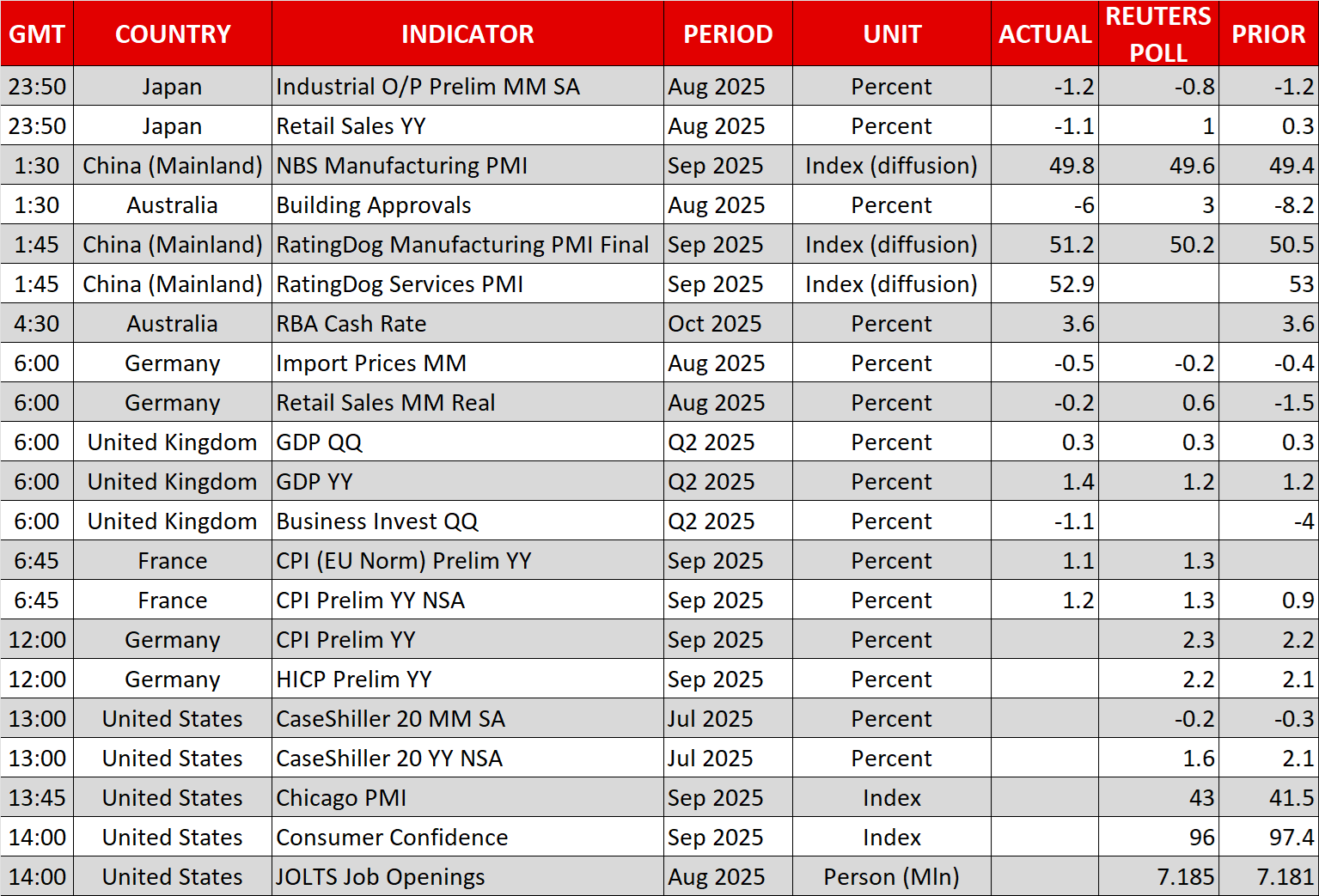

The US dollar gained ground last week as stronger than expected data, including an upside revision to GDP and a sharp fall in jobless claims, prompted investors to scale back their Fed rate cut bets. According to Fed fund futures, there are 42bps worth of rate cuts penciled in by the end of the year, while the total number of basis points worth of reductions by December 2026 has fallen to 104bps. That’s around 25bps less than the market projections a couple of weeks ago.

That said, the looming US government shutdown weighed on the US dollar as it would delay the release of the extra-important employment report this week. The US Labor Department has already confirmed that they would suspend economic releases if Republicans and Democrats fail to reach common ground.

Having said that, should the shutdown prove brief, the Fed is unlikely to alter its strategy. After all, the next FOMC decision is scheduled for October 29, and officials may still have the jobs data in their hands before they gather. However, a prolonged shutdown would not only leave policymakers without the information needed to conduct policy, but it could increase the downside risk to growth. This could revive ultra dovish bets and could result in deeper wounds for the US dollar.

Equities gain, gold extends rally to new all-time highs

On Wall Street, all three main indices closed in positive territory, confirming the notion that investors are not worried about a brief shutdown. However, should the government suspend operations tonight and remain shut for a protracted period without signs of resolution, investors may become more worried, something that could result in a corrective setback for equities, even if this translates into expectations of even lower borrowing costs.

For now, investors may have decided to increase their hedge bets by buying more gold. A combination of a US government shutdown risk and expectations of more rate cuts by the Fed seems to be a win-win situation for the precious metal, which marched to a fresh record high of $3,872 today.

Aussie strengthens on RBA, BoJ Summary boosts the yen

Elsewhere, the RBA decided to leave interest rates unchanged today and changed its view on inflation. Instead of reiterating that “inflation has continued to moderate”, this time officials said that “the decline in underlying inflation has slowed”. They also noted that it will take some time to see the full effects of prior rate cuts, which corroborates the view that they are in no rush to cut interest rates again. Investors interpreted the message as slightly hawkish, with the aussie gaining at the time of the release and the probability of a November rate cut sliding to 35% from 40%.

The yen gained notable ground against its US counterpart yesterday and is extending its rally today, after the Summary of Opinions from the latest BoJ meeting revealed that policymakers debated the likelihood of raising interest rates soon, with some saying that the time for action is approaching. The probability of a 25bps rate increase by December is now resting at 76%, while such a hike is fully priced in for January.

.jpg)