EBC Markets Briefing | A perfect storm lurks in Europe after far-right gains

The pound eased from its highest in nearly two years against the euro on Tuesday. The common currency tumbled after French President Emmanuel Macron called a snap election after being trounced by the far right.

The uncertainty in France adds one more element to what will be a busy week for markets with US inflation data due on Wednesday, the same day as the Fed's policy decision at its two-day meeting.

Centre, liberal and Socialist parties were set to retain a majority after the European Parliament elections, but eurosceptic nationalists made the biggest gains, raising questions about the prospect of policy.

Macron called a parliamentary election with a first round on June 30. If the far-right National Rally party wins a majority, Macron would be left with little influence on domestic affairs.

While the euro assets have been largely cushioned by political turmoil compared with elections in the 2010s and early 2020s, the results and surprise reaction from France could be a wake-up call.

Notably the UK general election with Labour taking the poll lead will come on the heels of the parliamentary election in France, which could create a “perfect storm” for prices to be stay volatile.

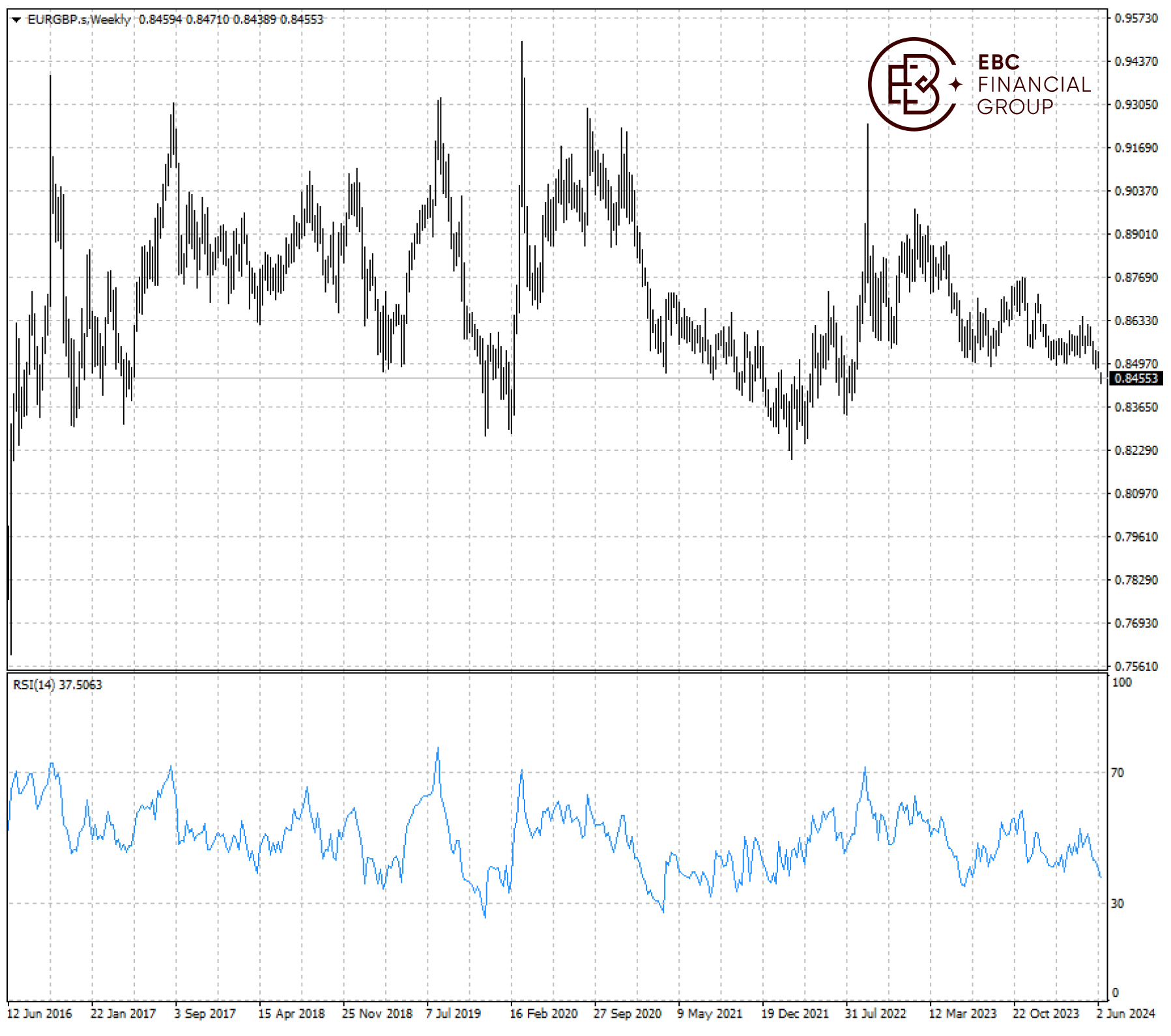

The pair is forming a falling wedge pattern on the weekly chart and tends to drop further before a reversal signal. But given an RSI flirting with 30, we do not see weakening below 0.8400 as very likely.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Forex Trading Platform or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.