EBC Markets Briefing | Euro hits 4-year peak despite France downgrade

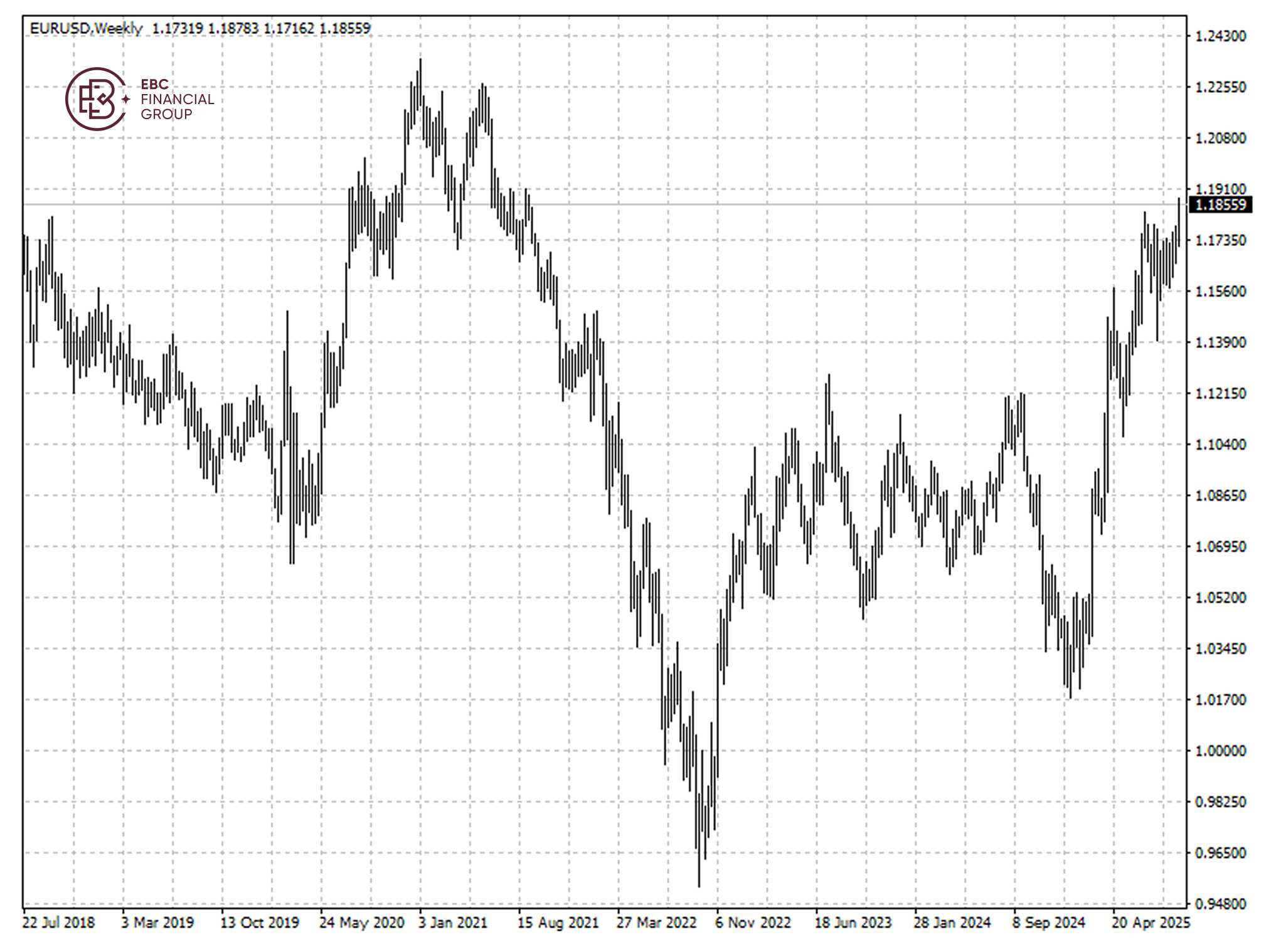

The dollar under renewed selling pressure hit a four-year low against the euro on Wednesday. Markets expect a 25-bp rate cut later with rapidly softening labour market data.

The greenback got little relief from data on Monday that showed US retail sales increased more than expected in August. Euro zone industrial production inched higher in July despite tariff hit.

The first estimates of euro area balance showed a €12.4 billion surplus in trade in goods with the rest of the world in July 2025, up sharply from one month earlier, predominantly due to chemicals and related products.

German ZEW data highlighted a sharp decline in current economic conditions, but investor sentiment on the outlook improved strongly. Elsewhere its neighbouring country plunges into a tailspin.

Fitch downgraded France credit rating last week, just as Emmanuel Macron's government wrestles with political turmoil and the daunting task of getting the public finances back in order.

The agency also poured cold water on the idea that France could hit its previous target of cutting the deficit to 3 percent of GDP by 2029. But economy minister Éric Lombard push back against the estimate.

The single currency shows strong upside momentum with the potential resistance around 1.1900. If it manages to push above the level, another leg higher is highly likely.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.