EBC Markets Briefing | Sterling rises amid risk sentiment; bullion crashes

Sterling inched up on Monday after Trump said retaliatory 100% tariff on goods from China would be "not sustainable", and confirmed he would still meet with Chinese President Xi Jinping in two weeks.

The British economy expanded by a lacklustre 0.1% in August, in line with consensus forecast. Economists say there is a case for BOE rate cuts in November as the labor market weakens and wage growth cools.

Finance Minister Rachel Reeves is expected to announce tax rises and spending cuts that could put a dampener on consumer spending, business investment and, ultimately, growth.

Speculators have eroded bullish dollar positions against the pound from August's almost three-year high of $3.3 billion to just $165 million, reflecting waning conviction that the pound could strengthen further.

But the boom in investment in AI is starting to be felt for the first time in currency markets across Europe, and analysts regard sterling as among the biggest beneficiaries.

By one measure, the UK received just over $4 billion last year in private AI investments, ranking third and fourth in a Stanford University AI index of biggest beneficiaries of such investments, behind the US and China.

Sterling is to flirt with 50 SMA, a level which could prove hard to overcome given lower highs and lower lows. Therefore, we see another leg lower in the upcoming sessions.

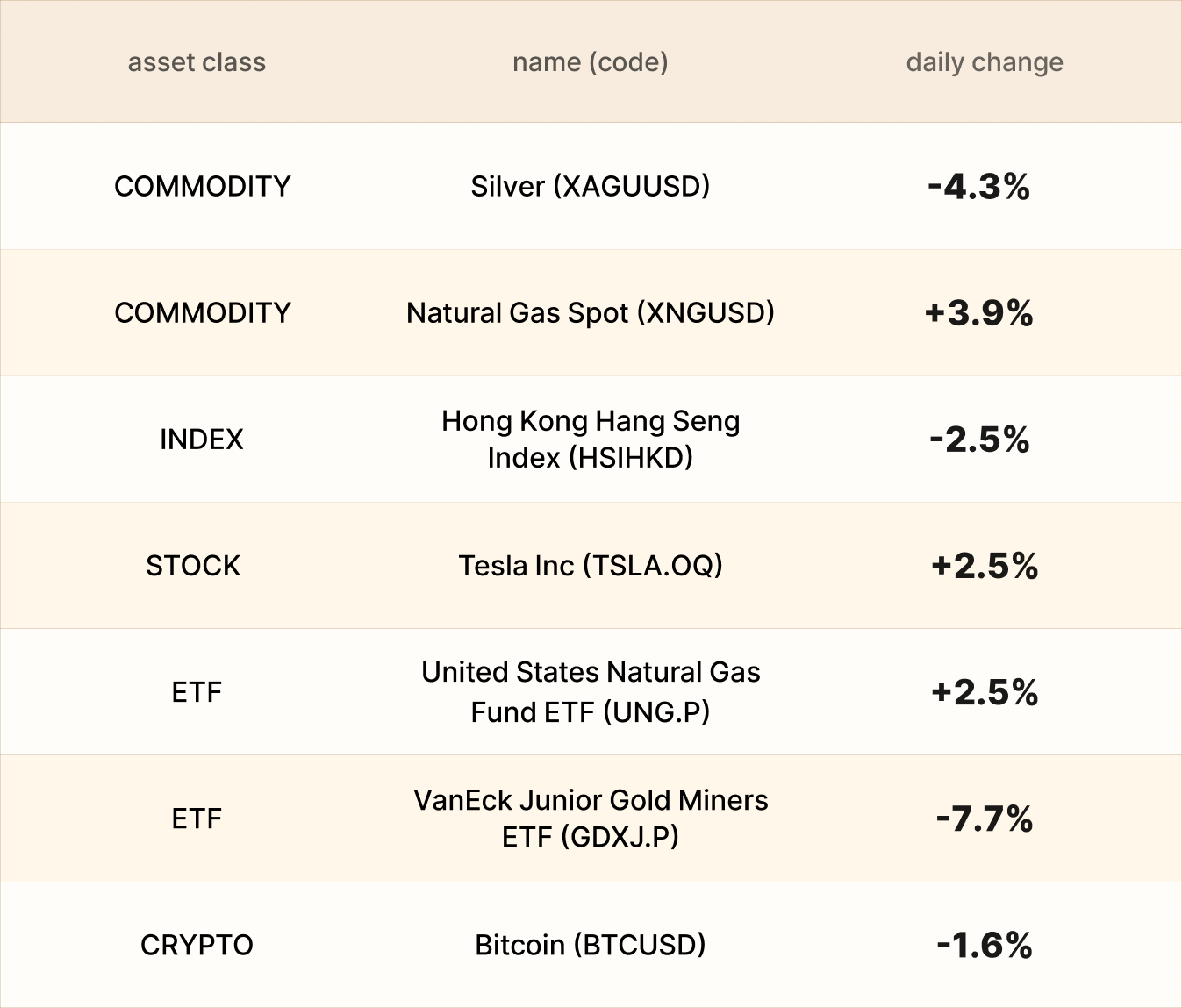

Asset recap

As of market close on 17 October, among EBC products, natural gas led gains. It rallied for the first time in four sessions, bolstered by strengthened export activity and bargain buying.

Gold and silver saw substantial selling pressure as trade tensions between China and the US eased and prospects of peace in Gaza emerged. Traders chose to take profits amid signs of overbought.

Despite fluctuating sales this year, Tesla has reported record-breaking production and deliveries of new cars. A huge majority of the vehicles sold and built were from the company's mass-market cars.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.