EBC Markets Briefing | US stocks muted as investors await key earnings

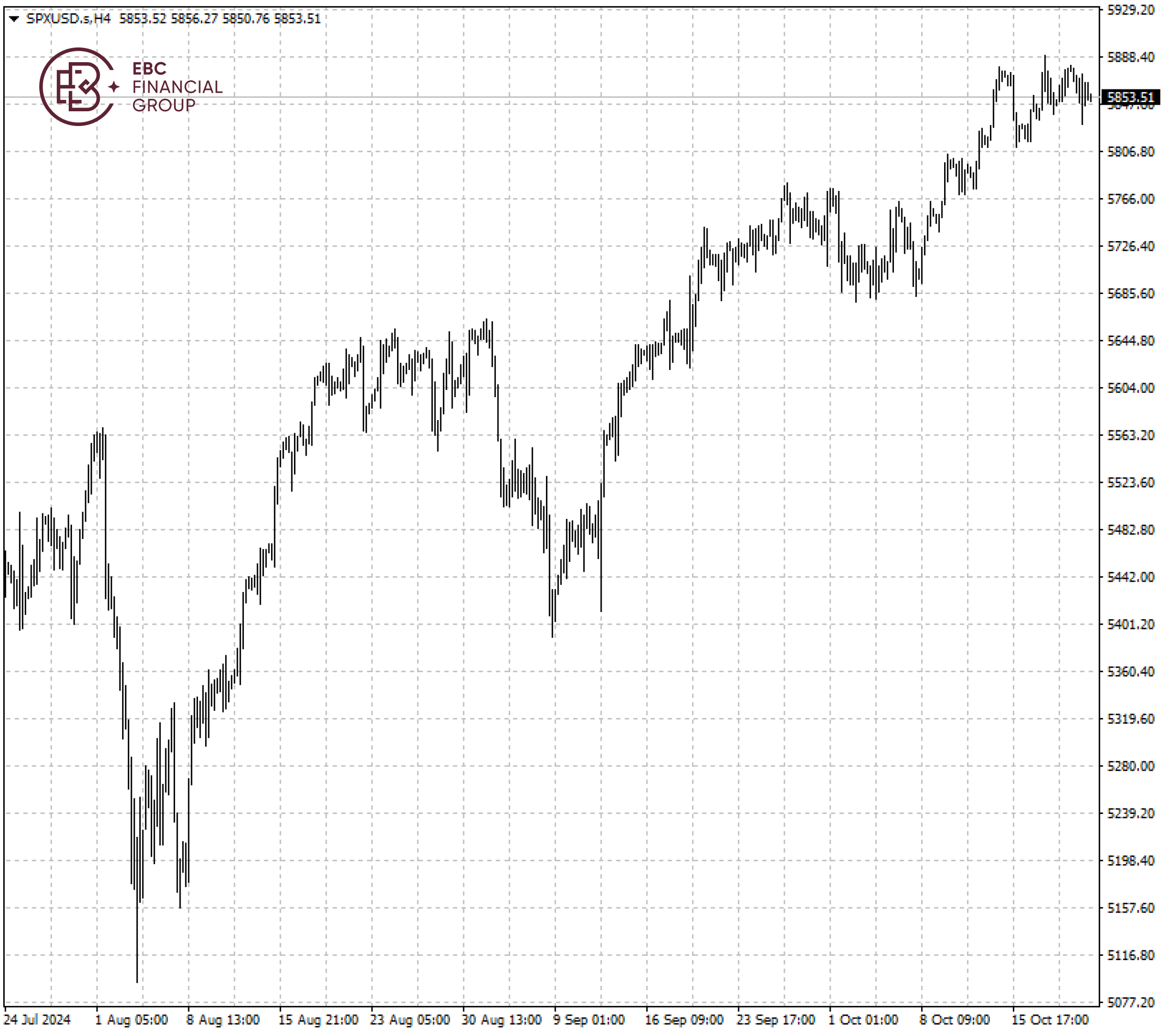

US stocks mostly retreated from record high closes and six straight weekly gains on Monday as Treasury yields rose and investors wary of high valuations.

Hedge funds have shown "a strong preference" for stocks that could perform well if Trump wins the election, JPMorgan said in a note late last week analysing how positioning is changing ahead of the nomination.

The S&P 500 Index will approach 6,000 by year-end and even reach 6,270 if markets see a replication of historical election year patterns, according to the latest Bloomberg Markets Live Pulse survey.

While earnings growth is only expected to be around 5% in Q3, this figure is expected to bounce back well into double figures in the coming quarters and settle around 15% for 2025 overall, according to LSEG I/B/E/S estimates.

The Magnificent Seven to either beat or perform in line with the rest of the market this quarter. One reason investors remain bullish is that the bulk of the S&P 500’s earnings growth still comes from the group.

Roughly 20% of S&P 500 members are scheduled to release results this week. About 70 companies in the gauge have reported already, with 76% announcing earnings that surpassed estimates, according to Bloomberg Intelligence data.

The benchmark index looks bullish and could retest the 5,900 level soon without extreme earnings surprises to the downside.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.