EBC’s Million Dollar Trading Challenge II | Tariffs Test Traders as Top Performers Turn the Tide

On 14 May 2025, EBC’s Million Dollar Trading Challenge II added yet another intense day of trades to this 3-month competition. Both Dream Squad and Rising Stars traders have been locked in exciting head-to-head battles.

Since the competition began, the leaderboard has seen a constant rotation of standout traders. Sometimes it’s a case of 1 trader shining above the rest; at other times, it’s a fierce free-for-all. Success here demands not only skill but also a fair share of luck.

As previously noted, President Trump’s unpredictable tariff policies have made the markets extremely tricky to navigate. While increased volatility creates more opportunities, the constant change in direction has made managing positions a real challenge.

But true champions never blame their circumstances. By midday in the Dream Squad category, 1 trader had posted nearly $400,000 in profits to achieve a 71x return.

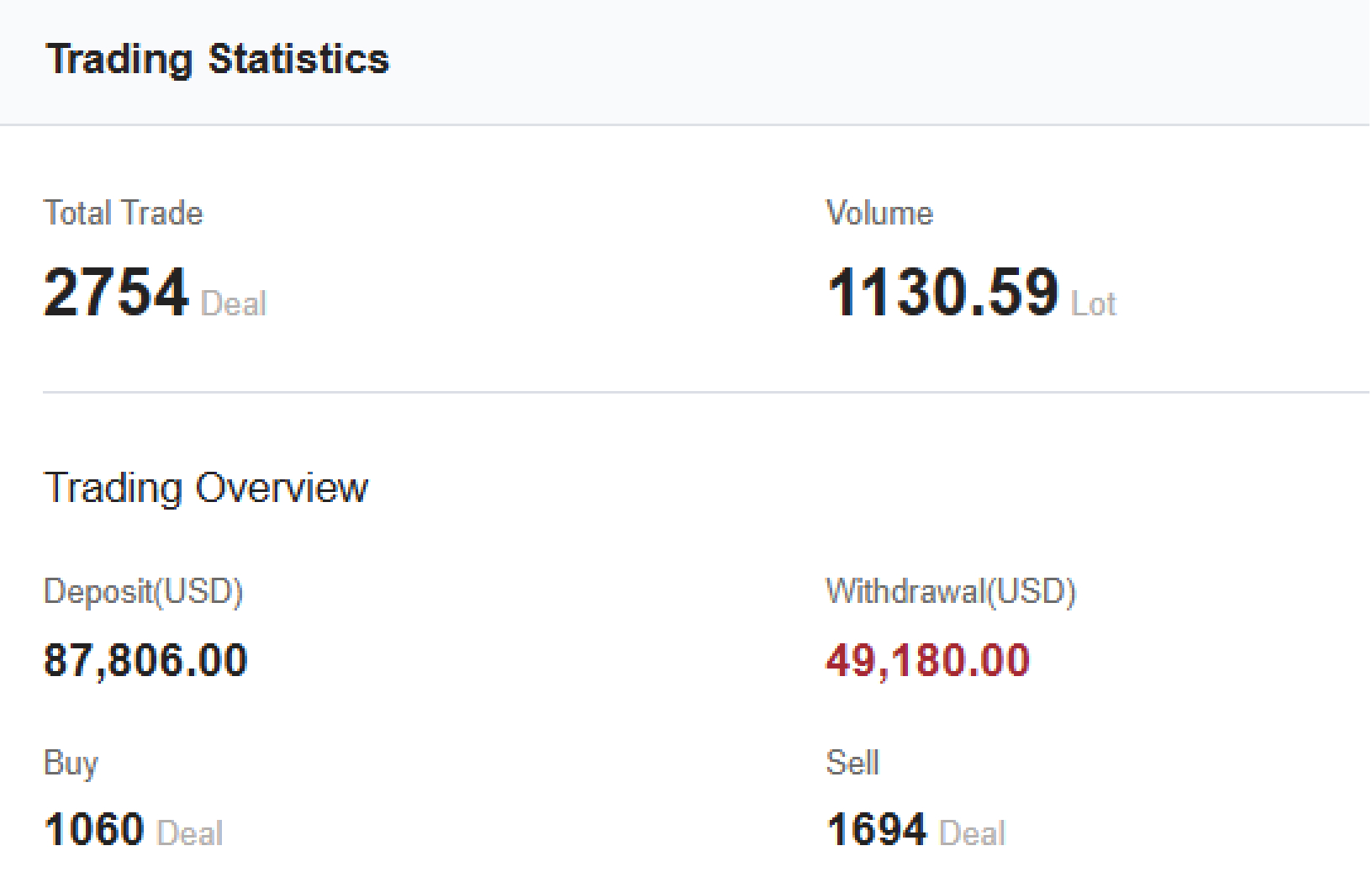

@Wolaiole is close behind having surpassed $230,000 in profits and withdrawn $49,180, sticking to a disciplined approach of intraday and even scalping trades across multiple instruments. This reminds us of a similar strategy used by the previous 2023 champion.

Meanwhile, the top spots in the Rising Stars category have seen less activity in recent days, leading to a dip in copy trading. For copy traders, patience is key, as Fibonacci trading pioneer Joe DiNapoli famously said, “Don’t chase after doubling your wealth every 15 minutes. Sometimes, waiting for the right opportunity is the wisest move.”

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.