Pound slides ahead of Bank of England decision

BoE - No rate cuts yet

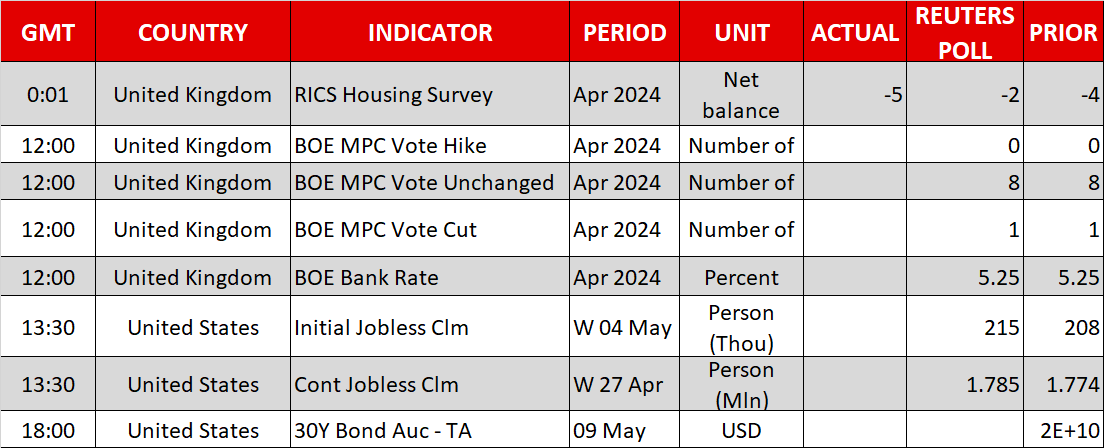

In a relatively quiet week, the spotlight today will fall on the Bank of England’s interest rate decision. Markets are pricing an almost 50-50 chance for a rate cut in June, so the question for traders is whether the Bank will signal that such a move is imminent or downplay it.

Britain’s economy seems to have escaped the shallow recession it fell into last year, with incoming business surveys pointing to an economy that has entered the recovery phase, powered by a rebound in consumer spending as wage growth has remained resilient.

The dark side of this economic resurgence is that inflation remains persistently hot. Core inflation held above 4% in March and business surveys warn of a reacceleration moving forward, as companies lift their prices to pass rising costs onto consumers.

Considering the persistence of inflationary pressures, the Bank of England will probably be reluctant to signal that rate cuts are imminent and might play down the likelihood of a cut in June.

In isolation, a message that rate cuts are still some distance away could benefit the pound, especially since speculators are net short on the currency. That said, the broader FX reaction will also depend on the updated economic forecasts and the vote composition of the Monetary Policy Committee.

Yen lags despite positive BoJ rate signals

Over in Japan, the yen has resumed its downtrend, surrendering a good chunk of the gains it recorded last week after two episodes of suspected FX intervention.

The striking part is that the yen remains on the ropes even despite the recent slide in US yields and mounting signs from the Bank of Japan that more rate increases are coming. The summary of opinions from the latest BoJ meeting revealed a growing consensus among policymakers to normalize further.

Still, the yen could not capitalize on those hawkish signals, perhaps because incoming data pointed to a sharp slowdown in wage growth, which might prevent the BoJ from pulling the rate-hike trigger in the near future.

All told, the fundamental factors that pushed the yen to multi-decade lows are still present, so the outlook remains negative, although the constant threat of FX intervention might help ensure the currency doesn’t hit new lows. A proper trend reversal in the yen will probably require interest rate differentials to narrow through Fed rate cuts, which is a longer-term story.

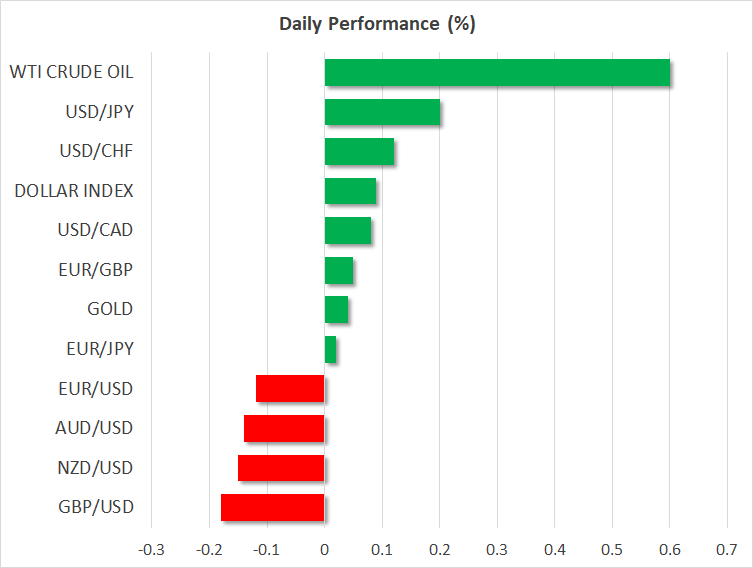

Dollar recovers, stocks and gold flat

In the absence of any real news this week, the US dollar has staged a stealth recovery, with some help from upward revisions in GDP growth estimates. The Atlanta Fed currently estimates GDP growth at 4.2% this quarter, reinforcing the notion that any Fed rate cuts are still far away.

Meanwhile, US stock markets and gold prices traded in a quiet manner yesterday. Both equities and gold could remain in a holding pattern ahead of the next major catalyst, which will probably be the next batch of US inflation stats on Wednesday.

Finally in China, local stock markets climbed today following some encouraging trade numbers. Both exports and imports rose in April from a year earlier, fueling optimism that the worst of the economic crisis is finally behind the Chinese economy.

.jpg)