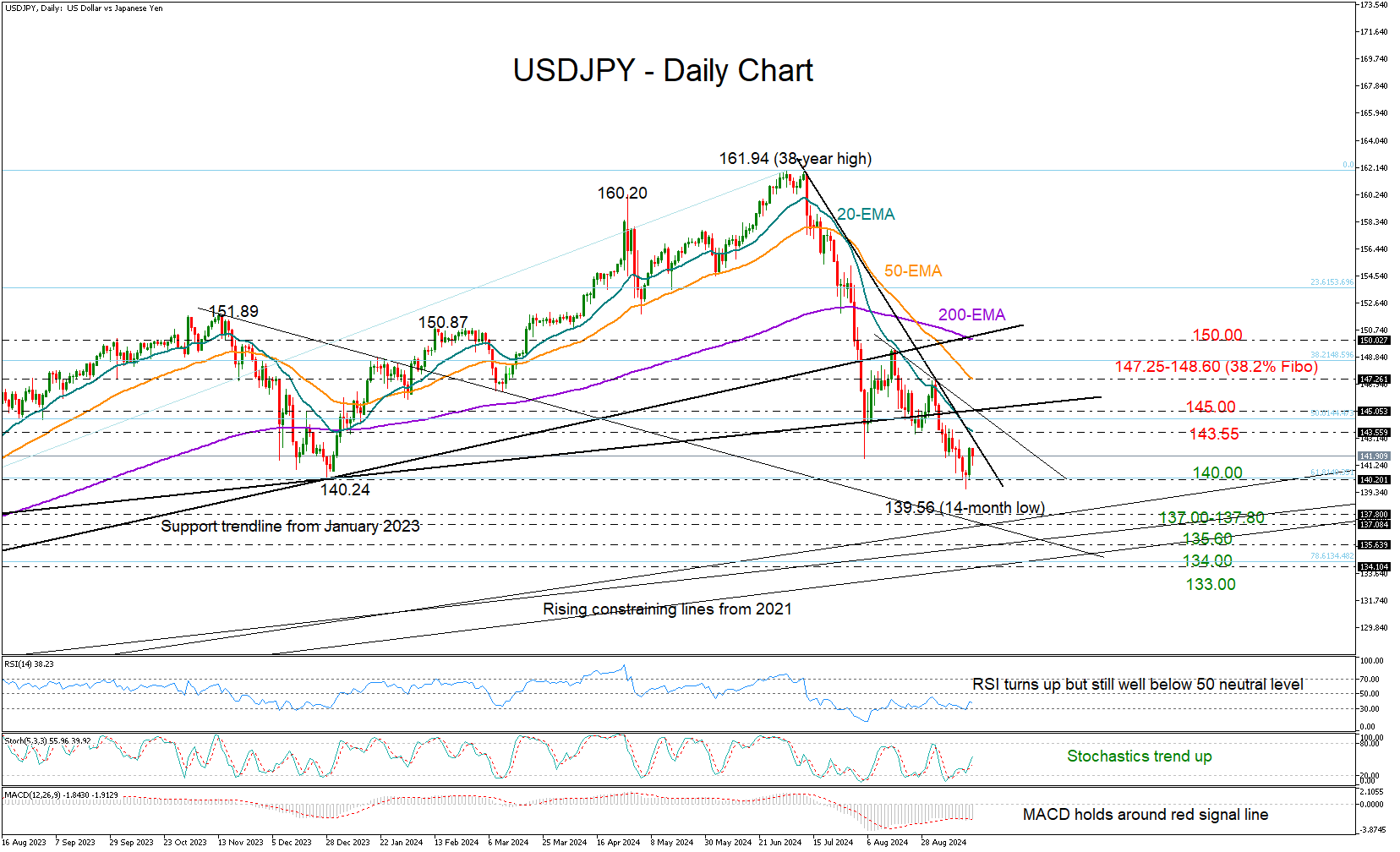

USDJPY poised for a new bullish wave; will it succeed?

USDJPY turned green on Tuesday, marking its best daily session in a month after securing a solid base around the 140 number.

The time has finally come for the Fed to make a crucial decision between a 25bps or a 50bps rate cut today at 18:00 GMT and the pair seems to have completed a bullish dragonfly candlestick pattern. Following a steep downward trend from a 38-year high of 161.94, the price might again push for some recovery, especially if the central bank announces a normal 25bps reduction.

Nevertheless, previous bullish endeavors were unable to surpass the 20-day exponential moving average (EMA) at 143.55, and additional obstacles may arise at the 145.00 trendline region prior to the 50-day EMA at 147.25.

Despite a slight improvement in technical indicators, downside risks persist as the RSI remains deep in bearish territory. Nonetheless, only a close below the 140.00 floor could bolster selling forces towards the 137.00-137.80 trendline zone. There are two more constraining lines to the downside, passing through 135.60 and 134.00. Falling lower, the pair might next stop near 133.00.

In short, USDJPY may be preparing for its next consolidation or bullish phase, but it’s unknown if it will successfully break above the 20-day EMA and exceed 145.00.