USD/JPY advances in the BoJ aftermath

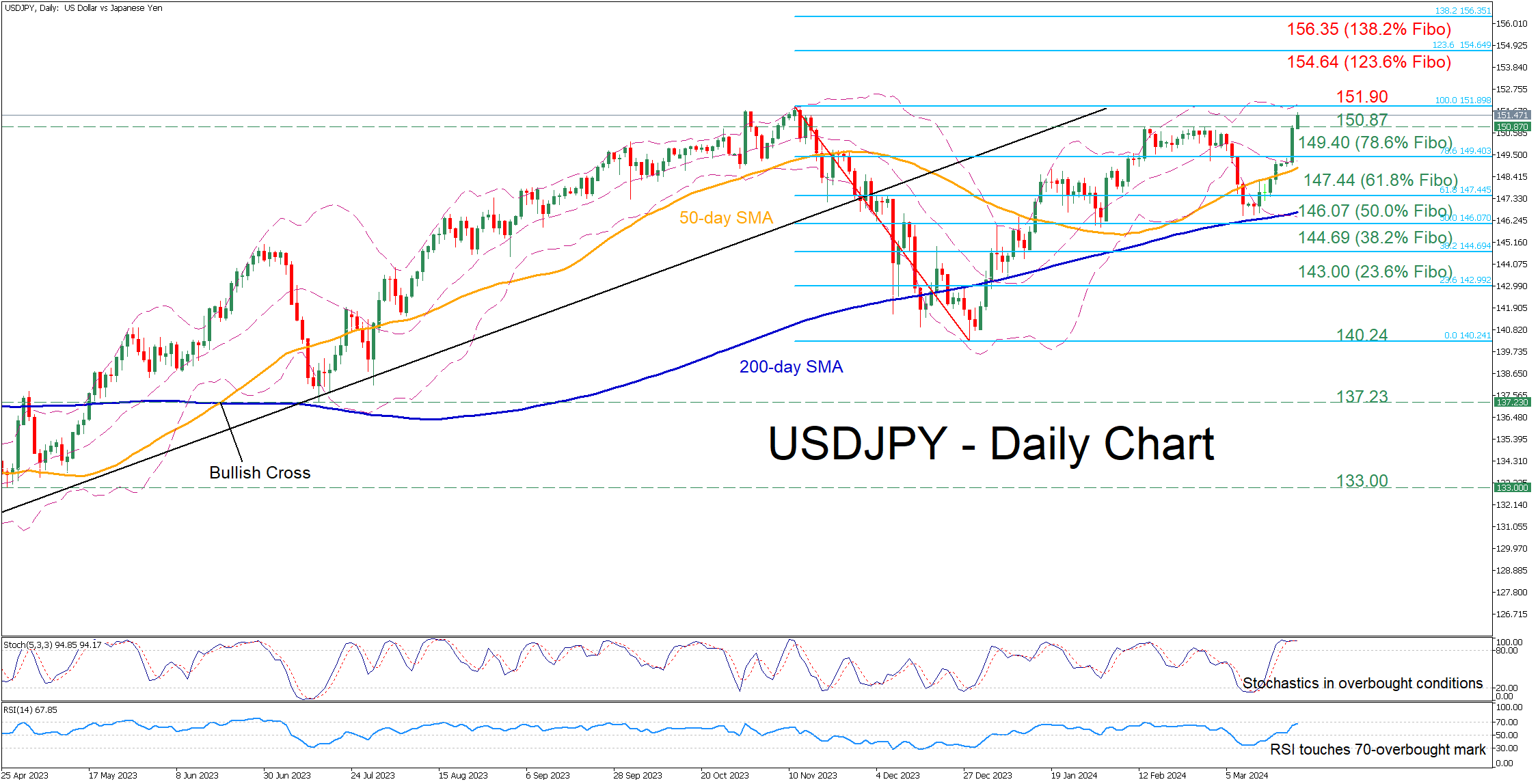

USDJPY has been in a steady uptrend after finding its feet a tad above the 200-day simple moving average (SMA) in early March. Meanwhile, the pair posted a fresh 2024 high following a dovish hike by the BoJ on Tuesday, while it has been extending its gains ahead of the FOMC meeting later today.

Should bullish pressures persist, the price might revisit the 2023 high of 151.90 ahead of the 33-year peak of 151.94 registered in 2022. Further advances could then cease at 154.64, which is the 123.6% Fibonacci extension of the 151.90-140.24 downleg. Conquering this barricade, the bulls could then attack the 138.2% Fibo of 156.35.

On the flipside, if the pair reverses lower, the 2024 resistance region of 150.87 could now serve as initial support. Even lower, the price could encounter strong support at the 78.6% Fibo of 149.40. A violation of that hurdle may set the stage for the 61.8% Fibo of 147.44.

Overall, USDJPY’s advance accelerated following the dovish hike by the BoJ, while the FOMC meeting later today could induce more upside pressures. Therefore, traders should be aware that there might be a battle around the 33-year high of 151.94 in the upcoming sessions.