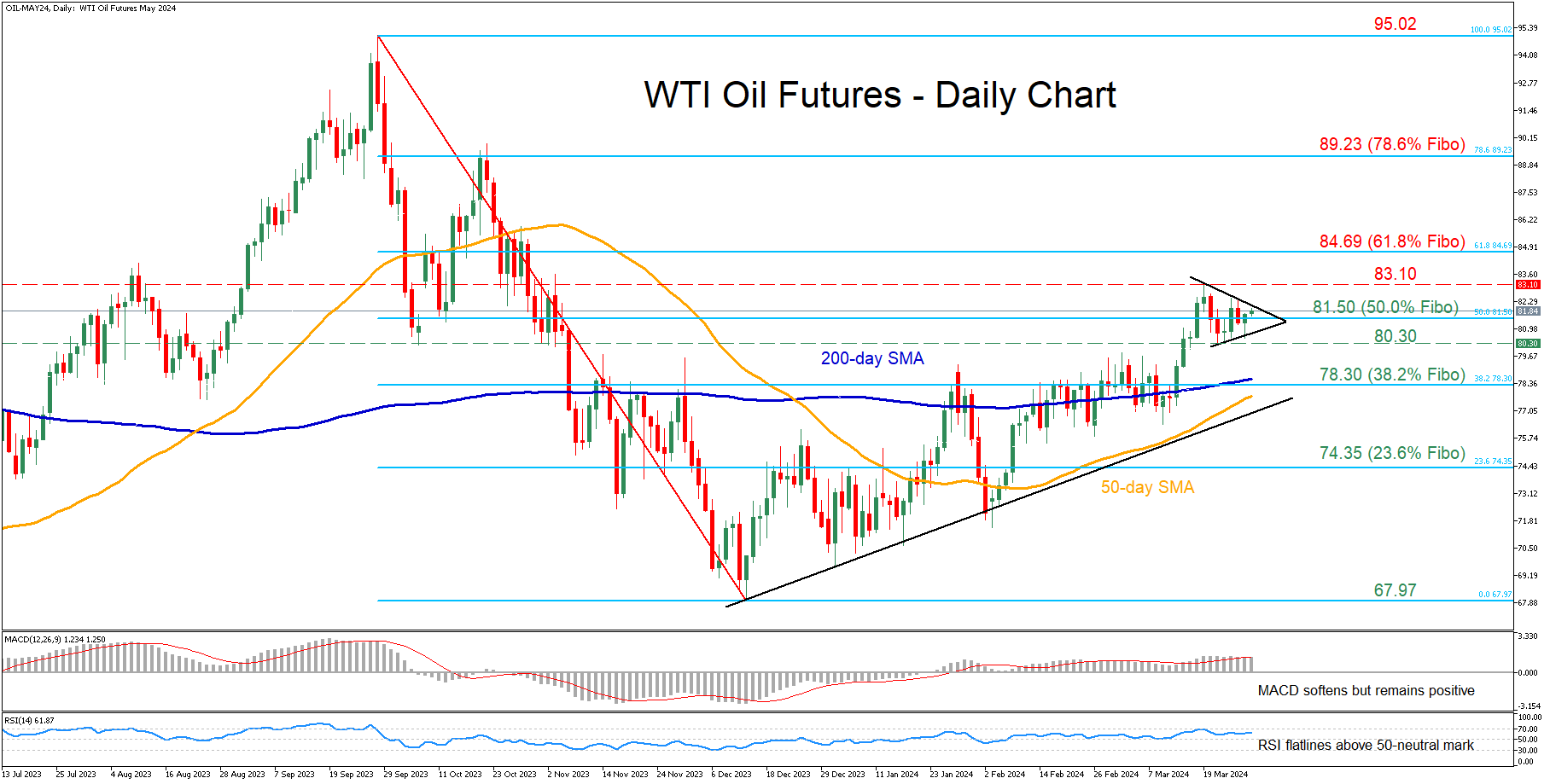

WTI oil futures in fierce battle with 50.0% Fibo

WTI oil futures (May delivery) have been in a steady recovery from their December bottom of 67.97, posting an almost five-month peak of 83.10 last week. However, the advance seems to be on hold for now as the price has reversed lower and formed a symmetrical triangle around the 50.0% Fibonacci retracement of the 95.02-67.97 downleg.

Given that both the RSI and MACD are tilted to the upside, the bulls could attack 83.10, which is the highest level observed since November 3. Further advances could then stall around the 61.8% Fibo of 84.69. Surpassing that zone, the price could ascend to face the 78.6% Fibo of 89.23, a region that held strong in October 2023.

On the flipside, if sellers re-emerge and push the price back below the 50.0% Fibo of 81.50, the decline could then cease at the recent support of 80.30. Lower, the 38.2% Fibo of 78.30 could act as the next line of defense. A violation of that territory could set the stage for the 23.6% Fibo of 74.35.

In brief, WTI oil futures’ rebound has stalled in the past few sessions, with the price lingering around the 50.0% Fibo of 81.50. Nevertheless, the formation of a pennant pattern around that region might be hinting at a potential breakout move in the upcoming sessions.

.jpg)