Advertisement

Analýza

EBC Markets Briefing | Gold and silver buoyant despite recent retreat

Gold and silver prices fell Thursday amid inflation concerns. Despite recent declines, analysts foresee their strengthening in the coming year.

EBC Financial Group

|

Pred 525 dňami

Daily Global Market Update

The EUR/USD pair decreased by 0.4%, while USD/JPY rose by 0.1%. Gold fell by 0.9%, and Alibaba shares increased by 0.4%, despite a bearish signal. Concerns over prolonged high interest rates weakened the Canadian dollar against the US dollar, and U.S. stocks fell, particularly in utilities.

Moneta Markets

|

Pred 525 dňami

GBP Breaks Higher and Reaches New Post-Brexit High – Or Is This Another Media Lie?

The British pound (GBP) is experiencing a significant rise, reaching new heights since Brexit. This increase has pushed the Bank of England's Trade Weighted Index (BoE TWI) past its previous March peak, reaching levels not seen since June 24, 2016, when the pound plummeted following the UK's decision to leave the European Union.

ACY Securities

|

Pred 525 dňami

Dollar Fuels by Strong Treasury Yield

The U.S. 7-year note auction held yesterday saw tepid demand for long-term Treasury yields, resulting in a decline in bond prices and pushing bond yields higher.

PU Prime

|

Pred 525 dňami

EBC Markets Briefing | UK stock market at high stake on Wednesday

The FTSE 100 tumbled Tuesday as bids for two major companies neared a deadline. Foreign investors are snapping up discounted stocks.

EBC Financial Group

|

Pred 525 dňami

EBC Daily Snapshot May 29, 2024

Wednesday saw the dollar rise as the Fed might delay rate cuts. The Aussie dollar stayed flat after strong inflation data.

EBC Financial Group

|

Pred 525 dňami

EBC Daily Snapshot May 28, 2024

Tuesday saw the dollar weaken slightly amid a rising risk appetite, holding steady in Asia with minimal currency movement.

EBC Financial Group

|

Pred 525 dňami

Australian dollar hits 0.6650 amid mixed economic signals

The AUD/USD pair rose to 0.6650 on Wednesday following the release of Australian economic data. Australia’s consumer price index (CPI) accelerated to 3.6% year-on-year in April, up from 3.5% in March.

RoboForex

|

Pred 525 dňami

Accelerating German inflation supports the euro on the downturn

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Accelerating German inflation supports the euro on the downturn

FxPro

|

Pred 525 dňami

Australia's inflation is ticking up despite weak retail sales

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Australia's inflation is ticking up despite weak retail sales

FxPro

|

Pred 526 dňami

Dollar trades sideways as focus turns to US yields

US stock indices under pressure as yields climb. German CPI could dictate next week’s ECB rhetoric. Yen underperformance lingers; all eyes on Friday’s Tokyo CPI

XM Group

|

Pred 526 dňami

Dollar Steadies, US Yields Climb on Poor Treasury Sales

The Dollar Index, which measures the value of the Greenback against 6 major currencies, steadied to finish with modest gains at 104.63 (104.55 yesterday).

ACY Securities

|

Pred 526 dňami

The Bank of Japan is Ready for Another Intervention, but When?

This was evident over the weekend as the G20 meeting in Kyoto, Japan, noted the need for stable rates of currency and at the same time, alerted against an increased currency volatility that would be damaging most of the global economies.

ACY Securities

|

Pred 526 dňami

USD/JPY Weekly Climb Fuelled by Fed Hawkishness and BOJ Actions

The USD/JPY started the week at 155.79. On May 20th, it was held around the 155 level after long-term Japanese Government Bond (JGB) yield news hit the wires that it will start to pick up.

ACY Securities

|

Pred 526 dňami

Bitcoin is gathering its strength

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Bitcoin is gathering its strength

FxPro

|

Pred 526 dňami

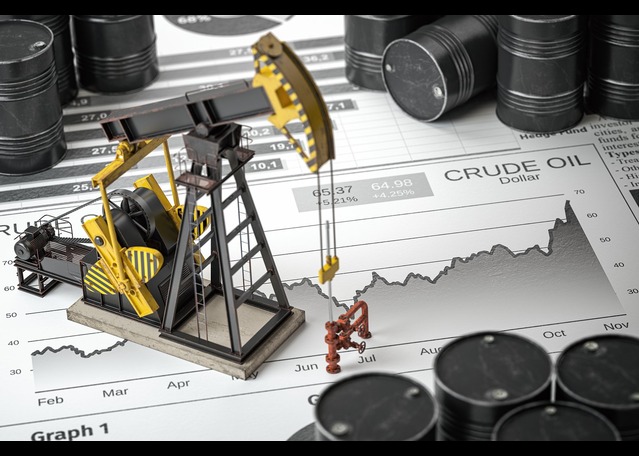

Oil prices Bullish As Geopolitical Tension Escalates

Geopolitical tensions in the Middle East have intensified, driving oil prices up by more than 3% since the start of the week.

PU Prime

|

Pred 526 dňami

Daily Global Market Update

Bitcoin dropped 1.5%, possibly oversold. Google stock rose 1% but signals potential downward pressure. AUD/USD stable, hints at upward movement. Gold up 0.3%, but may reverse. Oil prices surged $1 on OPEC+ supply expectations. US Treasury auctions weak, impacting dollar and yields.

Moneta Markets

|

Pred 526 dňami

Gold prices edge towards $2351 amid weakening US Dollar

Gold prices are on an upward trajectory, moving towards 2351.00 USD per troy ounce on Tuesday. This marks a significant rise after days of sideways movement, highlighting the metal's renewed appeal among investors.

RoboForex

|

Pred 527 dňami

A low VIX is positive for stocks

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: A low VIX is positive for stocks

FxPro

|

Pred 527 dňami

Euro takes advantage of weak dollar

Dollar extends slide on thin holiday trading - More Fed officials to step onto the rostrum - Euro gains ahead of key inflation data - Wall Street set to open higher, oil rebounds

XM Group

|

Pred 527 dňami