EBC Markets Briefing | Gold and silver buoyant despite recent retreat

Gold and silver slipped on Thursday as investors were on alert for inflation data. While the prices have been well off their perch hit last week, analysts expect those metals to strengthen over the next 12 months.

UBS strategists raised their forecasts for gold to $2,500 per ounce by the end of September, and $2,600 by year-end due to stronger Chinese demand and a series of soft US data in April.

China is currently the leading consumer demand for bullion, after the country overtook India in 2023 to become the world’s largest buyer of gold jewellery. The demand could remain elevated this year, the WGC said.

Gold’ poor cousin is in a sweet spot, benefiting in part from the application in solar panels. Chinese silver imports could surge in coming weeks as the arbitrage window has widened further.

The world’s second largest economy has seen a robust demand in recent months which reached a three-year high in December. TD warned that will likely squeeze supply for the West.

The premium on Shanghai spot prices climbed above 15% last week, more than compensating for the 13% tax that China imposes on imports. At the same time, Chinese stockpiles of the metal have dwindled.

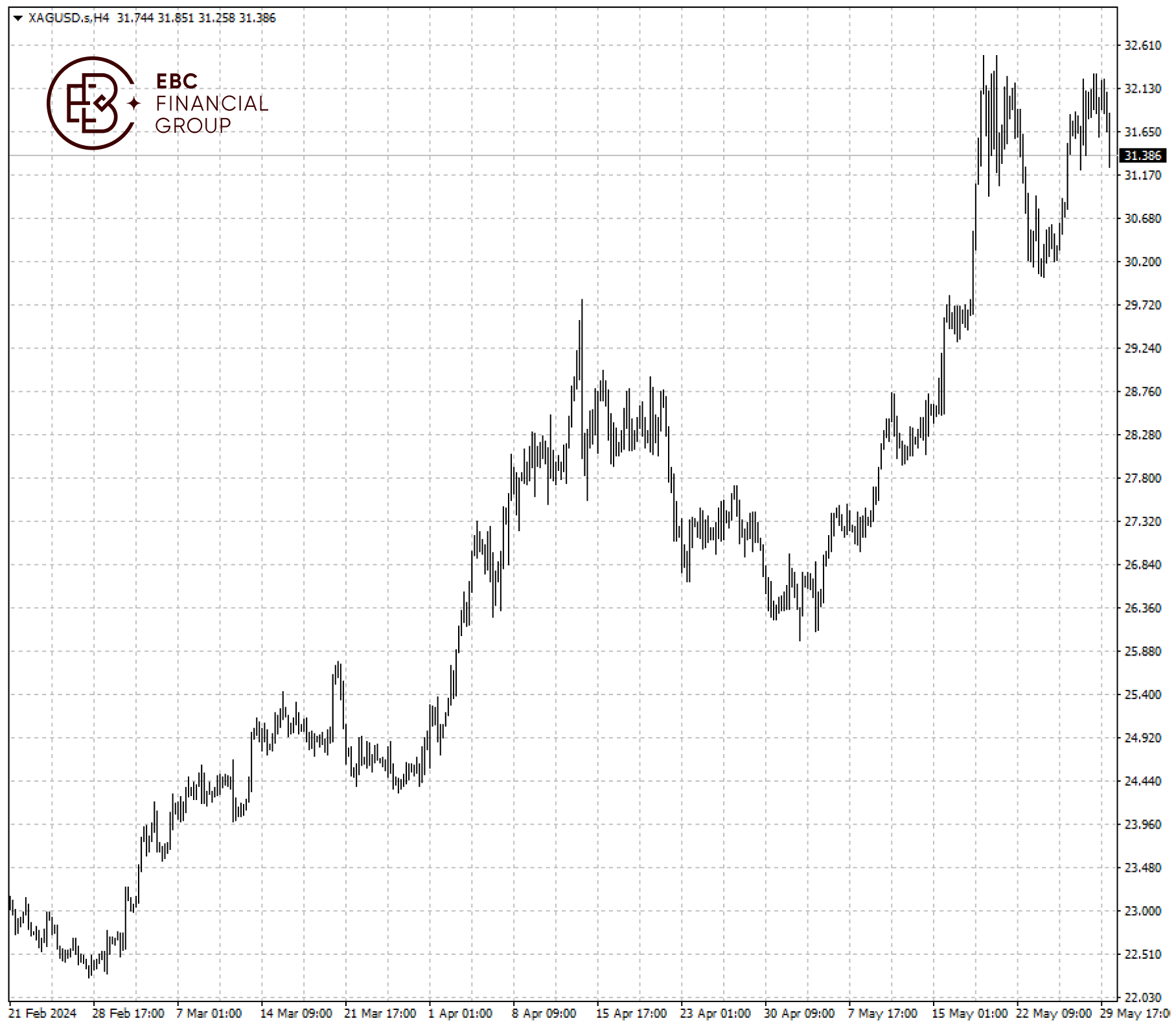

The white metal formed a double-top pattern, a bearish sign that it may retest the low around $30. On the flip side, a break above $32.50 will likely lead to another leg higher.

EBC Investment Strategy Report Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial Group or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.