Forex Cyborg

| Zisk : | +190.79% |

| Čerpanie | 19.88% |

| Pipy: | 6076.3 |

| Obchodníci | 2941 |

| Vyhrané: |

|

| Prehrané: |

|

| Typ: | Reálny |

| Páka: | 1:200 |

| Obchodovanie: | Automaticky |

Edit Your Comment

Forex Cyborg Diskusia

Členom od Nov 26, 2016

93 príspevkov

Aug 24, 2017 at 11:06

Členom od Nov 26, 2016

93 príspevkov

Princerise posted:

If you are using a strategy that gave poor results each year for the past 6 years then the probability for it to give bad results on the coming year is higher than average.

Mathematical just not true.

Forex is all about probabilities. No one know the futur, when someone enter the market it's all about probabilities of winning more money than what you lose.

True.

But this counters your first statement.

Probabilities = Stochastics.

Členom od Mar 24, 2016

7 príspevkov

Aug 29, 2017 at 12:20

Členom od Mar 24, 2016

7 príspevkov

You have seen the rest, now see the best!!

I'm starting to have some doubts when i see how ugly the charts are in real accounts compared to backtest.

Just look, it have gone beyond the 20% DD, it was not supposed to happen!!! And it happened just few months after forex cyborg start to trade, just imagine what forex cyborg will face on the long term.

I'm starting to have some doubts when i see how ugly the charts are in real accounts compared to backtest.

Just look, it have gone beyond the 20% DD, it was not supposed to happen!!! And it happened just few months after forex cyborg start to trade, just imagine what forex cyborg will face on the long term.

Členom od Mar 24, 2016

7 príspevkov

Sep 05, 2017 at 12:25

Členom od Mar 24, 2016

7 príspevkov

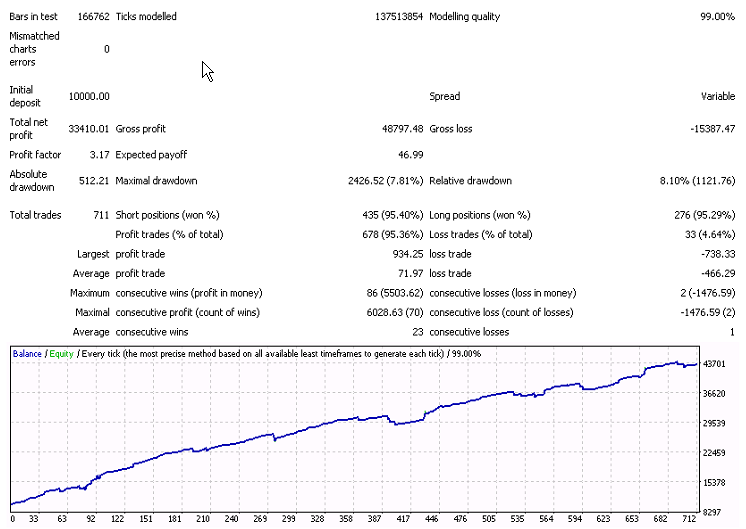

I have done some backtests with 99% precision and i am still confident in forex cyborg to generate some money in the long term. So i willl run each chart independently (without the risk correllation manager) and with low risks of 2% per trade on each chart, the preset will be normal, not conservative, the backtests reveals that conservative mode is too conservative, it don't generate enough money. EA will be allowed to trade on friday evening and monday morning. I will let that run for 3 or 4 months and see the results. If results are good, i will increase the risks depending on how much % it generated each months and also depending on the relative drawdown.

Členom od Aug 30, 2017

5 príspevkov

Členom od Mar 24, 2016

7 príspevkov

Sep 06, 2017 at 14:44

Členom od Mar 24, 2016

7 príspevkov

My backtests are done with Tick Data Suite 2, commissions, slippage, variable spread, over a period of 10 years, that's as close as we can get to the reality. And Forex Cyborg is not only surviving on thoses kind of rude conditions, but he is also generating good profits with some really reasonable drawdown.

commissions = 12$ per round lot turn (yeah i know my broker is greedy, it should be 5$ if i had a good broker).

I applied some slippage on the GBPAUD only, there is no simulated slippage on the EURAUD and on the AUDCAD backtests, but it's almost sure that the results will still be good even with added slippage cause GBPAUD is the worst performing pair among thoses 3 and still the slippage didn't stop him from generating good and consistent profits.

Spread is the real spread of dukascopy (variable spread).

As you can see the results seems to be rather correct. That's the reason why i don't use the currency correlation manager, cause i know for almost sure that each pair perform well when taken individually, but i am not sure if the currency correlation manager could cause some pairs to miss some potentially important trades.

If someone know a EA that don't rely on martingale and perform as good as this one, then please let know cause i haven't found any yet.

commissions = 12$ per round lot turn (yeah i know my broker is greedy, it should be 5$ if i had a good broker).

I applied some slippage on the GBPAUD only, there is no simulated slippage on the EURAUD and on the AUDCAD backtests, but it's almost sure that the results will still be good even with added slippage cause GBPAUD is the worst performing pair among thoses 3 and still the slippage didn't stop him from generating good and consistent profits.

Spread is the real spread of dukascopy (variable spread).

As you can see the results seems to be rather correct. That's the reason why i don't use the currency correlation manager, cause i know for almost sure that each pair perform well when taken individually, but i am not sure if the currency correlation manager could cause some pairs to miss some potentially important trades.

If someone know a EA that don't rely on martingale and perform as good as this one, then please let know cause i haven't found any yet.

Prílohy:

Členom od Jun 30, 2017

25 príspevkov

Sep 06, 2017 at 14:56

Členom od Jun 30, 2017

25 príspevkov

Hello,

the 99% backtests are not wrong, they just can't predict the future too. No one can do it. Not even what will happen in the next hour.

So even the best trading methods and EAs with the best backtests and with 2-3 years of forward tests can fail someday. All we can do is to analyse the past, develop a strategy that would fit into this market behavior and see if the market will have similar patterns in the future.

If you look into the august, you will see that we had some unusual movements especially for the CHF-pairs.

All multi-currency asian scalper with a forward tests failed to make profit in this month.

We are still confident, that this is just a unusal move but we will be profitable in the future again.

Have a great day everyone!

the 99% backtests are not wrong, they just can't predict the future too. No one can do it. Not even what will happen in the next hour.

So even the best trading methods and EAs with the best backtests and with 2-3 years of forward tests can fail someday. All we can do is to analyse the past, develop a strategy that would fit into this market behavior and see if the market will have similar patterns in the future.

If you look into the august, you will see that we had some unusual movements especially for the CHF-pairs.

All multi-currency asian scalper with a forward tests failed to make profit in this month.

We are still confident, that this is just a unusal move but we will be profitable in the future again.

Have a great day everyone!

Členom od Nov 26, 2016

93 príspevkov

Sep 06, 2017 at 16:01

Členom od Nov 26, 2016

93 príspevkov

You've mentioned earlier, that you have another pair in test.

Can you tell us a bit more?

Can you tell us a bit more?

Členom od Jun 30, 2017

25 príspevkov

Sep 07, 2017 at 06:25

Členom od Jun 30, 2017

25 príspevkov

Členom od Nov 26, 2016

93 príspevkov

Sep 07, 2017 at 17:16

Členom od Nov 26, 2016

93 príspevkov

95% winning trades is nice.

But on the other hand the average loosing trade is immense.

That's what we had in August.

But on the other hand the average loosing trade is immense.

That's what we had in August.

Členom od Jun 30, 2017

25 príspevkov

Sep 10, 2017 at 06:23

Členom od Jun 30, 2017

25 príspevkov

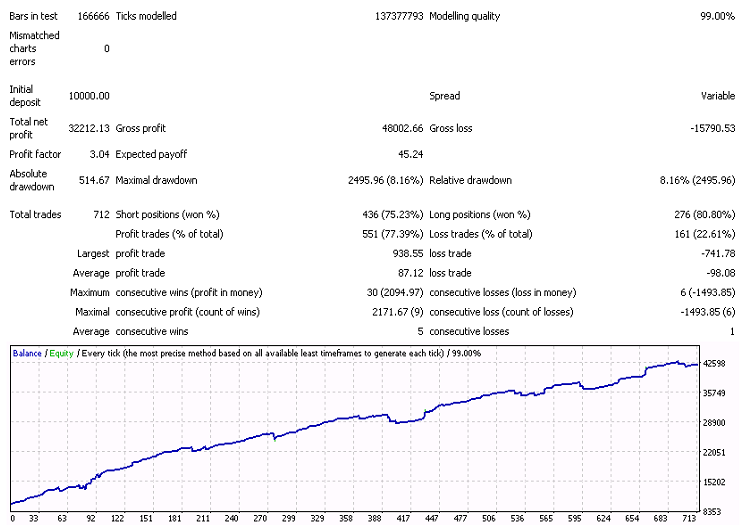

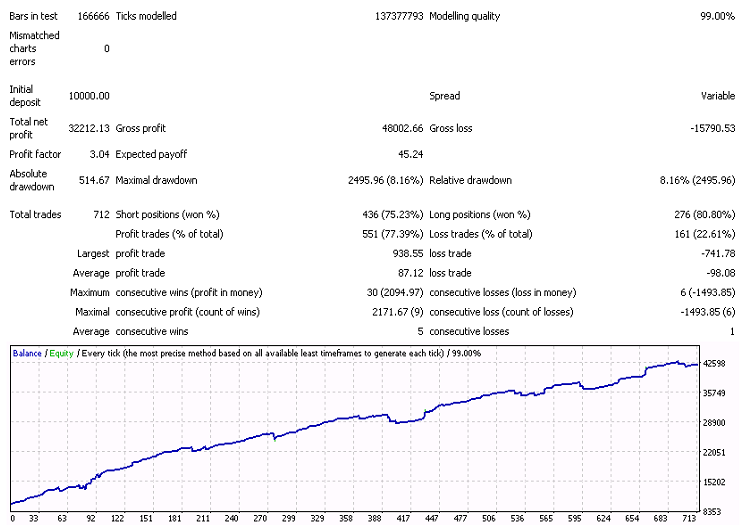

Well the average loosing trade is not what matter in my view. I will show you a backtest with the same settings, except the fact that small looses are accepted:

As you can see the average loss is now nearly at the same level as the average profit trade.

More important is how robust a trading strategy is on long term.

Every system can and will have draw down phases. One of the biggest mistakes in my view is to jump of at the lowest point and say that a EA is bad.

If a strategy is robust, than it will recover the loss if you give it enough time.

What is displayed here in the backtest charts as a "small" drawdown would be 1-3 months recovery time for this pair, before reaching a new equity high.

It is not possible to win every day or every month in my view. I know no system that could manage this for years. So the important factor is: how good is a strategy on long term. Not only on a few weeks.

As you can see the average loss is now nearly at the same level as the average profit trade.

More important is how robust a trading strategy is on long term.

Every system can and will have draw down phases. One of the biggest mistakes in my view is to jump of at the lowest point and say that a EA is bad.

If a strategy is robust, than it will recover the loss if you give it enough time.

What is displayed here in the backtest charts as a "small" drawdown would be 1-3 months recovery time for this pair, before reaching a new equity high.

It is not possible to win every day or every month in my view. I know no system that could manage this for years. So the important factor is: how good is a strategy on long term. Not only on a few weeks.

Členom od Nov 26, 2016

93 príspevkov

Sep 10, 2017 at 12:53

Členom od Nov 26, 2016

93 príspevkov

I would feel much more comfortable with latter.

If this would be adjustable I were really Happy.

If this would be adjustable I were really Happy.

Členom od Feb 16, 2011

208 príspevkov

Jan 15, 2018 at 15:28

Členom od Feb 16, 2011

208 príspevkov

Hello,

I have version 1.0. How can I get a new version 1.1?

Best regards,

Yury.

I have version 1.0. How can I get a new version 1.1?

Best regards,

Yury.

Členom od Jun 30, 2017

25 príspevkov

Jan 15, 2018 at 17:22

Členom od Jun 30, 2017

25 príspevkov

Hello Yury,

Every customer can contact us to get the lastest version.

I will send you a e-mail directly with the update.

I hope this post will be posted in this thread. My last 2-3 posts were not be posted and my account was suspended after it.

After the restoration, my lastest post from december disappeared too.

Seems like I can't inform the myfxbook users about all changes here and we need to send a newsletter in the future.

Here are the highlights / news from the lastest week:

- We had a xmas discount (15%) on our website. It will end tonight.

- We opened two new accounts at a new broker. You can find them on our myfxbook-page. One with moderate settings and one with high risk settings (5.5% risk per trade and risk correlation manager disabled).

- We finished v1.1. The improvements:

-> New pair: GBPCHF

-> Fine tuning of nearly all pairs

-> Improved exit rule for trades that are holding over the weekend and beeing closed on monday.

Every customer can contact us to get the lastest version.

I will send you a e-mail directly with the update.

I hope this post will be posted in this thread. My last 2-3 posts were not be posted and my account was suspended after it.

After the restoration, my lastest post from december disappeared too.

Seems like I can't inform the myfxbook users about all changes here and we need to send a newsletter in the future.

Here are the highlights / news from the lastest week:

- We had a xmas discount (15%) on our website. It will end tonight.

- We opened two new accounts at a new broker. You can find them on our myfxbook-page. One with moderate settings and one with high risk settings (5.5% risk per trade and risk correlation manager disabled).

- We finished v1.1. The improvements:

-> New pair: GBPCHF

-> Fine tuning of nearly all pairs

-> Improved exit rule for trades that are holding over the weekend and beeing closed on monday.

Členom od Feb 16, 2011

208 príspevkov

Jan 16, 2018 at 07:28

Členom od Feb 16, 2011

208 príspevkov

Hello,

I received new version 1.1. Thank you very much.

My last results from 03.12.2017:

Deposit/Withdrawal: 3 000.00 Credit Facility: 0.00

Closed Trade P/L: 961.07 Floating P/L: 0.00 Margin: 0.00

Balance: 3 961.07

Relative Drawdown: 1.97% (68.46)

Very good result.

Best regards,

Yury.

I received new version 1.1. Thank you very much.

My last results from 03.12.2017:

Deposit/Withdrawal: 3 000.00 Credit Facility: 0.00

Closed Trade P/L: 961.07 Floating P/L: 0.00 Margin: 0.00

Balance: 3 961.07

Relative Drawdown: 1.97% (68.46)

Very good result.

Best regards,

Yury.

Členom od Dec 25, 2016

25 príspevkov

Jan 16, 2018 at 19:21

Členom od Dec 25, 2016

25 príspevkov

Hello,

I'd like to share my experiences with Forex Cyborg - the vendor asked me and in this case I happily do it.

In August I almost returned the EA since it was not profitable (like many other EAs, whatever the reason may be).

The vendor offered me an extra testing month so I could have gotten a refund after that time.

Now I'm glad I kept the EA since it made me more money than it did cost. And I can say after testing many many EAs: there are only very few EAs that

- don't use Martingale strategies

- are profitable

If you want some additional information you can contact me.

P.S.: The only relationship I have with the vendor is that I bought his product and appreciate the good support.

I'd like to share my experiences with Forex Cyborg - the vendor asked me and in this case I happily do it.

In August I almost returned the EA since it was not profitable (like many other EAs, whatever the reason may be).

The vendor offered me an extra testing month so I could have gotten a refund after that time.

Now I'm glad I kept the EA since it made me more money than it did cost. And I can say after testing many many EAs: there are only very few EAs that

- don't use Martingale strategies

- are profitable

If you want some additional information you can contact me.

P.S.: The only relationship I have with the vendor is that I bought his product and appreciate the good support.

Členom od Nov 26, 2016

93 príspevkov

Jan 16, 2018 at 20:51

Členom od Nov 26, 2016

93 príspevkov

Yes support is excellent and I, too, started in mid of July taking the full August backdraw.

Since then it's working really well. Hope this will continue.

Since then it's working really well. Hope this will continue.

Členom od Jun 30, 2017

25 príspevkov

Jan 17, 2018 at 06:36

Členom od Jun 30, 2017

25 príspevkov

Thank you very much Yury48, UsY4dEH4GLuD and MicF for your positive feedback!

I really appreciate it.

I really appreciate it.

Členom od Mar 24, 2016

7 príspevkov

Jan 17, 2018 at 06:40

Členom od Mar 24, 2016

7 príspevkov

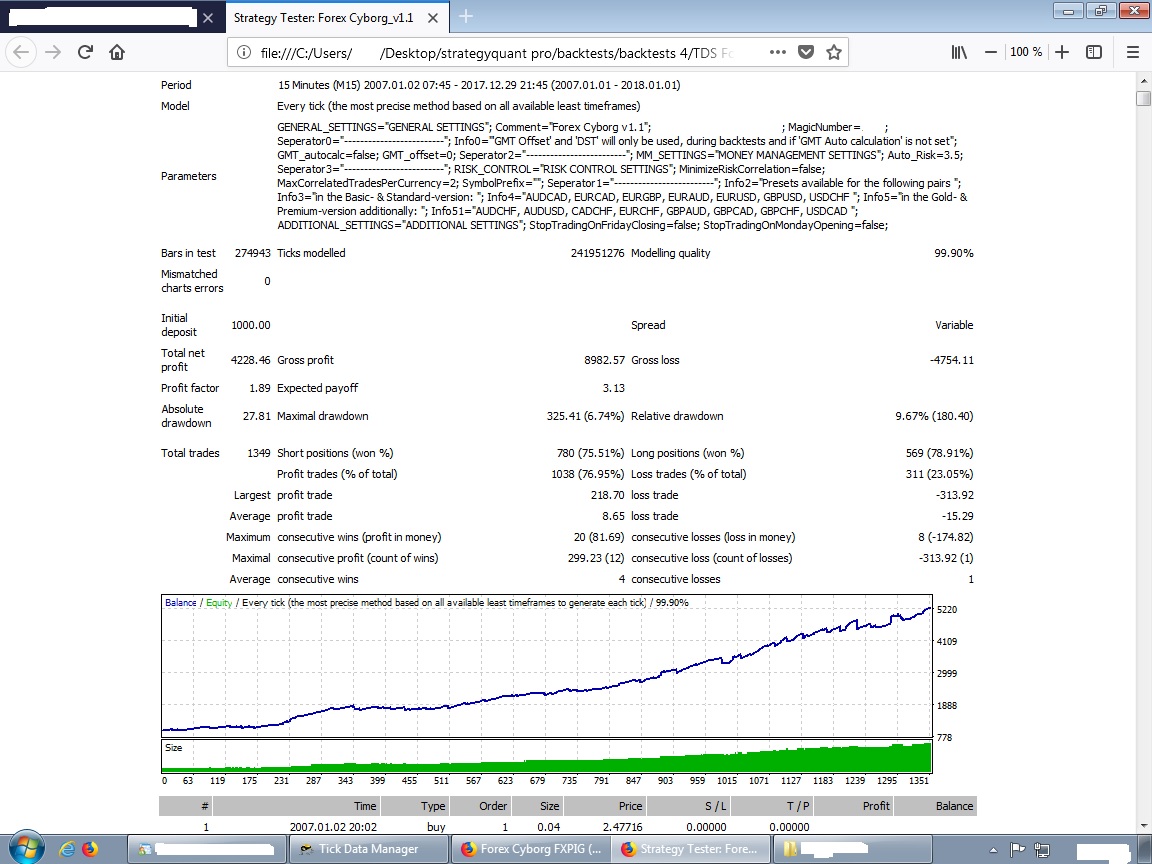

Thanks for this new version of Forex Cyborg v1.1, until now i was already happy with the results so far, cause i bought 5 differents EA in 2017 and only one EA performed well in this short period of live trading that i tested and this only EA that performed well in live was Forex Cyborg v1.0.

Now i will go and backtest this new version 1.1 with TickDataSuite to see how well it perform compared to others previous backtests.

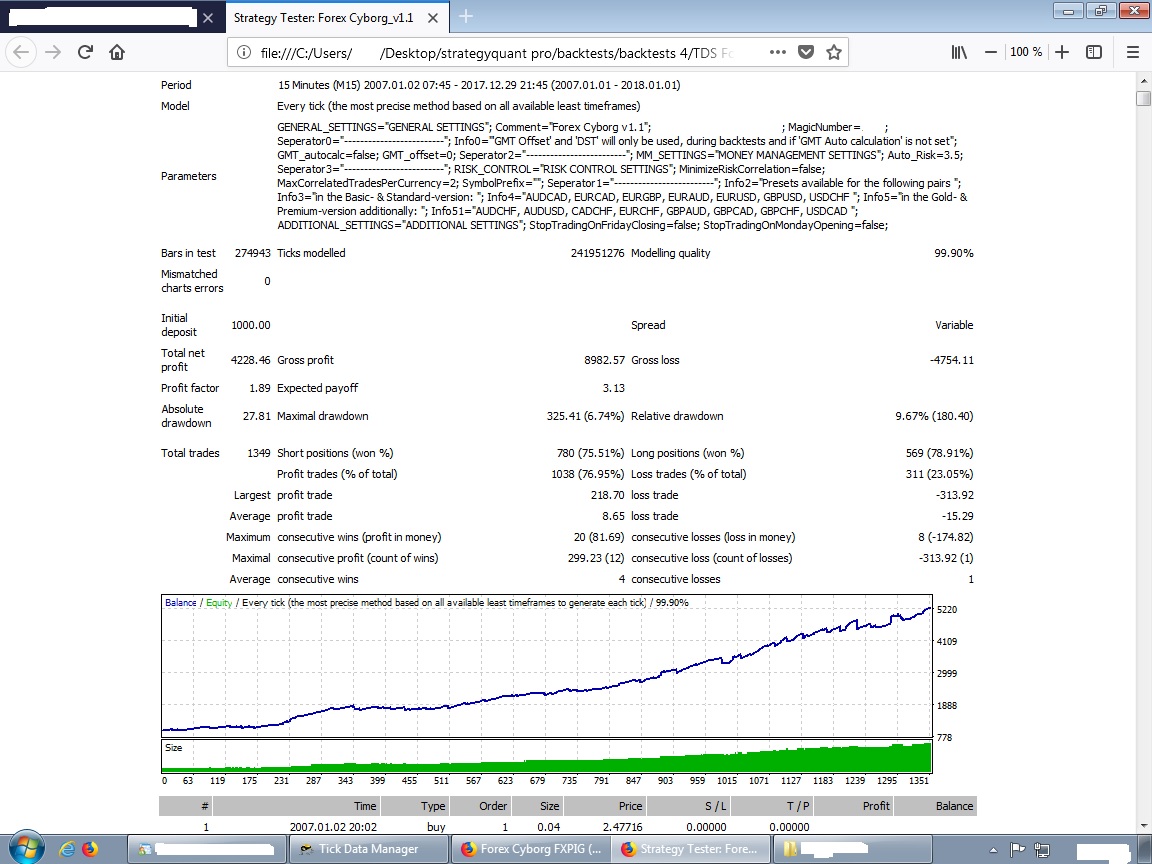

update: After few backtests with version 1.1, i can confirm the backtests gave slightly better results than version 1.0. Backtests done with risk per trade 3.5, variable spread, slippage based on execution delay between 200ms and 300ms on every trades, simulated mode activated, commission 12 per lot round turn in money, on dukascopy data from 1 january 2007 to 1 january 2018.

I join one of the backtest here.

Thanks again for great Expert Advisor, have a good day :)

Now i will go and backtest this new version 1.1 with TickDataSuite to see how well it perform compared to others previous backtests.

update: After few backtests with version 1.1, i can confirm the backtests gave slightly better results than version 1.0. Backtests done with risk per trade 3.5, variable spread, slippage based on execution delay between 200ms and 300ms on every trades, simulated mode activated, commission 12 per lot round turn in money, on dukascopy data from 1 january 2007 to 1 january 2018.

I join one of the backtest here.

Thanks again for great Expert Advisor, have a good day :)

Členom od Nov 26, 2016

93 príspevkov

Jan 17, 2018 at 19:40

Členom od Nov 26, 2016

93 príspevkov

One question to the risk settings. Am I right ...?

Setting it to 3.5, with 14 pairs running, a max of 7 trades are made with a total risk of 7 * 3.5 = 24.5% of the account's balance?

Setting it to 3.5, with 14 pairs running, a max of 7 trades are made with a total risk of 7 * 3.5 = 24.5% of the account's balance?

Členom od Jun 30, 2017

25 príspevkov

Jan 18, 2018 at 07:00

Členom od Jun 30, 2017

25 príspevkov

@Princerise: Thank you very much for your valuable feedback

@MicF:

I guess that the correlation risk manager is activated and the "MaxCorrelatedTradesPerCurrency" is set to 2?

If yes, than you could have (theoretically) two trades per currency.

So in sum:

2x CAD (Like CADCHF - buy and EURCAD - sell)

2x EUR

2x GBP

2x USD

2x CHF

-> 10 trades

If there will be ever a day where all this 10 trades would be opened at once and all 10 trades will reach the SL in the same trading session, than the overall risk would be 10 * 3.5% = 35% in your example

@MicF:

I guess that the correlation risk manager is activated and the "MaxCorrelatedTradesPerCurrency" is set to 2?

If yes, than you could have (theoretically) two trades per currency.

So in sum:

2x CAD (Like CADCHF - buy and EURCAD - sell)

2x EUR

2x GBP

2x USD

2x CHF

-> 10 trades

If there will be ever a day where all this 10 trades would be opened at once and all 10 trades will reach the SL in the same trading session, than the overall risk would be 10 * 3.5% = 35% in your example

*Komerčné použitie a spam nebudú tolerované a môžu viesť k zrušeniu účtu.

Tip: Uverejnením adresy URL obrázku /služby YouTube sa automaticky vloží do vášho príspevku!

Tip: Zadajte znak @, aby ste automaticky vyplnili meno používateľa, ktorý sa zúčastňuje tejto diskusie.