Ahead of NFP: slowdown, but still growth in the US labour market

Ahead of NFP: slowdown, but still growth in the US labour market

On the eve of the monthly labour market report, alternative indicators point to a deterioration, albeit not too dramatic.

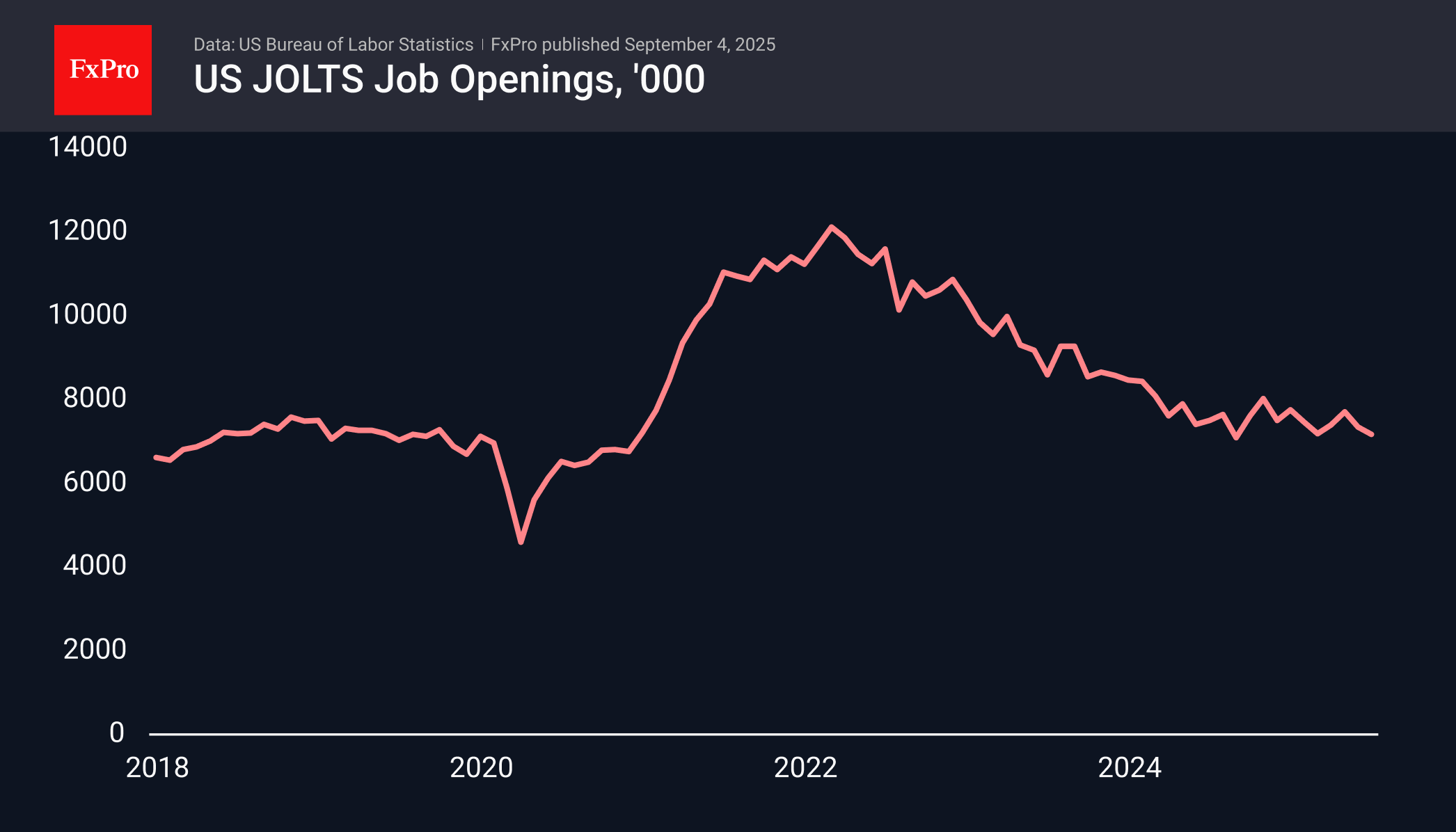

Data released on Wednesday showed job vacancies falling to a ten-month low. Looking at the bigger picture, this is a return to pre-pandemic levels, during which the number of vacancies jumped due to the spread of remote working. In fact, this is a signal that employers are now looking for staff less than before the pandemic, but there is no point in talking about a dramatic collapse.

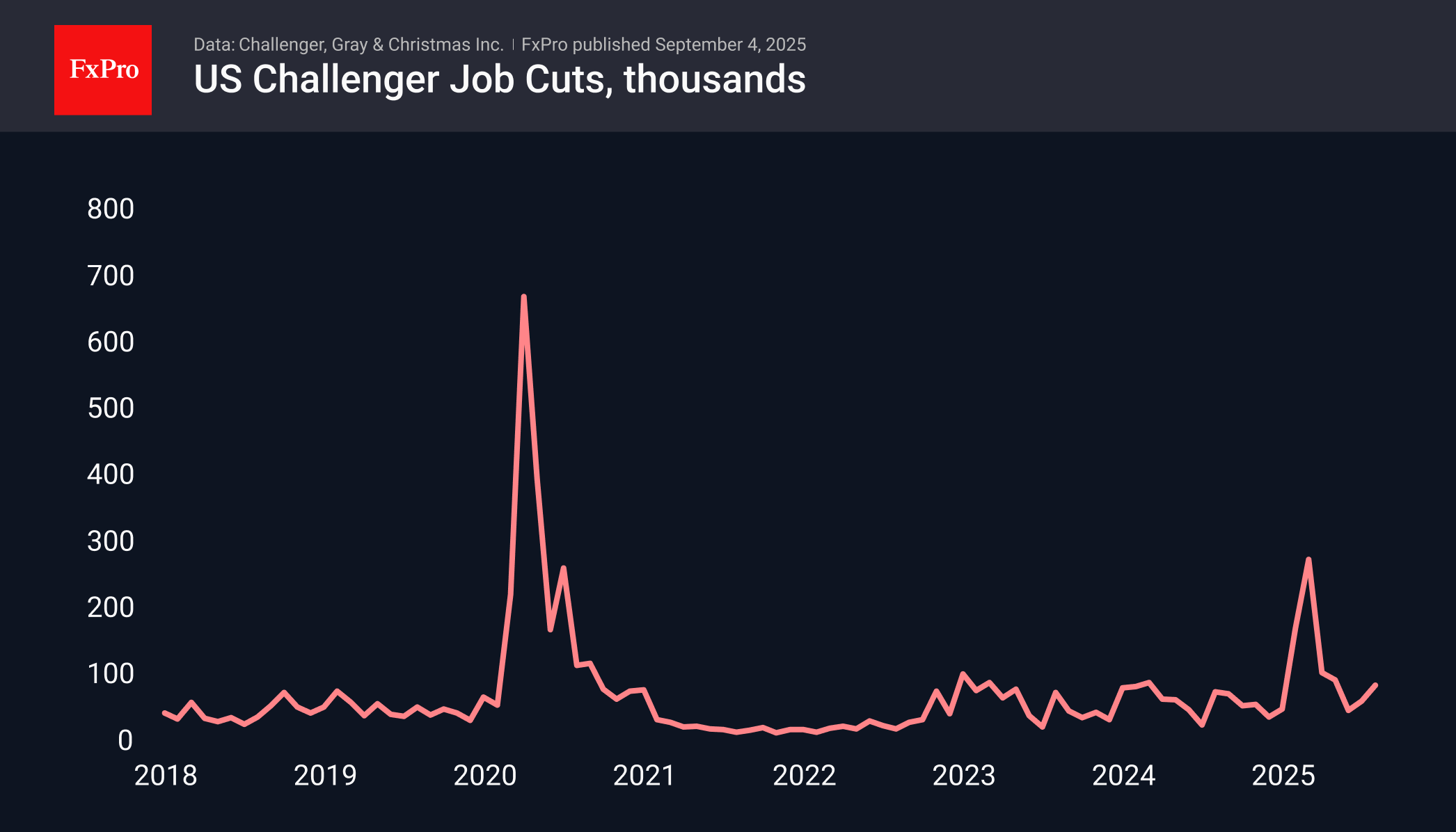

Earlier on Thursday, statistics on planned layoffs were also released. In August, their number approached 86,000, compared to 62,000 a month ago and 76,000 a year earlier. This indicator, more than any other, points to a deterioration, with nearly 900,000 layoffs since the beginning of the year. Only in 2009 and 2020 were the figures higher. At that time, there were severe recessions, but now, the consequences of optimisation in healthcare and finance are as follows. The report also mentions the lowest number of planned expansions since records began in 2009 – 1,494.

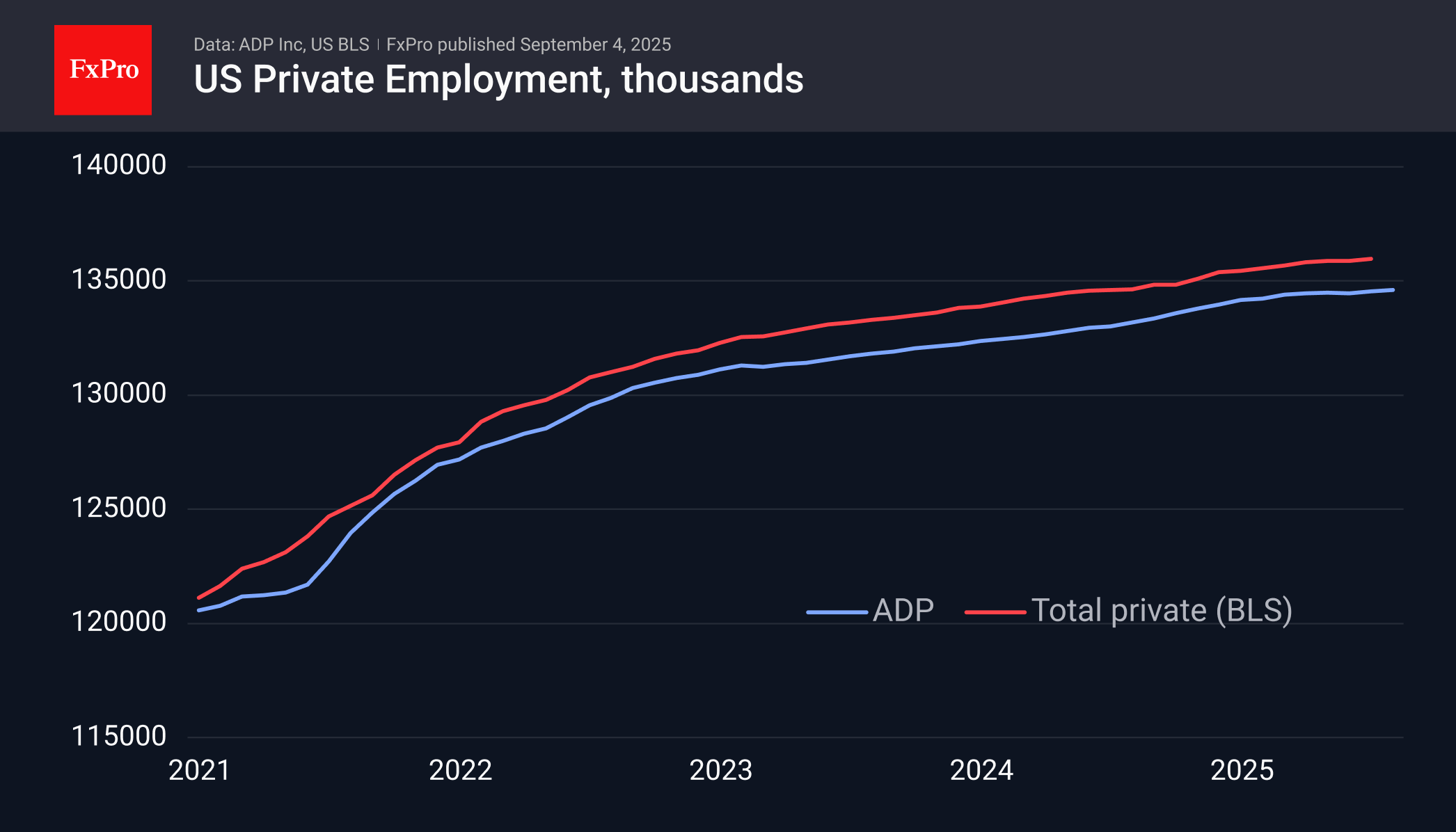

According to ADP, the number of private-sector jobs grew by 54,000 in August, compared to 106,000 a month earlier. This is slightly worse than the expected 74,000. The leisure (+50,000) and construction (+16,000) sectors fared better than others. Trade (-17,000), healthcare and education (-12,000), and manufacturing (-7,000) made a negative contribution.

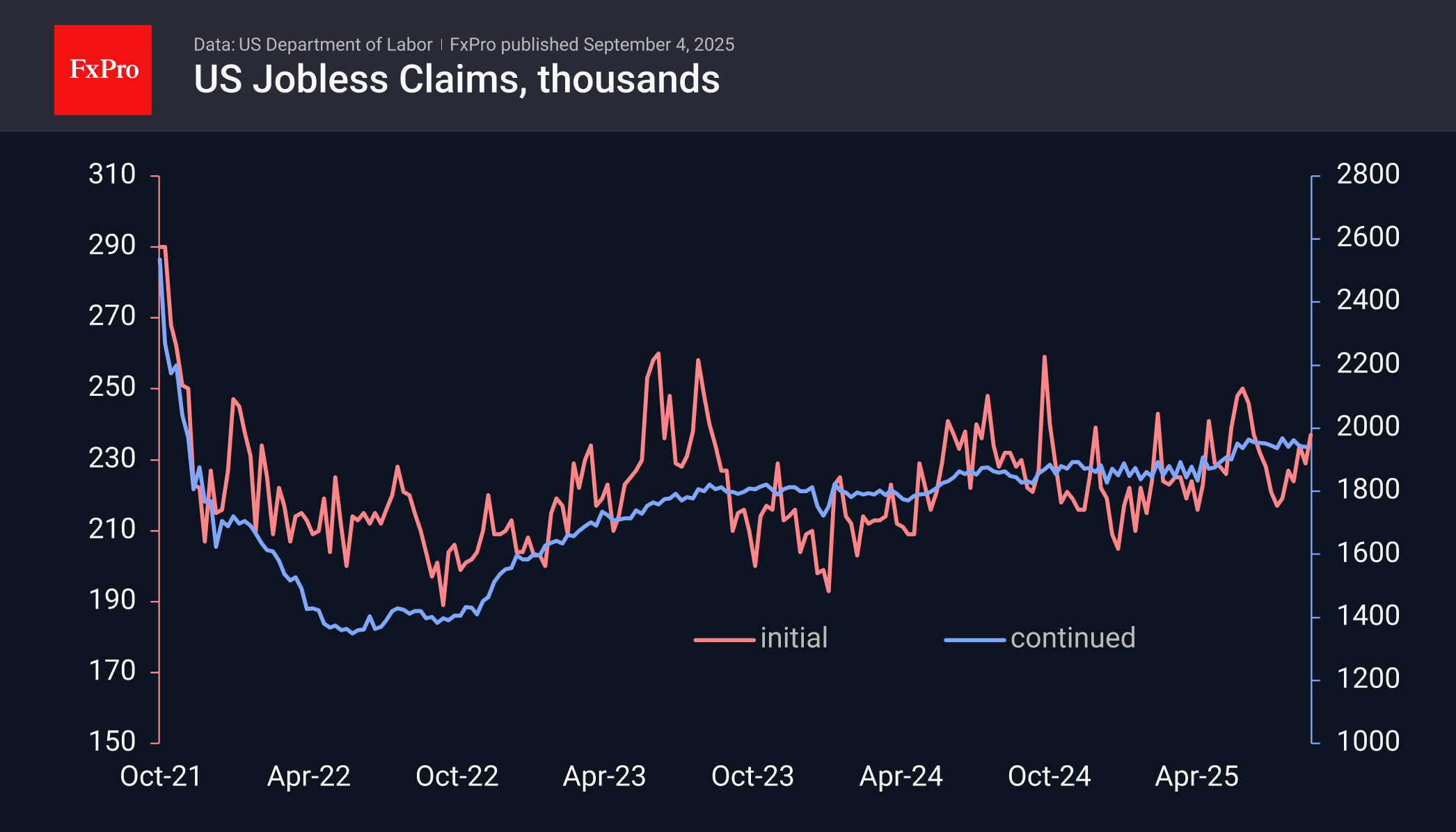

The number of initial claims for unemployment benefits rose to 237,000, the highest since the end of June. Overall, the figure is roughly in the middle of the range for the past year and a half.

The indicators do not suggest any dramatic deviation in tomorrow's official data from the average values of recent months. Market analysts predict an average value of around 75,000, but we would not be surprised to see a value of 130,000, which would correspond to the average values of the last year and a half. Strong figures are also unlikely to stop the Fed from returning to a cycle of rate cuts, and the main subject of speculation is the number of cuts before the end of the year, two or three. The latest data is more on the side of the ‘two’-camp, but it is important to consider the political pressure on the Fed.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)