Australian Dollar Declines as External Pressures and Rising Risks Weigh

By RoboForex Analytical Department

The AUD/USD pair fell to 0.6257 on Tuesday, marking its second consecutive session of losses. The Australian dollar remains under pressure due to external factors, including a strengthening US dollar and growing global risks.

Key drivers behind the AUD decline

The US dollar has gained strength following renewed threats from US President Donald Trump to impose trade duties. Trump announced plans to levy tariffs on imported chips, pharmaceutical products, and raw materials such as aluminium, copper, and steel, aiming to stimulate domestic production. These developments have heightened market uncertainty and weighed on risk-sensitive currencies like the Australian dollar.

In addition, global markets are jittery due to a sharp sell-off in the US stock market. The sell-off was driven by concerns over the open-source AI model DeepSeek which poses a potential challenge to the dominance of US companies in the artificial intelligence sector. This risk-off sentiment has further pressured the aussie.

On the domestic front, Australia reported an improvement in business activity metrics for December. However, the focus is now on the upcoming inflation data, which will provide critical insights ahead of the Reserve Bank of Australia's (RBA) February meeting to review interest rate policy.

AUD/USD technical analysis

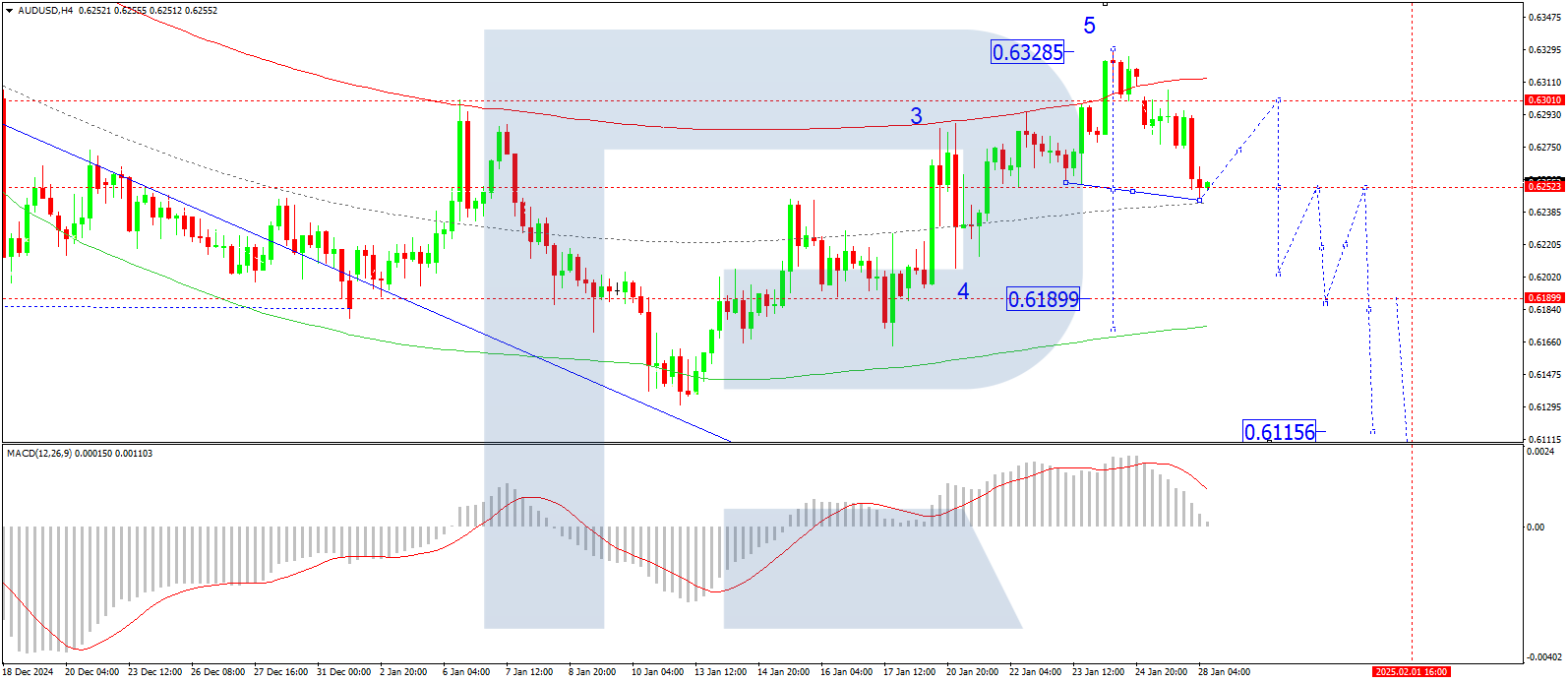

On the H4 chart, AUD/USD has executed a downward wave to 0.6245. A correction towards 0.6290 is expected today. Subsequently, another downward wave targeting 0.6250 may develop, with the potential for a consolidation range forming around this level. If the pair breaks upwards from the consolidation, a further correction towards 0.6290 is possible. Conversely, a downward breakout would open the potential for a deeper decline to 0.6190, which serves as a local target. The MACD indicator confirms this scenario, with its signal line above the zero mark but pointing decisively downwards, indicating continued bearish momentum.

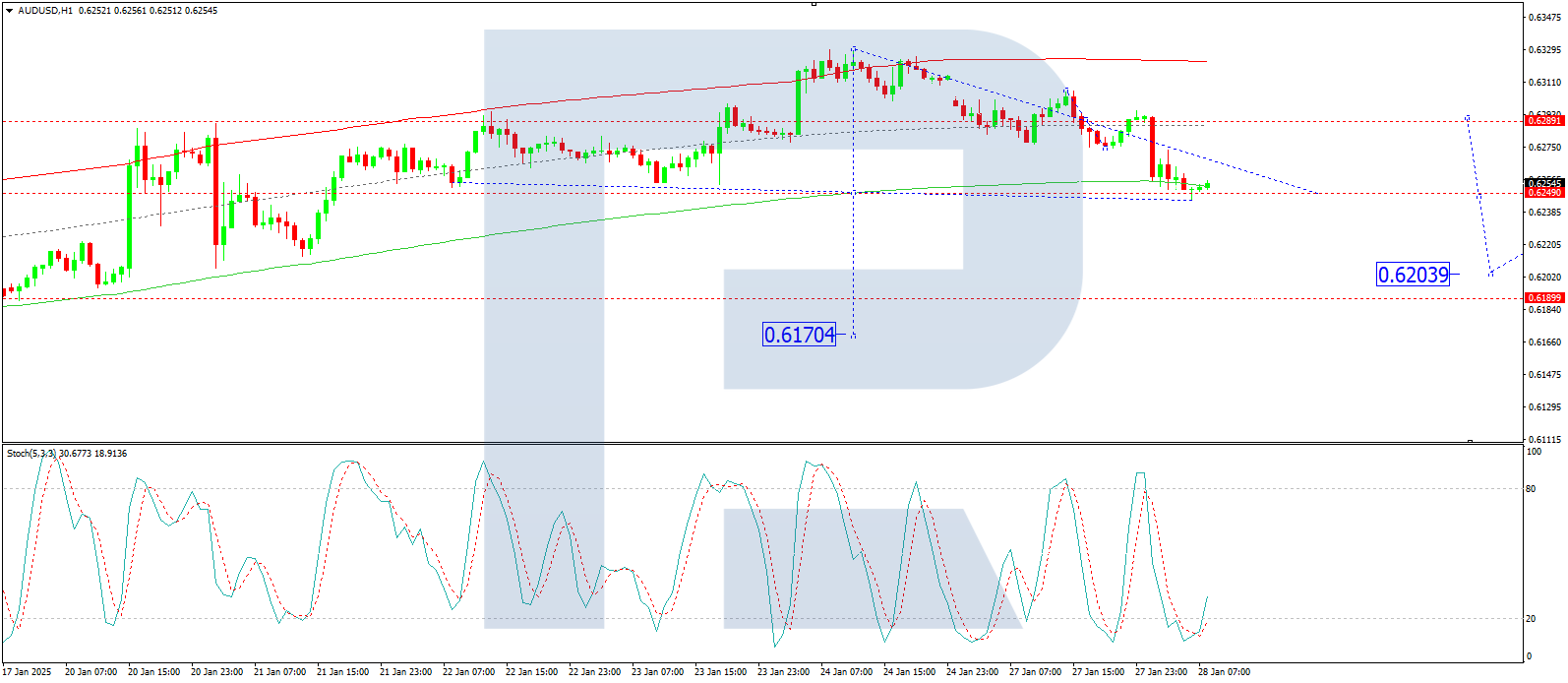

On the H1 chart, AUD/USD formed a consolidation range around 0.6290 before breaking downwards to 0.6245. The market is now consolidating at the current lows. An upward breakout could lead to a correction back to 0.6290 (as a test from below). However, a downward breakout would signal a continuation of the decline towards 0.6204, with the trend potentially extending to 0.6190. The Stochastic oscillator supports this outlook, with its signal line below the 20 mark but pointing upwards towards 80, suggesting a possible short-term correction before further declines.

Conclusion

The Australian dollar remains under pressure due to external uncertainties, including US trade policy developments and global risk aversion. While technical analysis suggests potential for a short-term correction, the broader trend remains bearish, with targets at 0.6204 and 0.6190. Upcoming Australian inflation data will play a key role in determining the currency’s near-term trajectory, particularly as the RBA’s February policy meeting approaches.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.