Dollar extends pullback, stocks mixed as markets lack direction

Markets steadier but stuck in wait-and-see mode

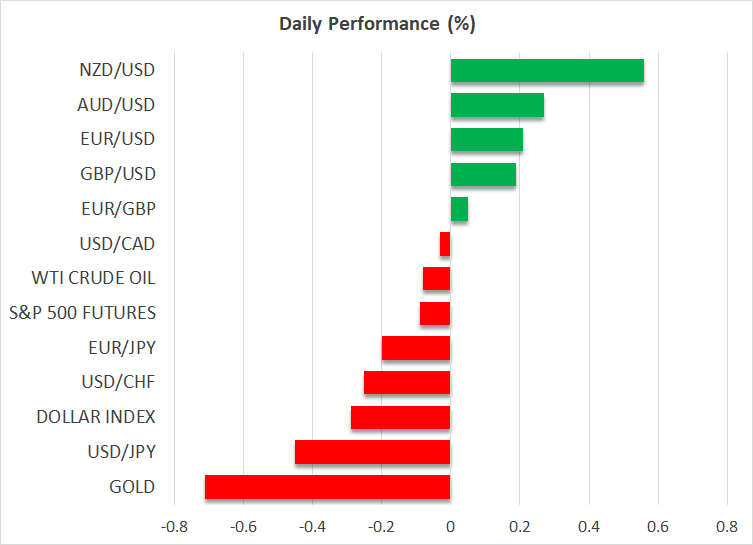

The US dollar remained under pressure on Friday, but equities perked up somewhat after a mid-week wobble, while gold’s woes deepened against the backdrop of easing trade tensions. In the absence of any fresh developments, markets appear to be holding onto the optimism that the worst of the tariff war is over and that things can only get better following the US-China trade truce, even as the initial excitement fades.

Still, many traders have taken to the sidelines as they await fresh clues on trade negotiations, while uncertainty around Fed policy is also keeping a lid on the positive sentiment. On the whole, there’s a bit of a wait-and-see mood in the markets, keeping most major FX pairs range bound.

Stocks pin hopes on new trade deals

In equity markets, however, there’s still some bullish conviction, as the lack of clarity about the Fed’s next move isn’t proving to be as much of a hindrance, with investors focusing more on the growing signs that the Trump administration is keener to strike deals than escalate tensions.

Following the preliminary agreements with the UK and China, India could be the next nation to reach a deal with the US imminently. Talks with Switzerland are also progressing. The successful conclusion of those negotiations could refuel the risk rally. Although there’s also the danger that some of the talks could drag on, namely those with Japan and the European Union. Japanese and US officials may meet next week for a third round of talks.

In the meantime, stocks are mostly edging higher today. Germany’s DAX index is aiming for a new all-time high, while the S&P 500 has managed to erase its year-to-date losses and futures are currently up slightly.

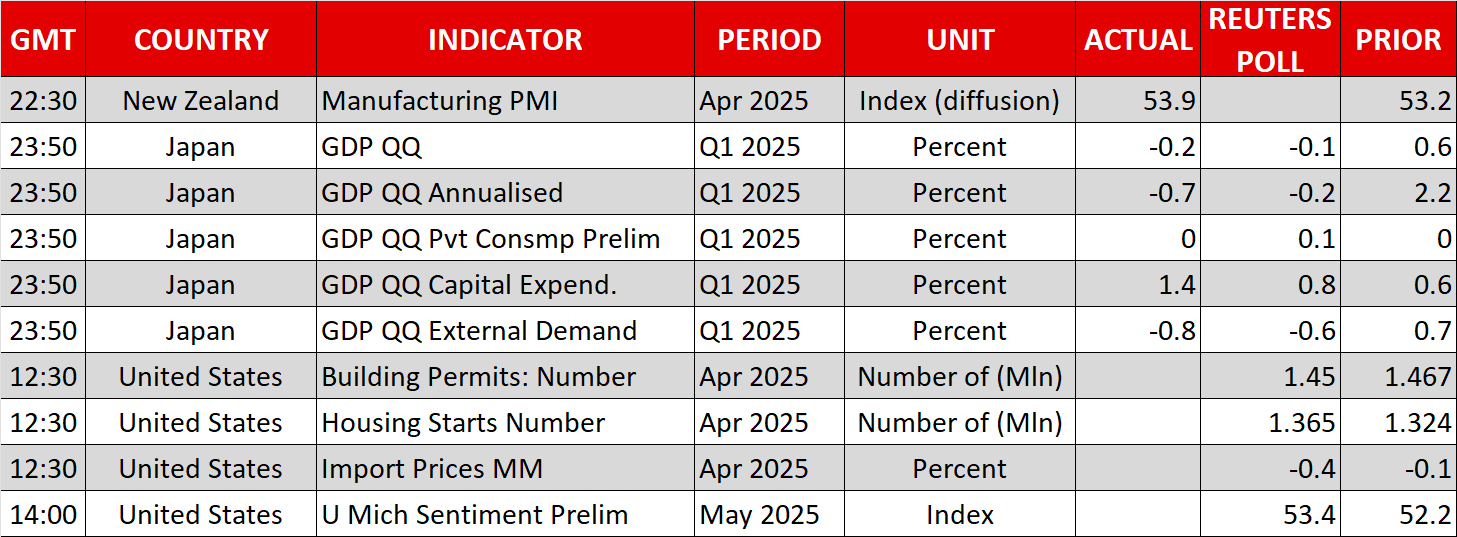

In Asia, Alibaba stocks were a drag on Hong Kong’s Hang Seng index following a profit miss, and Japan’s Nikkei 225 index closed flat, weighed by a bigger-than-expected contraction in Japanese GDP in Q1.

Yen finds some love as dollar struggles

The weak data didn’t stop the Japanese yen from advancing today, however. The yen has bounced back strongly from Monday’s slump against the US dollar and could even finish the week with modest gains. This comes despite the doubts about a swift trade deal with the US and dovish commentary from the Bank of Japan. Earlier today, board member Nakamura warned against rushing to raise rates during an economic slowdown. However, as long as a hike remains on the table, the yen’s downside will likely be limited.

As for the Fed, yesterday’s slew of US economic indicators pushed the odds slightly in favour of a rate cut sooner rather than later. But at the same time, there’s nothing in the data to suggest that the Fed can’t afford to wait longer before deciding to ease again. Investors currently see slightly more than two 25-bps rate cuts this year. It will be interesting to see if today’s preliminary consumer sentiment survey by the University of Michigan will affect those odds.

The dollar index, meanwhile, is drifting lower after receiving no direction from Fed Chair Powell yesterday, who did not comment on the policy outlook during a scheduled appearance. Powell did hint, however, that the Fed might need to modify its policy framework, to put less emphasis on its employment mandate during periods of high inflation.

In other currencies, the New Zealand dollar is the best performer today, after inflation expectations inched higher in the RBNZ’s latest quarterly survey.

Gold skids again, oil slides too

Surprisingly, gold turned negative again on Friday, unable to sustain yesterday’s rebound and adding to its weekly losses. The de-escalation in the trade war has seriously harmed gold’s near-term bullish prospects. The low hopes of any progress ahead of a meeting between Russian and Ukrainian officials due to take place in Turkey later today are not providing much support.

Oil futures are also in the red, as the US and Iran appear close to reaching a deal aimed at curbing Tehran’s nuclear program.

.jpg)