Dollar Pullback from Overbought Territory Boosts Appeal

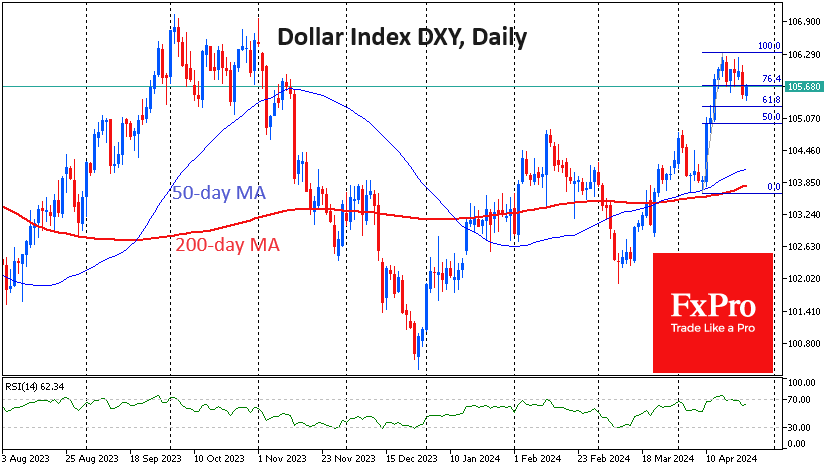

The US dollar's gains stalled last week, and on Tuesday, it lost a third of a cent against a basket of major currencies to 105.4 from a peak of 106.3 the week before.

Yesterday's pullback more closely resembles the start of broader profit-taking than a reversal of the dollar's upward trend since early March.

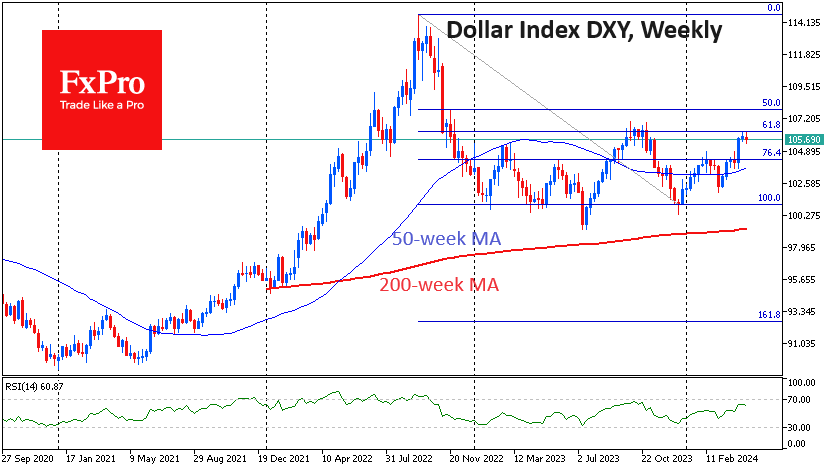

The dollar was somewhat overheated after the 10-12 April spike. In addition, earlier this month, the DXY entered the turning area of last October. As it often happens, the ascent to the previous extremums is fast, but their overcoming indicates a change of the market regime, which happens only after a significant shakeout.

The formal reason for the weakening of the dollar on Tuesday was the positive dynamics of stock indices and the strengthening of the pound, with less certainty for a soon rate cut from BoE.

Now, there are higher chances for deepening the DXY correction with the potential to go down to 105.3 or even to the area of 104.8-105.0, where many turning points are concentrated. Such a plunge would increase the appeal of buying the dollar against major currencies, removing the technical overheating.

The ability to rise from current levels opens a fast road to the April highs near 106.3, with the finale of this journey near 108.0.

The bearish scenario for the dollar, in our view, will be activated in the event of a failure under 104.8, forcing a search for support in the 103.80-104.0 area.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)