EBC Markets Briefing | Bullion unchanged after Trump tariff vow

Gold prices were unchanged on Tuesday after Trump vowed tariffs. The metal plunged over 3% in the last session, breaking a five-session rally to as Israel reportedly neared a ceasefire with Hezbollah.

Bullion rose nearly 6% last week, spurred by escalating tensions in the Russia-Ukraine conflict. Focus has shifted to US economy data and Trump’s clarity on his policies which could reshape Fed rate cut expectations.

The new president said that on his first day in office he would impose a 25% tariff on all products from Mexico and Canada, and an additional 10% tariff on goods from China, raising trade war concerns.

Traders see the newly nominated Treasury secretary Scott Bessent as fiscal conservative. However, he has openly favoured a strong dollar and supported tariffs, so an inflationary bias might be inevitable.

The State Street chief gold strategist Milling-Stanley highlighted demand from both central banks and individual investors in emerging markets, such as India and China, as major tailwinds for the precious metal.

Investment in gold has shifted away from jewellery and into bullion and ETFs as demand for the precious metal has jumped, which is seen as a “huge change” to the commodity investment landscape.

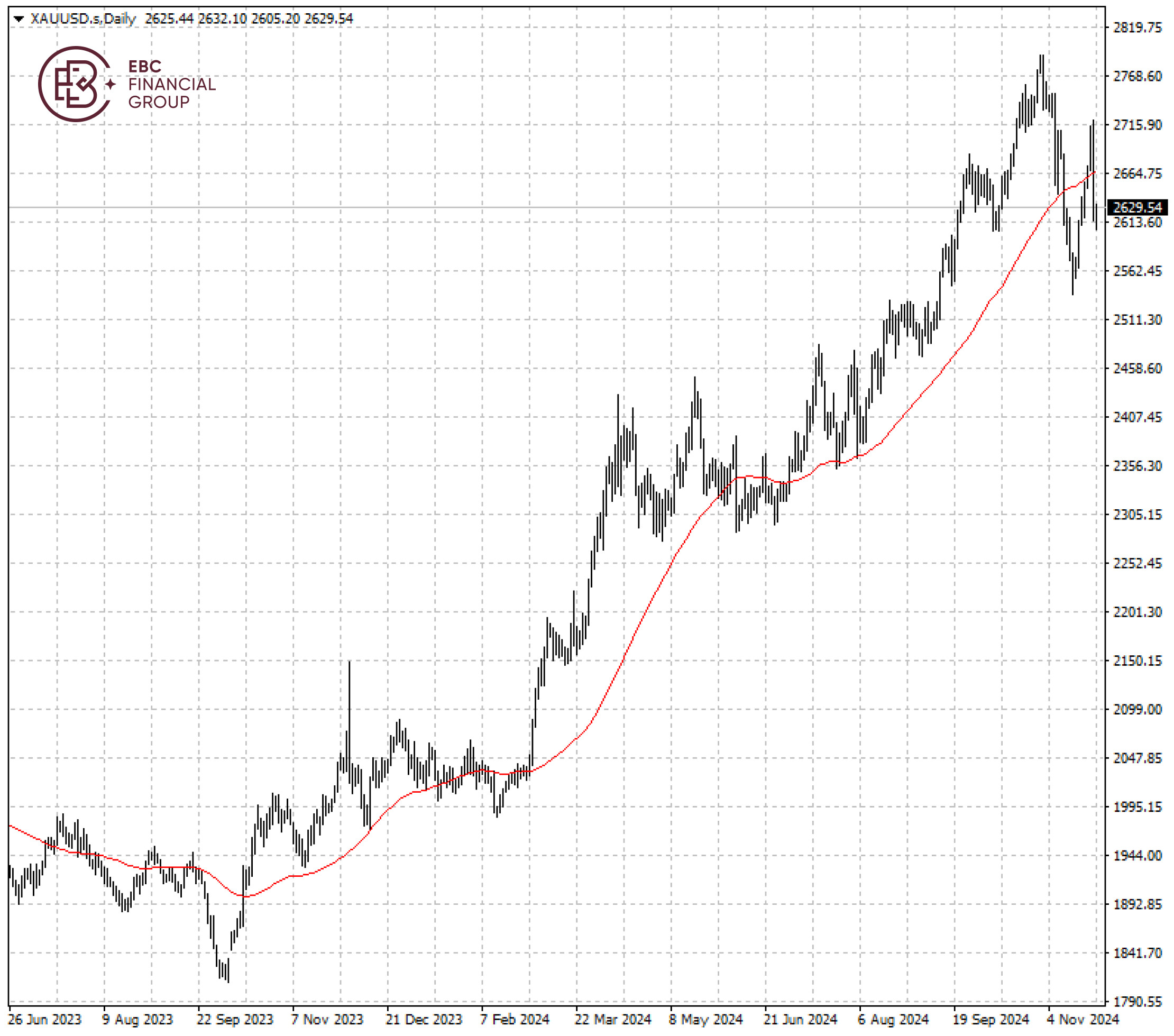

Gold again tumbled below 50 SMA – a sign of fragility after US election. The major support lies at $2,600, and a break below the level could lead to the low around 2,540 hit in mid-November.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.