EBC Markets Briefing | Gold prices wobble as Asia purchase stalls

Gold prices steadied on Tuesday after a decline of more than 1% which was sparked by a risk-on rally in equities and profit-taking by investors. Moreover, the buying spree across Asia cooled.

The Nasdaq 100 and the S&P 500 hit record highs, while the Dow scaled a more than one-month high. Analysts on average see S&P 500 companies increasing their aggregate EPS by 10.1% in Q2, according to LSEG.

Expectations for interest rate cuts as early as September grew after Friday's nonfarm payrolls report showed US job growth slowed in June. Growth stocks are seen to benefit the most from moderating inflation.

China’s central bank did not buy any gold for a second month in June when the price stayed at a high level. India – the world’s biggest gold importer – also saw spending cuts on bullion.

Demand for gold jewellery in India fell 6% last year, according to the WGC, compared with the 10% increase in China. Crisil predicts sales volumes to “stagnate” in the year to March 2025.

Despite India’s “passion for gold”, escalating costs will have an impact on families ahead of weddings, said India Bullion and Jewellers Association. “They … either to buy lower quantities or to buy lower carats.”

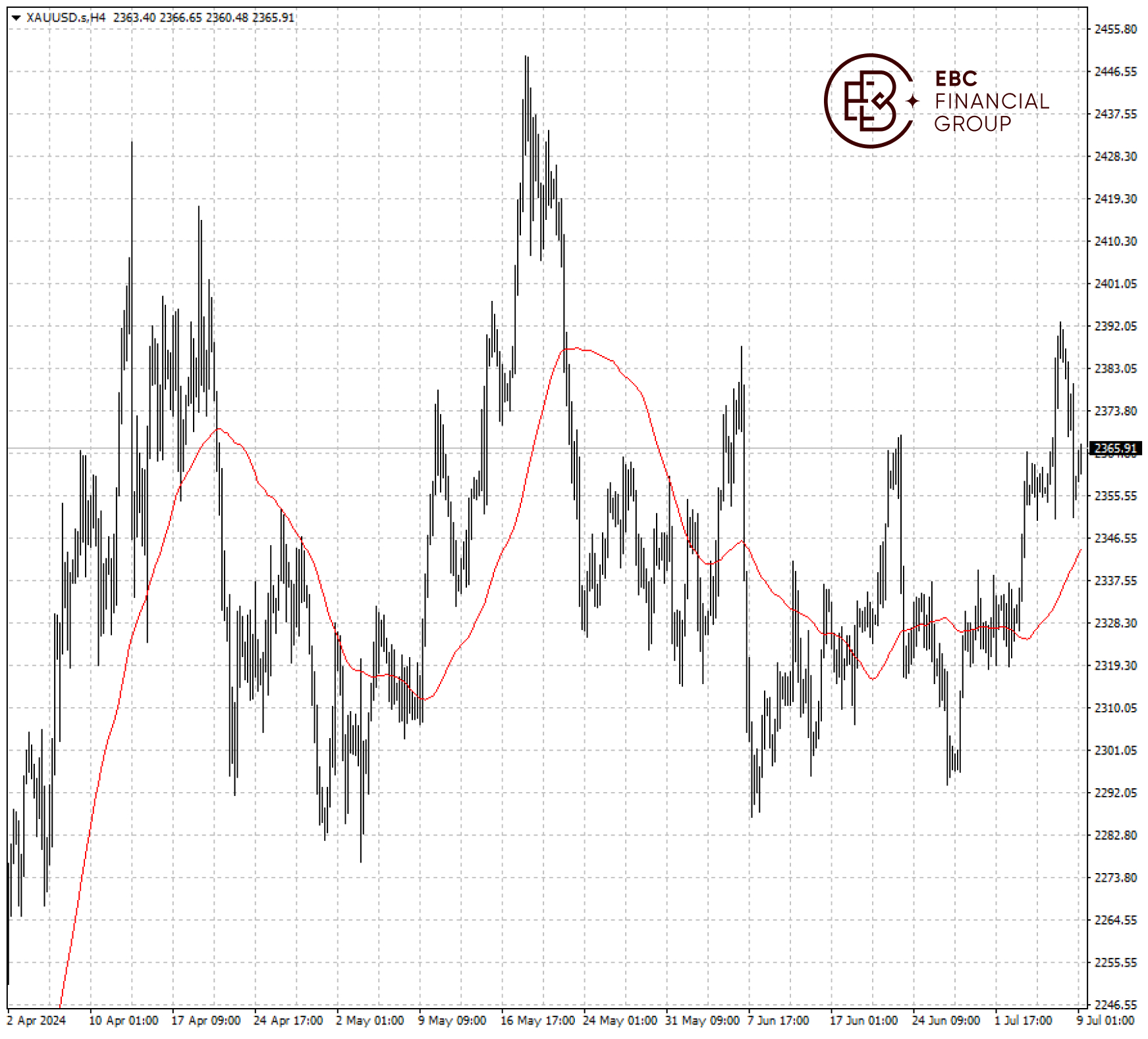

Gold has faced strong resistance at $2,400 since its major pullback from an all-time high in late May. The risk is slightly titled against the downside with 50 SMA potentially stemming its losses.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.