EBC Markets Briefing | Magnificent 7 keep shining

The three major US stock indexes closed higher on Monday with the S&P 500 and the Nasdaq 100 notching intraday record high closes, ahead of the Fed's crucial policy meeting later this week.

Tesla's gains boosted the S&P 500 consumer discretionary sector 1.1% to its highest level in nearly nine months. Meanwhile, Alphabet helped lift the communication services sector up 2.33%.

Sales rout this year in a number of European markets continued in August – the 8th consecutive month of declines - amid fierce competition from China's BYD and a backlash against CEO Elon Musk.

Earlier this year Tesla representatives in Europe argued that the sales decline was largely because production was shifting to a revamped version of the Model Y that had been Europe's top-selling car in 2023.

Alphabet joined other tech giants Apple and Microsoft in hitting a $3 trillion valuation. A US court earlier this month allowed the company to retain control of Chrome and Android.

The company's shares trades at around 23 times its forward earnings - the lowest among the "Magnificent 7" - compared to its five-year average 22, according to data compiled by LSEG.

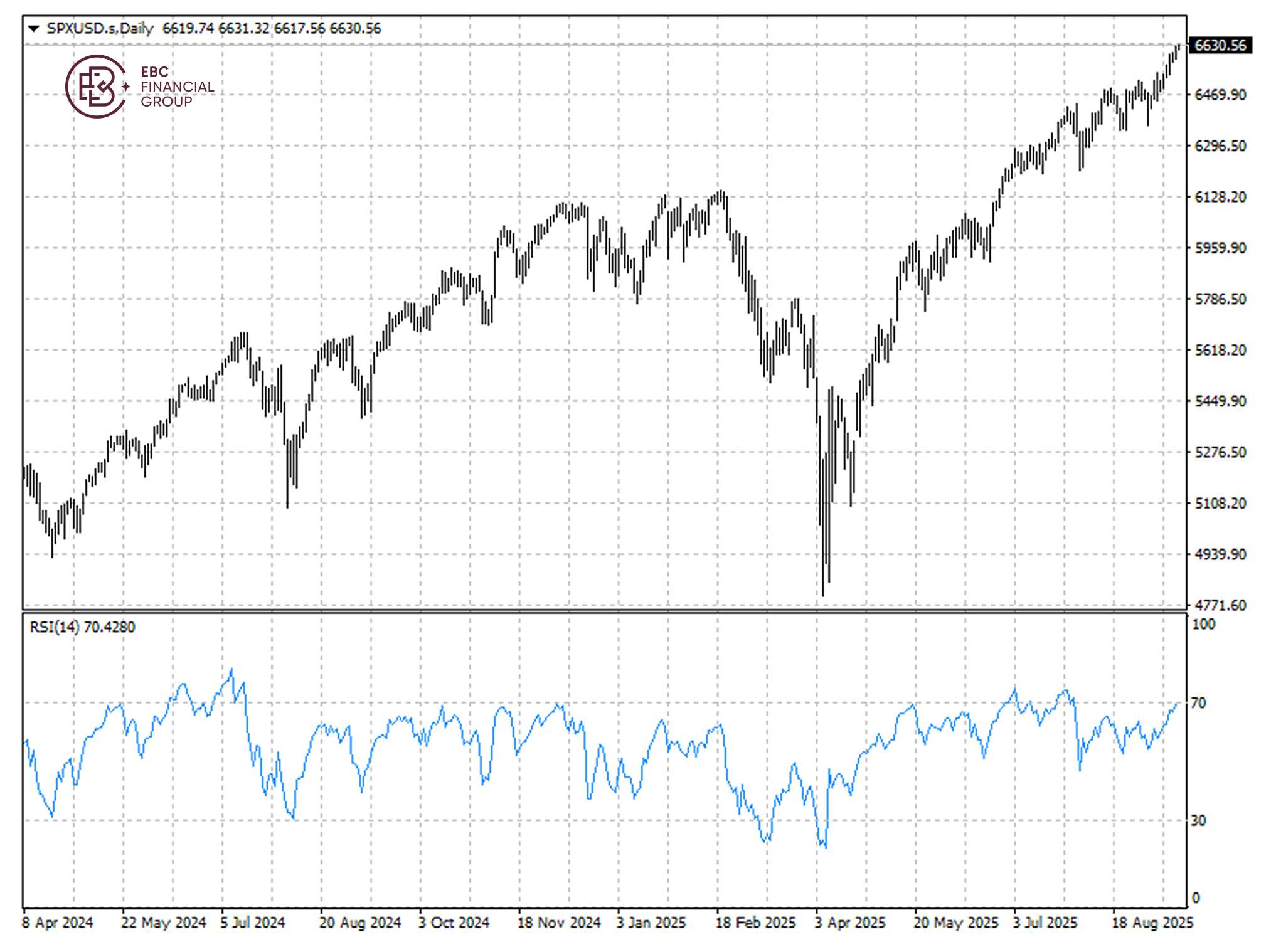

RSI suggested the S&P 500 rose to the overbought territory, a sign of buying fatigue in store. The index could be heading back to 6,600 rather than notching a fresh peak.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.