EBC Markets Briefing | Sterling looks like a safe haven now

Sterling traded around its strongest level since October 2021 on Tuesday, after Trump announced new tariffs set to go into effect 1 August for a spate of countries including Japan and South Korea.

Services sector activity in the UK expanded at the fastest rate in nearly a year in June, and the prices they charged rose at the slowest pace in almost four years, according to a survey on Thursday.

Meanwhile, the manufacturing reading improved for a third month - signs of turning a corner in its long slump as businesses pushed up their prices to offset higher labour costs.

The attractiveness of the US as an investment destination has plunged in the eyes of British business executives who now see opportunities closer to home, a survey showed.

The report tallied with official US data last month that showed inward FDI fell sharply in early 2025, a drop that coincided with high business uncertainty over Trump's tariff plans.

Nevertheless, the exodus of billionaires could be set to accelerate after the Labour government opened the door to introducing a wealth tax, which would suppress business sentiment.

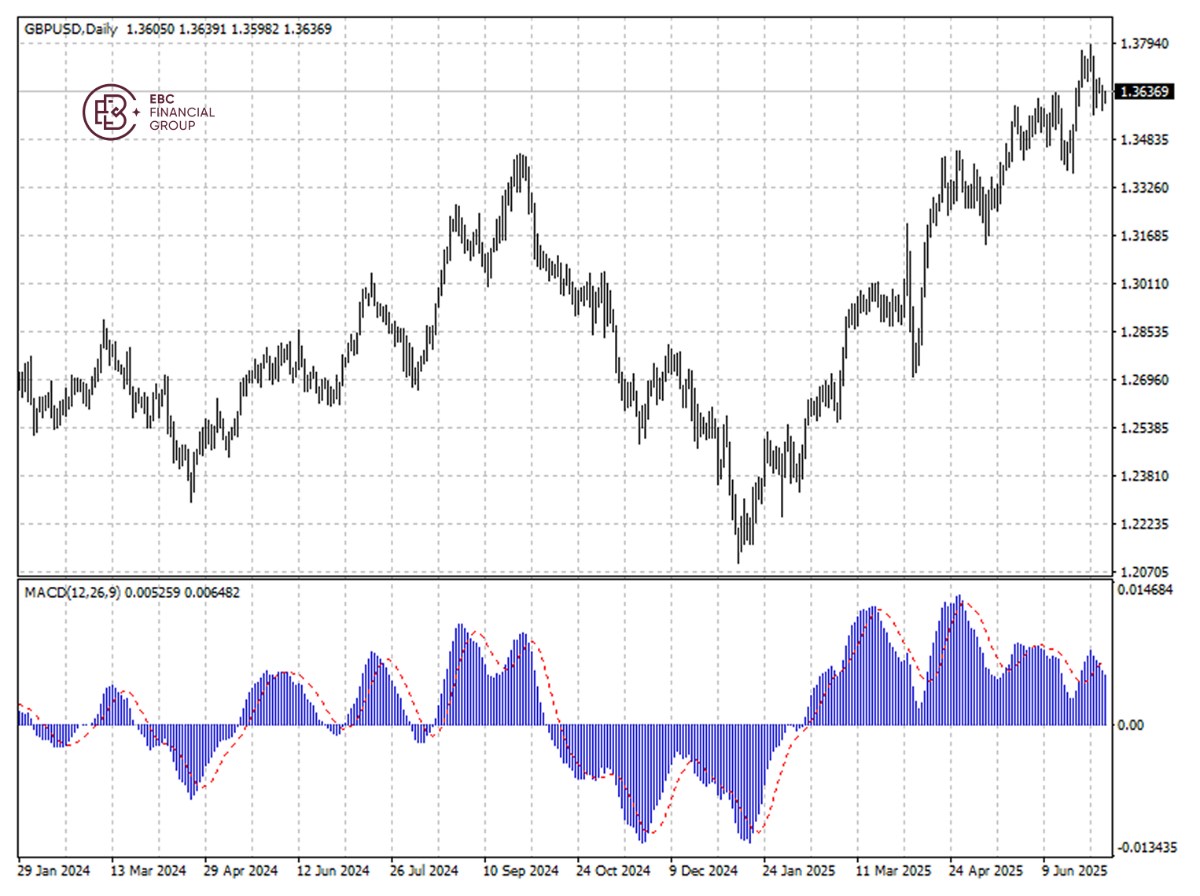

The pound shows bearish MACD divergence, suggesting the sluggishness could go on for a while. The initial support is expected to lie around 1.3600.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.