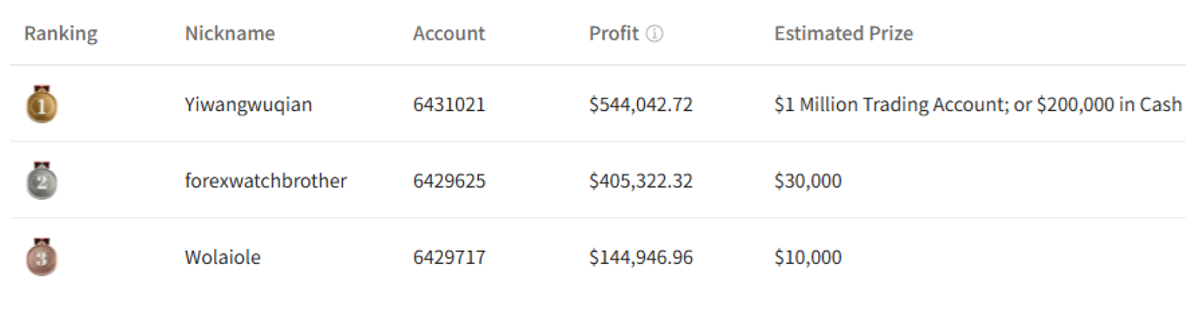

EBC’s Million Dollar Trading Challenge II | Newcomer’s $544,000 Day Sets New Benchmark in EBC Challenge

EBC’s Million Dollar Trading Challenge II moves into mid-May on 15 May 2025 and a new trader has made a big mark. In a single day, this new trader racked up an astonishing $544,000 in profits, an achievement straight out of a trading fantasy.

This feat has shattered the competition’s previous single-day profit record by a wide margin. Such a result could only be achieved with bold, heavy positions: most of this trader’s orders were for 3 lots of gold, with some reaching as high as 5 lots.

Meanwhile, @forexwatchbrother has kept up his impressive momentum, with profits soaring to $400,000. Both traders capitalised on yesterday’s dramatic plunge in gold prices, propelling themselves to new heights.

@Yiwangwuqian executed the perfect trend-following strategy, shorting gold near its peak and riding the move all the way down to around $3,150. Despite this overnight windfall, he still holds a number of profitable positions and hasn’t withdrawn any funds yet, living by the mantra, “Armour on till the battle is truly won.”

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.