Fed can end US Indices’ divergence

The US indices, S&P500 and Nasdaq100, closed at new all-time highs, largely due to Apple's positive performance. However, other markets and indices are far from similarly positive. This both leaves room for growth and indicates investor wariness.

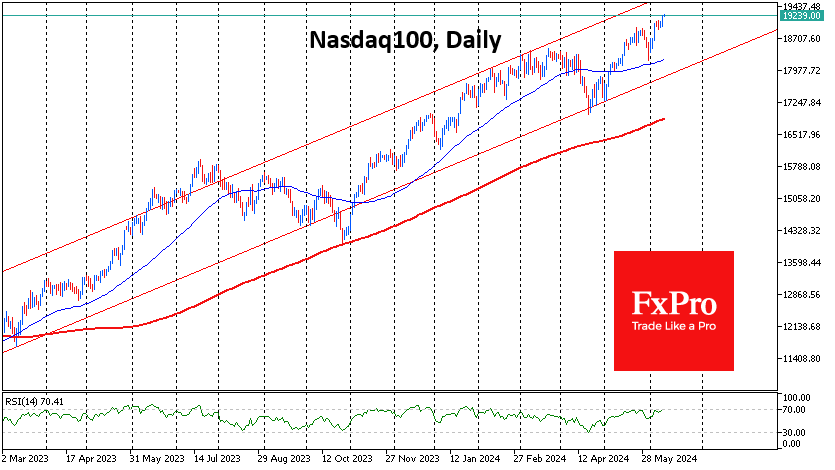

The Nasdaq100 index is above 19200, adding 0.7% over the last day and adding 16.1% YTD. Futures are trading in a slight plus on Thursday. The S&P500 rose 0.3% to 5375, bringing its YTD advance to 13.3%. Both have maintained positive momentum since the beginning of the month after a quick correction in late May.

The immediate driver of the gains was a 7.3% jump in Apple shares in a single day. The market's initial negative reaction to the announcement of the AI strategy, which took away 2% at the premarket, turned into an abundant short squeeze by the opening of trading, sending the stock well into the territory of all-time highs. Interestingly, Apple continues to lag in the market, adding 11.6% YTD.

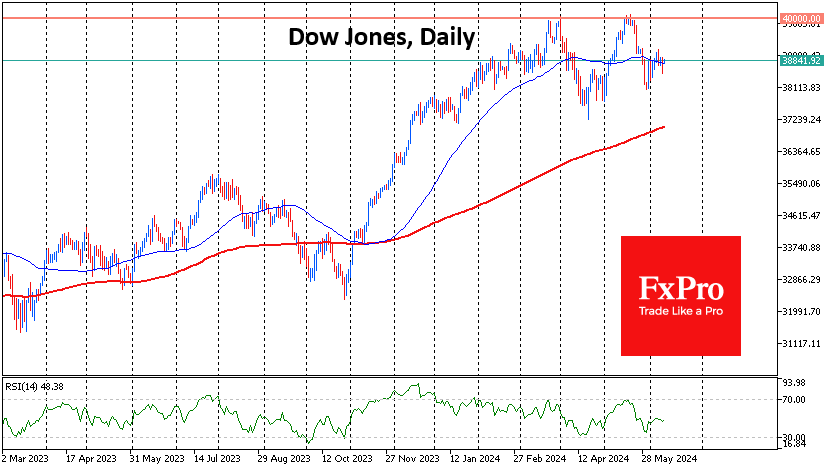

At the same time, we note the slippage of the Dow Jones, which lost 0.3% on Thursday and is adding just 2.7% YTD. This index formed a double top at the 40,000 touches in March and May and is now 3% below that resistance.

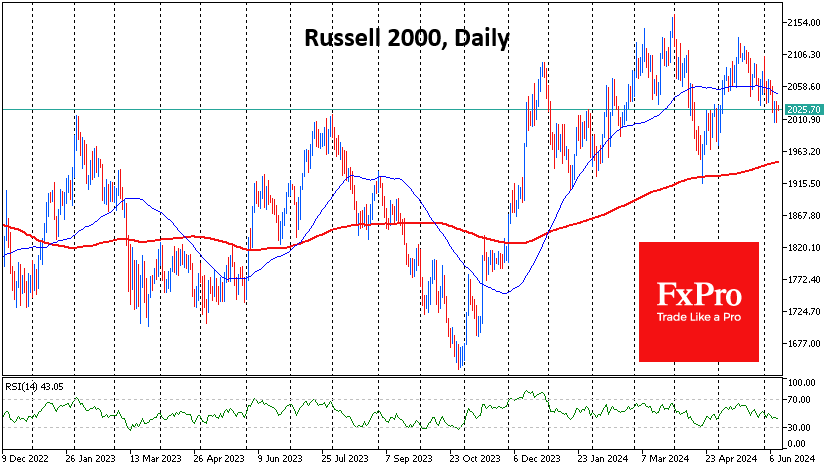

Smaller companies are feeling even worse. The Russell 2000 lost 0.4% the day before and has added 0.6% since the beginning of the year. The index needs to rise another 17% to the all-time high reached in November 2021, and it has been in a downtrend for almost a month.

The inflation data and FOMC comments released today have enough potential to synchronise the dynamics of not only the US indices but also the global risk appetite in general.

Investors are focused on how all of today's events will impact year-end key rate expectations. Right now, rate futures suggest an 88% chance of a cut before year-end, with a 13% chance of a cut of more than 50 points. In other words, markets are plotting a 40-point decline in 2024.

A sharp rise in that number could support the markets' upswing by making it broader. In this case, the Nasdaq100 can reach 20,000 before the end of the month and the S&P500 to 5,600, while the road to all-time highs would open for the Dow Jones and Russell 2000 in the perspective of a couple of months.

If inflation or Fed sentiment shifts expectations to one or less downside, however, it would prove to be a blow to the markets, capable of taking 5% or even 10% away from them in the next few weeks.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)