GBP/USD: A false bullish breakout?

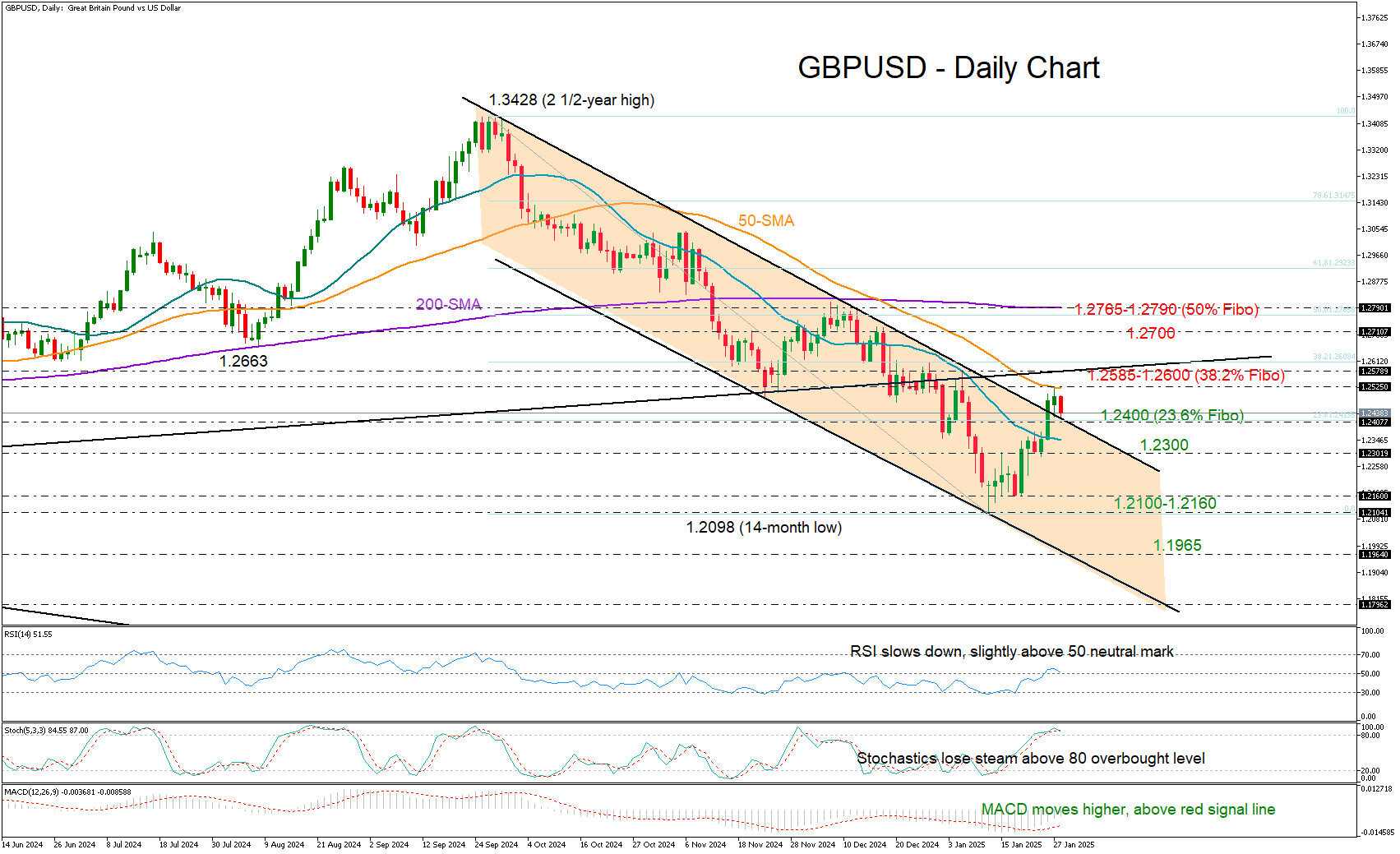

GBP/USD stalled around the falling 50-day simple moving average (SMA) at 1.2525 soon after exiting the bearish channel on the upside.

Was this a false bullish breakout? No, not as long as the price continues to trade above the channel’s upper boundary seen near 1.2400. The area is currently under examination along with the 23.6% Fibonacci retracement of the latest downtrend. Hence, failure to pivot there could disappoint traders, bringing the 1.2300 round level next into view, while a deeper fall might aim for a bearish extension below the crucial support area of 1.2100-1.2160.

According to the technical indicators, downside risks are still alive. The falling 20- and 50-day SMAs have yet to show any signs of improvement, while the RSI is losing steam marginally above its 50 neutral mark and the stochastic oscillator is set for a negative reversal.

In the event the pair crosses above its 50-day SMA, the bulls must also jump the wall at 1.2580-1.2600, where the 38.2% Fibonacci mark and the broken support-turned-resistance trendline from March 2023 are sitting. A successful penetration higher could bolster buying appetite, lifting the price swiftly up to the 1.2700 number or even higher to the 50% Fibonacci of 1.2765 and the 200-day SMA at 1.2790.

All in all, GBP/USD moved out of a bearish formation, signaling a potential upward trend reversal. Despite this, the pair has yet to close above the wall of 1.2600, which might be a prerequisite for a major bullish wave.

.jpg)