GBPUSD pullbacks despite surprise in GDP data

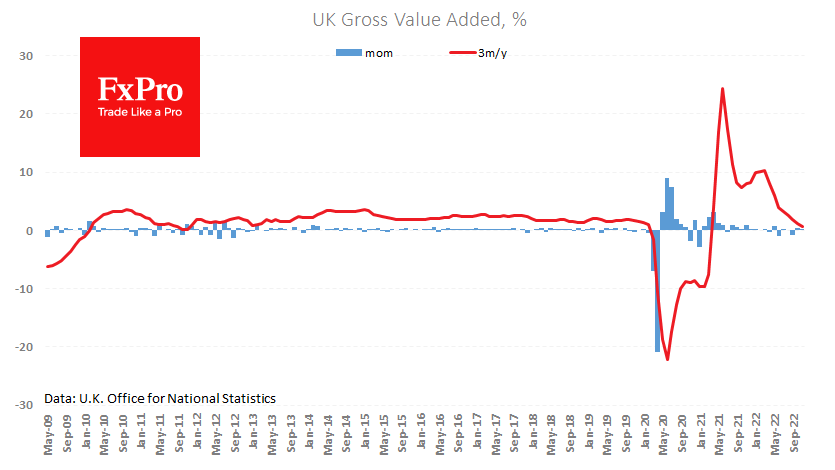

Britain, as previously with mainland Europe, is showing better than expected GDP performance, tempering expectations on the depth and duration of the looming recession. Monthly GDP estimates showed an unexpected growth of 0.1% in November after 0.5% in October, markedly better than the 0.2% contraction that had been expected. This was driven by a better-than-expected service sector performance, representing the lion's share of the UK economy. Construction also held off a decline in November, but the annual growth rate slowed to 4.0% compared to 5.9% a month earlier.

However, things are deteriorating in the industry. Industrial production has fallen for 8 of the last ten months. Although the rate fell markedly in the previous quarter, activity in November was 5.1% lower than a year earlier. The manufacturing sector is losing 5.9% YoY, holding around this rate since July. Although industry contributes less than 10% to the country's GDP, the dynamics of this sector are often ahead of the business cycle, being the first to take the hit when economic conditions deteriorate.

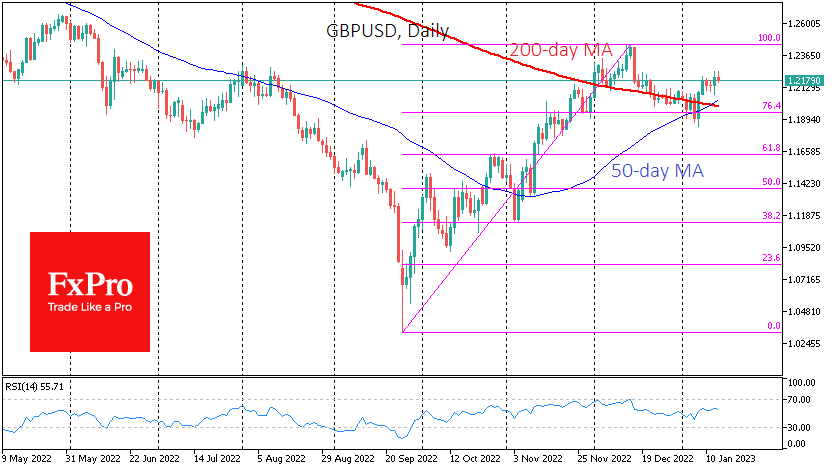

Initially, the market reacted to the monthly data release by buying the pound, pushing the FTSE100 to its highs for the year and only 0.7% from its historic peak in mid-2018. However, markets soon retraced the gains, which fits well with the desire to lock in some profits after the impressive progress of the past two weeks. GBPUSD pulled back to 1.2175, despite the ‘golden cross’ formed two days ago (the 50-day MA overcame the 200-day MA). Despite the bullish signal, the pound exchange rate and British asset prices remain vulnerable to short-term pullbacks without breaking the upward trend. We cannot discuss breaking the trend until GBPUSD falls below 1.1900. However, it is more likely that a short-term correction into the 1.2000-1.2050 area will be followed by renewed buying after a short-term shakeout.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)