Gold is not yet tired of rising

Gold is trading at $1875 per troy ounce - near the highs since last May. Having pushed back from the bottom in early November, the price has rallied by more than 15%, above $260, and so far, probably has not exhausted the upside momentum.

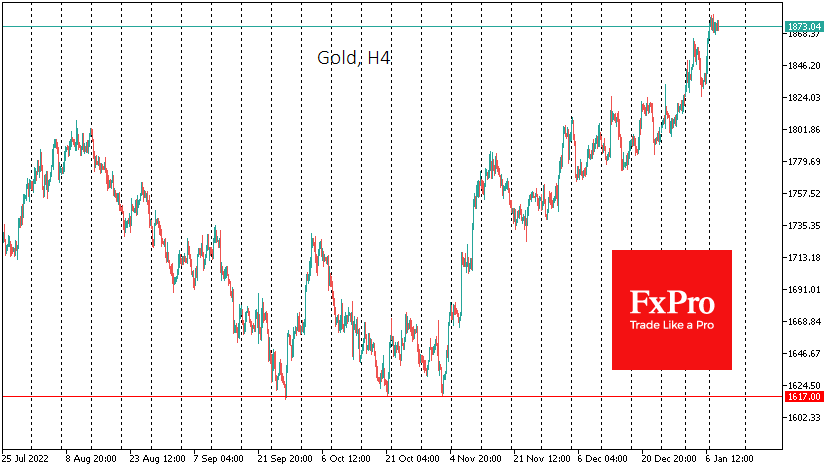

Three touches of $1617 between the end of September and the beginning of November formed a firm bottom, from which the gold pushed off two months ago. The momentum of gold's rise started later but was more resilient than the dollar's decline against its major competitors and did not compare with the stumbling increase in the major US stock indices.

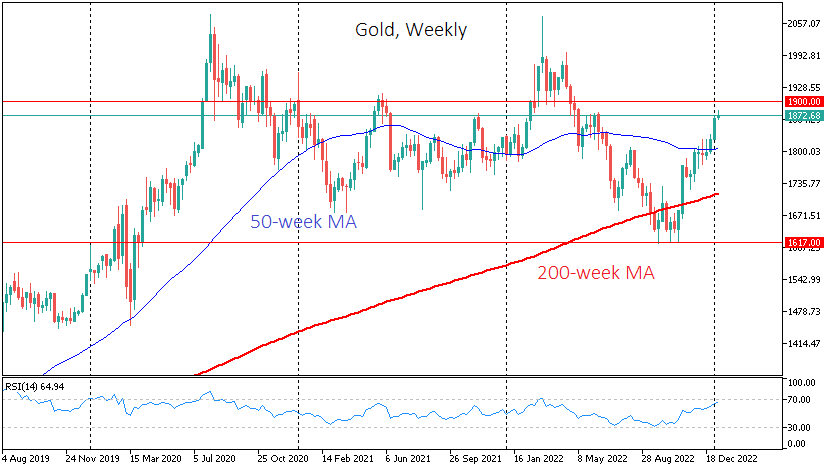

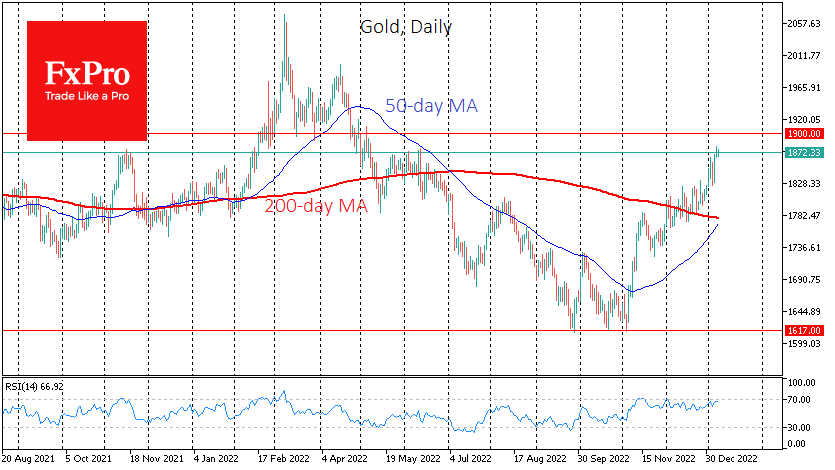

On the weekly charts, the RSI has moved out of the oversold area but has not yet entered the overbought zone. On the daily chart, gold also manages to avoid being overbought due to short-term local pullbacks. Often this kind of market dynamics is observed when investors form long-term positions rather than when they succumb to short-term impulsive ideas.

There is also a new bullish signal of change in the long-term trend, the "golden cross", which is formed on the daily charts. A bullish signal is created when the 50-day moving average crosses the 200-day moving average upwards, reflecting a long-term trend reversal. Additionally, this signal is strengthened by the price above these averages, promising to form a golden cross as early as this week.

Gold is well-positioned on the cross of the 50- and 200-day averages. In July, for example, the "death cross" (the 50-day MA falling below the 200-day MA) initiated a 7% sell-off in the following three weeks. And the formation of the golden cross in February 2022 was followed by an almost 15% rally in the following two and a half weeks, which was the second test of the historic highs above $2070.

This time, the rally looks stretched, so we see the short-term potential for the gold price to rise to the $1900-1910 area before the bulls might need to recharge.

Longer term rise of gold is unlikely to stop above $1900. We shall expect another test of the historical highs in 2070 before the end of 2023; this time, it will be successful. The main reasons for such optimism are growing investor doubts about the stability of the major reserve currencies due to the high debt burden and speculation that central bankers will allow inflation to remain slightly above target despite current assurances.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)