Gold: moonshot to $2800 or dive below $2000?

Gold volatility has fallen markedly in recent days as gold traders consider their next move, while many commodities are in a corrective decline.

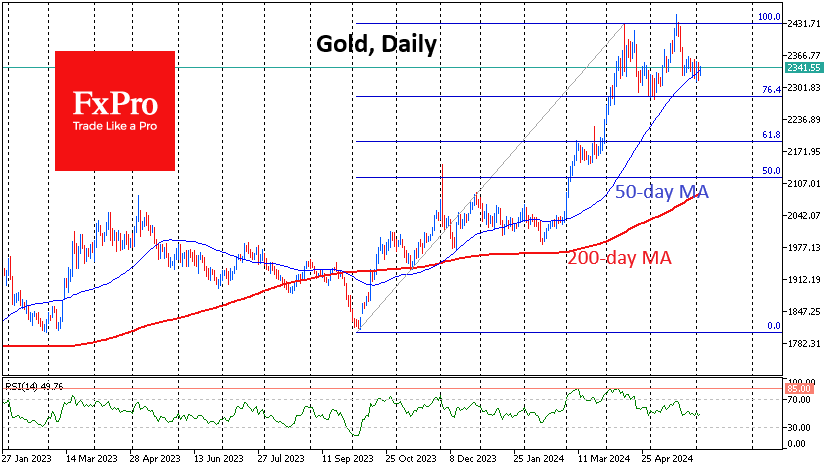

In May, the gold price climbed towards $2450, above the peaks of April, but failed to consolidate near all-time highs. During the last two weeks, the price has changed in the range of $2330-2360, with a slight downward trend, which can be seen on the daily candlestick charts.

Right now, Gold has dropped to support in the form of the 50-day moving average, which is enjoying temporary interest from short-term buyers. The 50-day moving average has been effectively acting as uptrend support since last October.

It is easy to see the result of this support as the prices of other actively traded metals (silver, platinum, copper) have been steadily losing ground for the past week. But there is no guarantee that this will continue.

Further declines in prices for raw material assets may cause bulls in Gold to capitulate. This fight for the trend is in full swing.

The first signal that the bullish trend is breaking would be a sustained price drop below $2320. It is also worth closely watching the behaviour of Silver and Platinum. Their further plunge could tip the scales in Gold towards the sellers. A full-fledged correction could bring the gold price back to $2000 or lower before it becomes interesting for long-term buyers again.

However, it cannot be ruled out that Gold will be able to withstand the sell-off in related assets and subsequently pull them back up, as it did in January. Such a turn of events would trigger a scenario of gold growth with the potential to take the price to the area of $2800. And it could be quite an aggressive fast rally rather than a smooth climb.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)