NZDUSD rebounds: Is it a dead cat bounce?

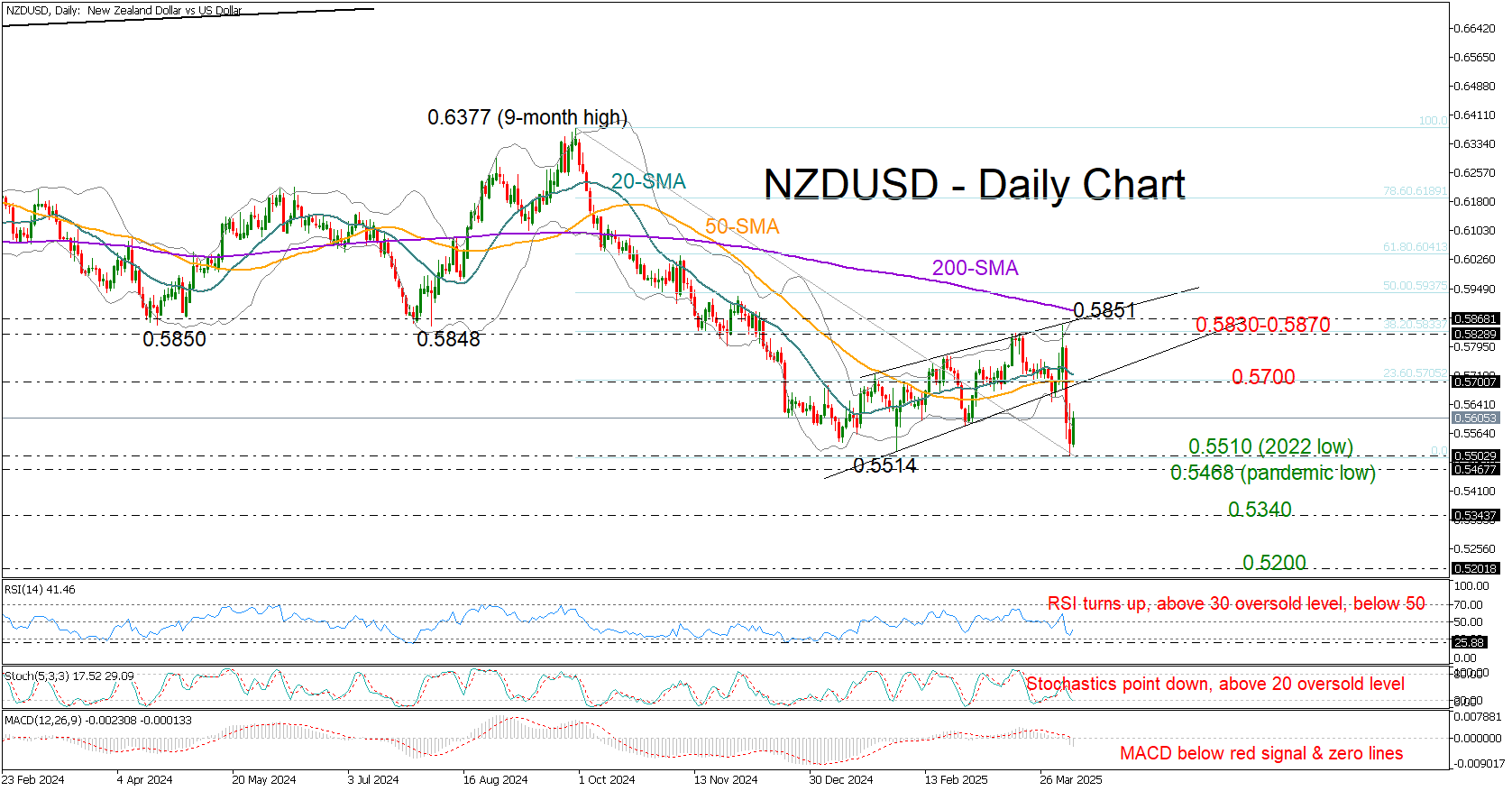

NZDUSD switched to recovery mode on Tuesday after a bleak start to the week, which pushed the price slightly below the 2022 low of 0.5510 and closer to its pandemic trough of 0.5468, as investors continued to digest tariff-led growth risks.

The RBNZ’s policy decision on Wednesday (03:00 GMT) is the next highlight on the calendar. While a 25bps rate cut to 3.5% is expected, a larger 50bps move might be on the cards as well. However, with the global trade war having just escalated between the US and China, and other economies preparing their countermeasures against the White House, policymakers may hold off on aggressive actions.

Technically, the short-term outlook remains bearish. Momentum indicators like RSI and MACD suggest limited upside, with no clear signs of oversold conditions or reversal.

Still, with the price hovering near a long-term pivot area, some stability could emerge. The main target could be the 0.5700 round figure, where the 50-day simple moving average (SMA) intersects with the short-term support trendline from February. A decisive break above this level could lead to a retest of the key 0.5830–0.5870 zone and the 200-day SMA. A move above that range would upgrade the short-term outlook.

In the bearish scenario, if the downtrend extends below the pandemic low of 0.5468, support may emerge near the 0.5340 level and then around 0.5200. Then, the 2009 bottom at 0.4890 might come into play.

All in all, NZDUSD continues to exhibit weakness despite today’s bounce. For the risk bias to turn positive, the bulls must stage a sustainable rally above the 200-day SMA and the 0.5870 region.

.jpg)