The Dollar Index Balances Before Choosing This Year's Trend

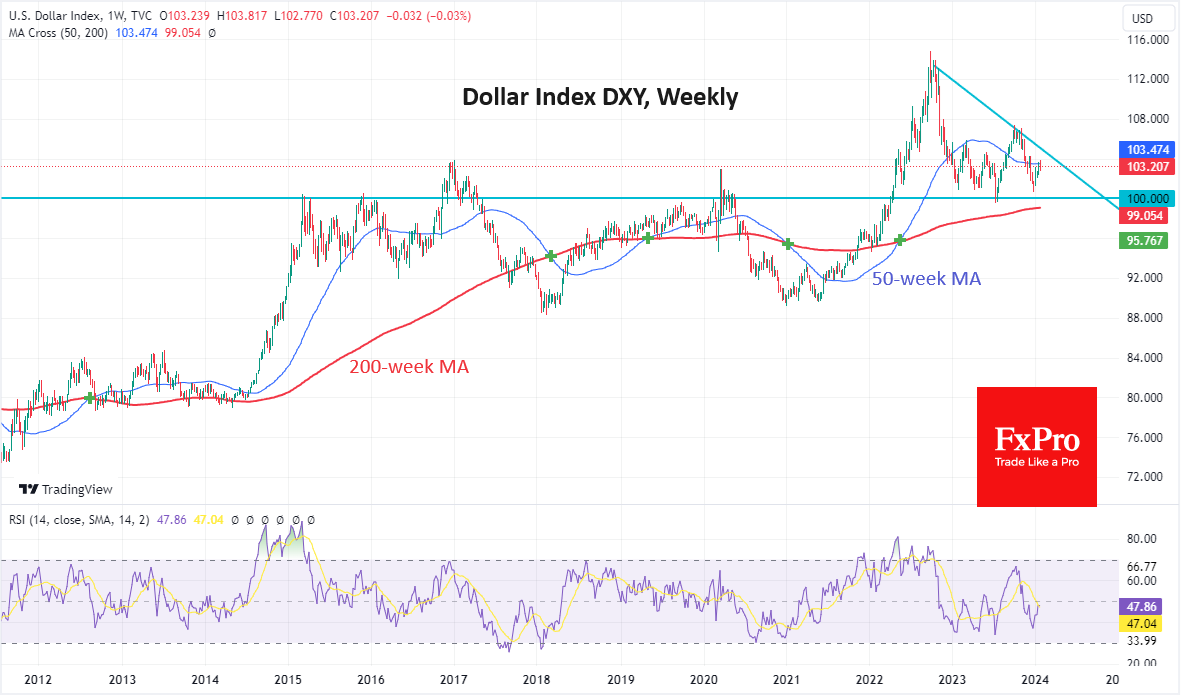

The Dollar Index has found a balance around key technical levels in what looks like a consolidation before the start of a new medium-term trend. The DXY has been holding at its 200-day moving average for the past eight days, trading near the 103 level. Just over a month ago, the dollar consolidated at this level and ended in an intensified sell-off with a 2.9% drop.

The fact that the dollar was able to turn higher and retest previous levels suggests that there was significant support on the downside that kept the DXY below 100. Approaching this level has attracted buying interest over the past year.

During the last consolidation, the downward-sloping 50-day moving average changed its status from resistance to support.

Both of these factors are bullish for the dollar and point to further growth. Previous significant consolidations were at 113 and 106, which were pivotal levels in 2022 and 2023, respectively.

At the same time, two consecutive lower annual highs point to long-term pressure. It is characteristic of the dollar to fall when the Fed is preparing to ease or is just beginning to do so in a growing economy. In this environment, domestic demand and imports are growing, and a number of smaller economies are of greater interest to investors.

The dollar's movements over the past two years fit into a triangle, with the lower boundary at 100 and the upper boundary now at 104. It is only when the dollar breaks out of this triangle that we will see evidence that the market is setting the direction of the dollar. Until then, the market may change its mind more than once.

The outcome of this story may come next week when the Fed meeting and the monthly employment report are scheduled. A decisive exit from the triangle could be the start of a multi-month move towards the breakdown, with the potential to go as high as 115 in a bullish scenario (+11%) and as low as 90 in a bearish scenario (-13%).

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)