UK CPI inflation stays in double digits

OVERNIGHT

Asian equity markets are mostly under pressure this morning as investors assess corporate earnings announcements and prospects for global interest rates. The US Federal Reserve’s Bostic indicated a preference for one more hike and then a pause for some time, while Bullard reiterated his more hawkish stance. European Central Bank Chief Economist Lane, meanwhile, said another rate rise in May is likely but the scale of the increase, whether 25bp or 50bp, would depend on the upcoming data.

THE DAY AHEAD

UK CPI inflation figures for March, released earlier this morning, showed a smaller decline than forecast to 10.1% from 10.4% in February, thus remaining in double digits where it has been since August. The decline primarily reflected lower petrol prices, while core inflation excluding food and energy remained unchanged at 6.2%. Markets expected a bigger fall in both headline and core CPI to 9.8% and 6.0%, respectively. This morning’s data come on the back of yesterday’s labour market report which revealed stronger than expected wage growth at 6.6% (ex-bonus) in the three months to February. Bank of England policymaker Mann speaks later today on climate change and monetary policy.

Later today, Eurozone CPI inflation figures for March are also due but they are final readings. They are expected to confirm preliminary estimates showing a sharp fall in the headline rate to 6.9% from 8.5%, the lowest for over a year. Core inflation, however, remains much higher than twelve months ago with the flash estimate expected to be confirmed at 5.7%. The latter is a concern for more hawkish ECB members while doves attach more weight to declining headline inflation. Several ECB speakers today, including Chief Economist Lane, may provide further insight into their views on the policy outlook.

There are no major US data releases today. The Fed Beige Book will be released this evening and the Fed’s Williams is scheduled to speak later. The Beige Book may provide anecdotal evidence of economic prospects including any impact from recent concerns about US regional banks.

MARKETS

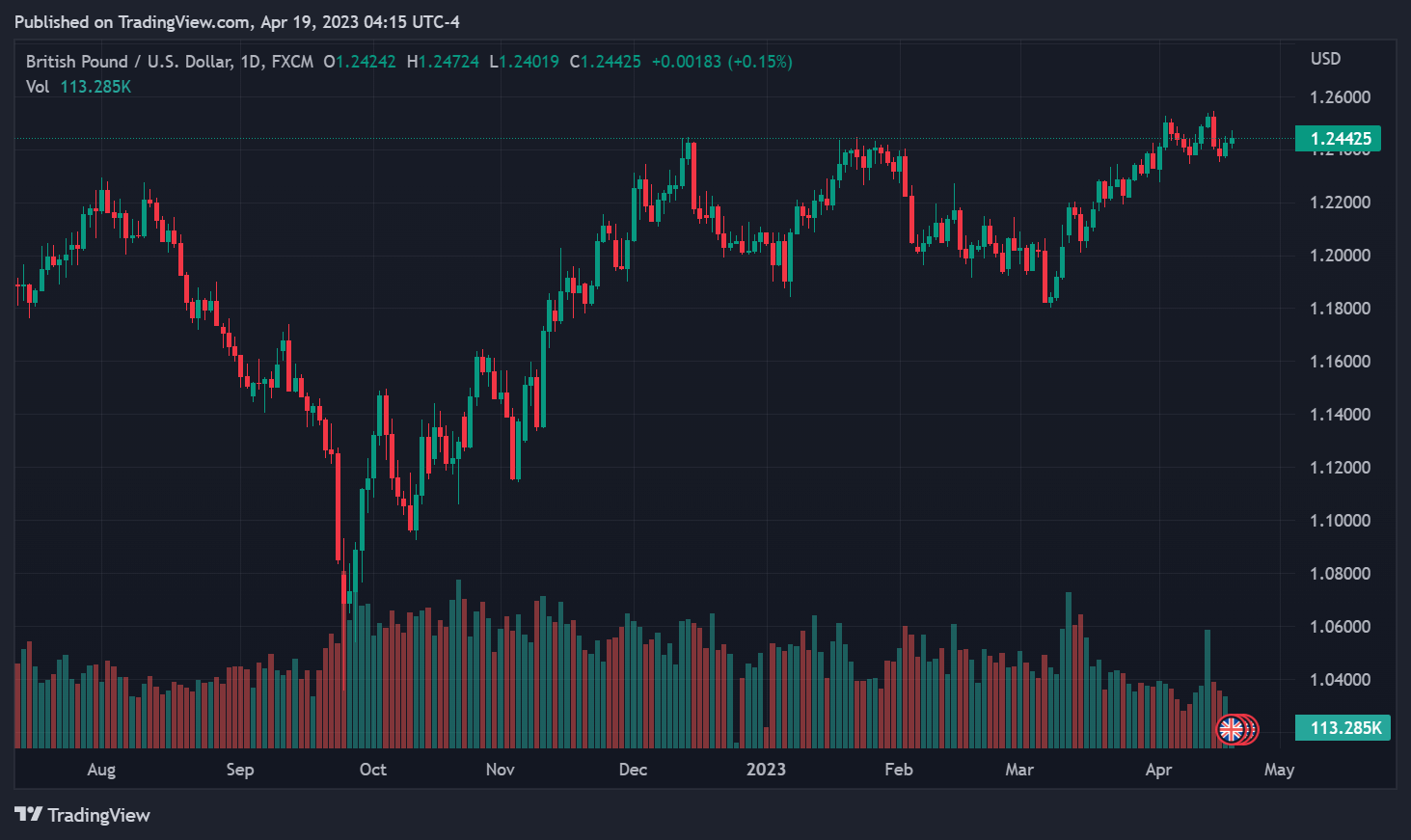

The stronger than expected UK inflation figures provided some support for the pound. Nevertheless, the currency’s recent performance has been more mixed following a positive first quarter. Markets have almost fully priced in a BoE 25bp hike in May with conviction levels having risen after recent data.